If you live in Florida or Louisiana, you already know that finding affordable home insurance used to be a chore. These are the two top-priced home insurance markets in the country with annual premiums averaging $1,951 and $1,968, respectively. Unfortunately, more severe storms and rising materials costs mean insurance premiums will continue to climb in the near term.

Making homeowners insurance affordable is one of our primary goals, so we regularly survey our customers to see how we're doing. Here's what our Q2 survey revealed.

How much do customers save on average with kin?

Our survey last year showed customers save approximately $600 on average when they switch to Kin. Take a look at the savings based on the type of policy that new Kin customers purchased. That’s a substantial amount of savings, especially when you consider that most of our customers are in high-risk zones for natural disasters.

Average kin customer savings by policy

| Policy Type | Average Savings |

|---|---|

| Homeowners | $616 |

| Condominium | $438 |

| Mobile Home | $620 |

Kin customers who own condominiums don’t save quite as much as home and mobile homeowners do. That’s because condo insurance is generally much cheaper than the other products because it doesn't usually cover the building's exterior – typically, the HOA is responsible for insuring that.

How much do Florida homeowners save on average with kin?

Let’s take a closer look at Florida. The most recent data puts the average annual home insurance premium in the Sunshine State at $1,951. Kin homeowners insurance customers report an average savings of $676.

Average kin Florida customer savings by policy

| Policy Type | Average Savings |

|---|---|

| Homeowners | $676 |

| Condo | $429 |

| Rental Dwelling | $562 |

| Mobile Home | $597 |

We’ve only been writing policies in Louisiana since March 2021, so we didn’t have a large enough data pool to provide detailed information about savings. That said, our Louisiana customers report savings of $698 per year on homeowners insurance.

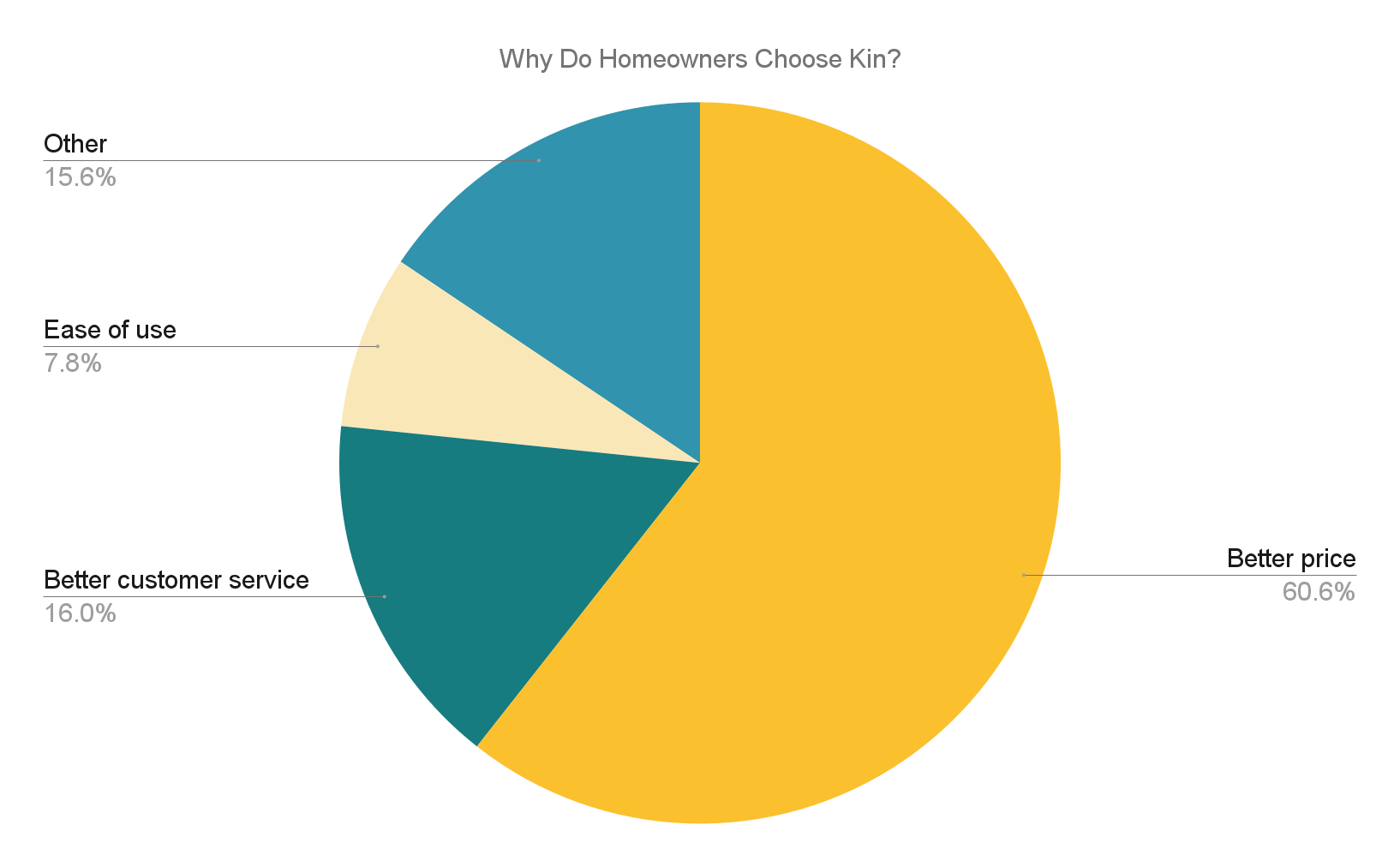

Why do homeowners choose kin?

We also wanted to find out if price is the only reason people made the move to Kin. Otherwise, how can we know if we’re providing the best insurance experience possible? So we asked customers to rank their reasons for choosing Kin between four options:

- Better price.

- Better customer service.

- Ease of use.

- Other.

More than 60 percent of new customers came because we offered a better price. Another 16 percent came for improved customer service, and eight percent chose us for our ease of use.

This is the second year that our Customer Savings Survey showed that better prices drew most new customers our way. But it is the first time that cost far outstripped both better customer service and ease of use﹘although together, those accounted for nearly a quarter of are new customers. Ultimately, these responses indicated that we’re offering a simple process with exceptional service all for the best possible price.

How do we achieve this? We’ve cut out extra costs like independent agents and brick-and-mortar locations. By completely digitizing the product and process, we’ve been able to make a better experience that saves customers money.

Would homeowners recommend kin to a friend?

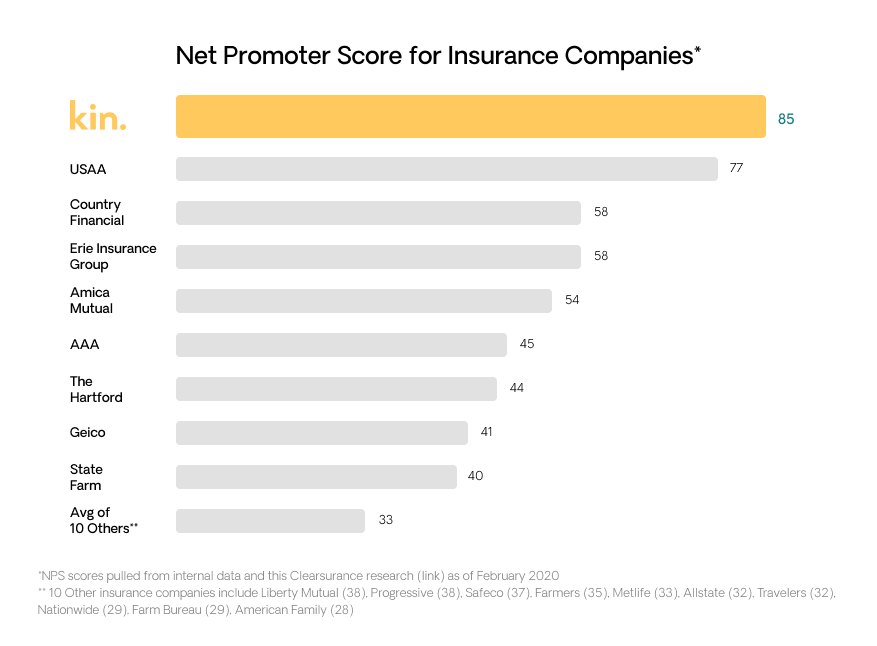

The better experience customers get with Kin is also evident in our Net Promoter Score (NPS). It’s a metric that looks at a company’s customer experience and is useful in predicting business growth. Essentially, the NPS says whether customers will recommend a service to a friend.

The average NPS in the insurance industry is 42, and most of our direct competitors’ NPS is in the 40s and 50s. Our NPS is 85, nearly 10 points higher than the next best, USAA. This tells us that our customers are big fans who are ready and willing to share their positive experience with friends and family.

Net promoter scores for homeowners insurance companies

The takeaway

As you can probably tell, we’re excited about our survey results. They mean we’re fulfilling our promises and that is important to us. But it’s probably even more important to note that people who may otherwise struggle to find home insurance are getting coverage that makes homeownership possible.

If you want to see what real customers have to say about us, check out the more than 1,700 reviews on Trustpilot. You can see for yourself why we have an 89 percent five-star rating and read exactly what customers are talking about.