Why you'll love Kin

You get more than coverage — you get a team that follows through.

Here to help

We reach out before, during, and after major weather events to make sure you’re okay — and to assist if you need to file a claim.

24/7 claims support

Easily file a claim over the phone with a member of our support team or online in your Customer Portal.

5-star care

Licensed Kin agents are easy to reach and ready to listen. Contact us via email, phone, or live chat.

What does mobile home insurance cover?

We’ll help you understand what’s covered and why — with simple and personalized protection for your home.

Dwelling coverage

for the actual structure of your home, inside and out.

Other structures

for things like your detached garage or shed.

Personal property

for your personal belongings that make your house a home.

Loss of use

for additional living expenses when a covered loss forces you to temporarily relocate.

Personal liability

if you accidentally cause someone bodily injury or property damage.

Medical payments

if a guest is injured on your property.

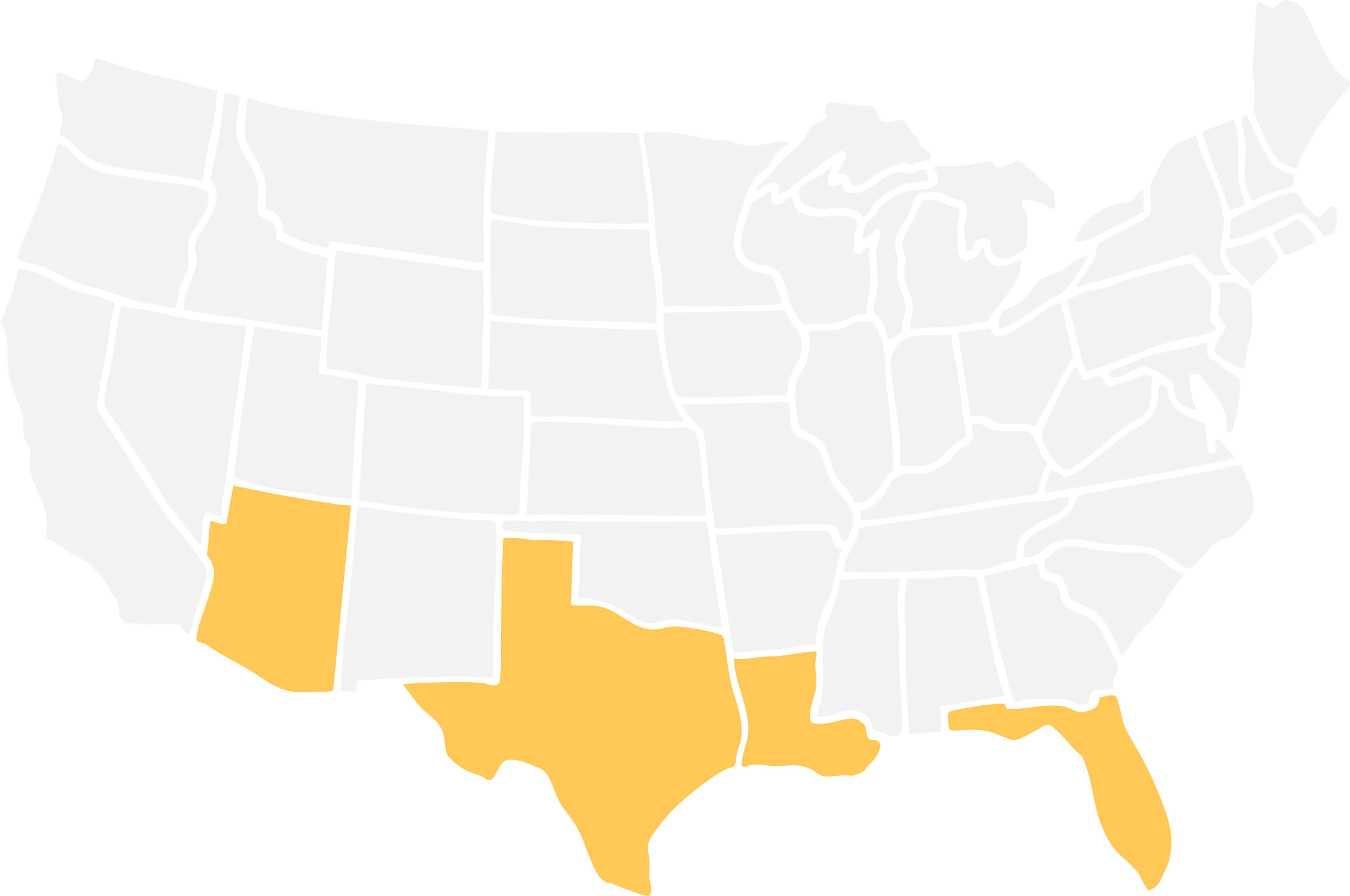

4 states and counting

We currently offer coverage in the following states.

Common questions about mobile home insurance

What is mobile home insurance?

Mobile home insurance, also known as an HO-7, is a specialized type of homeowners insurance designed to protect mobile and manufactured homes. It typically covers your home’s structure, other structures on your property (e.g, detached garages, sheds, etc.), and your personal belongings against damage caused by specific hazards (called perils), including fire, theft, lightning, and falling objects.

A standard HO-7 policy also offers liability insurance if you or a member of your household injures someone or damages their property.

If a covered loss occurs, you can file a home insurance claim. Upon approval, your insurer will issue a claim payout up to your policy limit minus any applicable deductible(s).

What factors affect the cost of mobile home insurance?

How much you pay for mobile home insurance (called your premium) depends on a variety of factors, including:

- Replacement cost. The cost to replace your mobile or manufactured home in the event it is destroyed by a covered event is a primary factor in how much you'll pay for coverage.

- Location. Homes in high-risk areas, such as those prone to hurricanes, wildfires, or theft, often have higher premiums.

- Age and condition of the home. Older or poorly maintained mobile homes may cost more to insure due to a higher risk of claims.

- Claims history. A history of frequent claims may lead to higher premiums.

- Security and safety features. Smoke detectors, security features, and proper anchoring efforts can lead to lower premiums.

- Credit history. In many states, insurers can use your insurance-based credit score when determining your rate. Poor credit can lead to higher premiums.

- Policy details. Your coverage limits, deductibles, and any additional coverage options will affect your rates.

The best way to determine how much it will cost to insure your property is to get a mobile home insurance quote. In most cases, you can get a quote online within minutes.

What do I need to have in order to qualify for mobile home insurance?

To qualify for the best rates, insurance providers may require mobile homes to:

-

Have anchored tie-downs in accordance with state, city, and county regulations.

-

Be skirted or have a fully enclosed foundation.

-

Have handrails anywhere with three or more steps.

-

Be owner occupied.

-

Be well maintained.

Can I get insurance for older mobile homes?

Mobile homes built after 1976 are technically called “manufactured homes,” not mobile homes. That’s because they adhere to the HUD Manufactured Home Construction and Safety Standards, which makes them safer and more durable. As a result, Kin can’t offer coverage for mobile homes built prior to 1976. These homes may have a tough time getting insured without adherence to federal building codes.

What does mobile home insurance not cover?

Even though mobile home insurance offers protection against a range of losses, it typically does not cover the following:

-

Flooding caused by heavy rain, storm surges, or breaches levees or damns

-

Earthquakes or sinkholes

-

Intentional damage caused by the policyholder or covered household members

-

Fungal or bacterial growth

-

Wear and tear

-

Settling, bulging, shrinking, or expanding of the foundation

-

Damage caused by pests or rodents

Keep in mind that coverage exclusions vary by insurer, location, and policy. For instance, if you live in a coastal community, your policy may not cover wind or hurricane damage. Always check your policy details or contact your insurer to determine specific exclusions.

What additional coverages should mobile home owners consider?

To ensure your mobile home is adequately covered against risk, talk to your insurer about adding the following coverages:

- Flood insurance. Often required if you have a mortgage and live in a high-risk area or if your property has received FEMA assistance in the past. May be available as an add-on to your mobile home policy (called an endorsement). Otherwise, you can purchase a separate, standalone flood insurance policy.

- Earthquake insurance. Provides financial protection if your home is damaged due to seismic activity.

- Windstorm or hurricane coverage. In coastal areas, windstorm and hurricane damage are often excluded or limited in standard policies.

- Water backup coverage. Helps cover the cost of damage caused by failed sump pumps or sewer backups, which is often excluded from standard coverage.

- Scheduled personal property. Offers higher coverage limits for high-value items, such as jewelry, collectibles, or art.

Is mobile home insurance required?

Manufactured or mobile home insurance isn’t required by law. However, you may need it if:

-

You financed your mobile home. Most lenders require mobile home owners to carry coverage until their loan is paid in full.

-

Your mobile home community requires it. If you live in a mobile home community, you may be required to carry a minimum amount of coverage.

Even if you aren’t required to carry mobile or manufactured home insurance, it’s wise to purchase a policy. The cost of repairing, rebuilding, or replacing your mobile home after a loss can be significant, making monthly premiums well worth the resulting financial protection.