The national average cost of home insurance is $3,303 per year according to the Consumer Federation of America. However, your premium could be different because home insurance rates vary considerably. This is partly because homes in different areas – or of different values, sizes, and construction types – face different levels of risk for damage from storms and other perils.

How much does homeowners insurance cost?

Homeowners in the US pay an average of $3,303 for their home insurance. That number, reported by the Consumer Federation of America on HO3 policies across the country, represents 2024 data, the most recent year information is available.

HO3 insurance is the most common type of home insurance in the US. It provides open perils coverage on owner-occupied dwellings and named peril coverage on personal property. Additionally, an HO3 policy usually covers:

-

Personal liability.

-

Loss of use.

-

Medical payment.

Knowing the national average for home insurance is a good starting point, but it can only tell you so much about what your policy might cost. Not only do rates vary by state, but your home’s unique characteristics also play a role in your insurance premium.

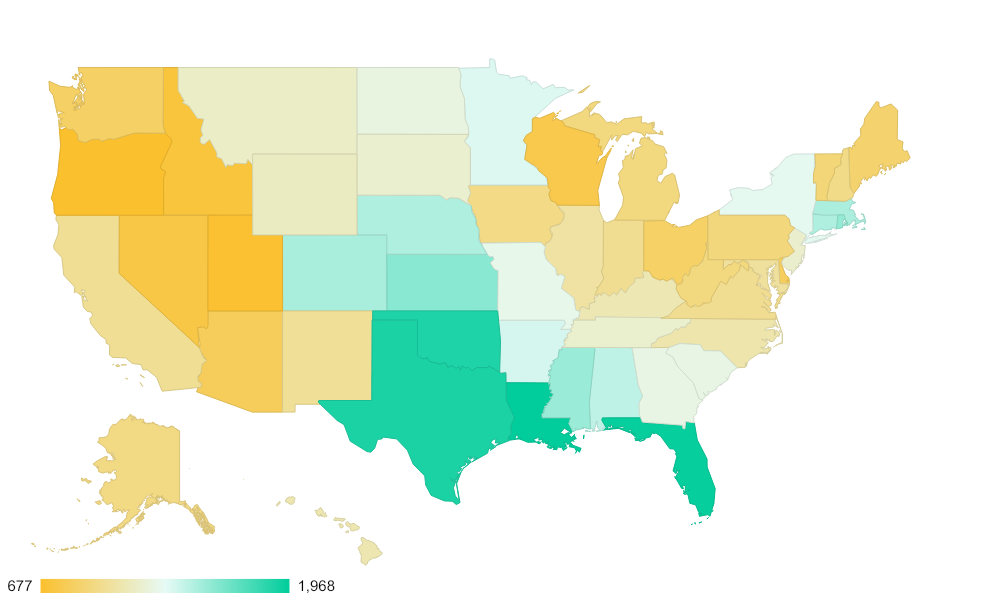

Average home insurance cost by state

|

State |

Avg premium |

State |

Avg premium |

| Alabama | $4,132 | Montana | $2,638 |

| Alaska | $1,606 | Nebraska | $5,127 |

| Arizona | $2,238 | Nevada | $1,555 |

| Arkansas | $4,067 | New Hampshire | $1,313 |

| California | $1,724 | New Jersey | $1,484 |

| Colorado | $3,869 | New Mexico | $2,917 |

| Connecticut | $2,503 | New York | $2,192 |

| Delaware | $1,655 | North Carolina | $3,689 |

| D.C. | $1,685 | North Dakota | $3,254 |

| Florida | $9,462 | Ohio | $2,115 |

| Georgia | $3,037 | Oklahoma | $5,819 |

| Hawaii | $672 | Oregon | $1,594 |

| Idaho | $2,488 | Pennsylvania | $1,978 |

| Illinois | $2,942 | Rhode Island | $2,761 |

| Indiana | $2,979 | South Carolina | $2,977 |

| Iowa | $2,894 | South Dakota | $3,860 |

| Kansas | $4,258 | Tennessee | $2,912 |

| Kentucky | $5,499 | Texas | $4,786 |

| Louisiana | $6,939 | Utah | $1,795 |

| Maine | $1,599 | Vermont | $984 |

| Maryland | $1,716 | Virginia | $2,245 |

| Massachusetts | $1,576 | Washington | $1,550 |

| Michigan | $2,516 | West Virginia | $1,825 |

| Minnesota | $3,523 | Wisconsin | $1,816 |

| Mississippi | $3,670 | Wyoming | N/A |

| Missouri | $3,558 | United States | $3,303 |

Source: Consumer Federation of America, The Dramatic Increase in Homeowners Insurance Premiums and its Impacts on American Homeowners. Accessed 6/15/2025.

The average cost of home insurance varies by state because every state has its own rules, regulations, and risks. While some perils are universal – a home can get broken into anywhere – others are specific to a region. For example, a home along the coast of Florida is uniquely exposed to hurricanes, while one in Oklahoma typically has more risk for tornadoes and earthquakes. Arizona homes face serious wildfire risk, but homeowners in Louisiana worry more about flooding and hurricanes.

Factors that affect home insurance cost

Individual homeowners insurance costs vary widely based many factors, including:

-

The specific region you live in.

-

Your area’s weather-related risks.

-

The amount of dwelling coverage you carry.

-

Your deductible.

-

Your home’s age, value, roof type, construction type, and other factors.

-

Your insurance score.

-

Your claims history.

-

Any available discounts.

How to estimate the cost of insurance

The best way to know how much your home insurance policy will cost is to get a free, no-obligation quote from a provider. But when you’re shopping for a new policy, you may want an idea how much you can expect to spend on your policy to make it easier to compare. In that case, your can get a very rough insurance estimate by:

-

Checking out the average for your state.

-

Evaluating your basic coverage requirements.

-

Assessing your risk.

How to reduce home insurance cost

While you can’t control some factors that influence your homeowners insurance cost, such as your home’s location, its age, and its replacement cost, there are some things you can do to reduce your rates.

These tips can help you get the cheapest homeowners insurance possible without sacrificing the quality of your coverage.

1. Comparison shop

Don’t go with the first insurance provider you find or the one your parents use. The best way to make sure you get a good deal on your coverage is to shop around. Get a quote from a few different providers, and don’t look at price alone. You’ll also want to consider:

-

The reputation of the company. Check out their online reviews to get a glimpse into the customer experience you can expect.

-

The amount and type of coverage offered. You might save a few dollars with an actual-cash value policy, but you will sacrifice coverage. It’s wise to only consider policies that offer replacement-cost coverage.

2. Get the right amount of coverage

When you find an insurance provider you trust, this part should be easy. A good insurance provider can help you choose the appropriate amount of coverage for your home, your belongings, and your liability. Not too much coverage, which can drive up your premiums, and not too little, which leaves you inadequately protected.

Ideally, your policy will offer replacement cost coverage for both your home (which means you can rebuild with similar materials at the current market rate) and your belongings (which allows you to replace your missing or damaged possessions with similar, like kind and quality or new items).

3. Rethink your deductible

Typically, the higher your deductible, the lower your premium will be. While it may be tempting to choose the highest possible deductible to offset your monthly bill, be careful. You don’t want to choose such a high deductible that it puts an unreasonable financial burden on you when you have a loss.

4. Avoid risky investments

While you can’t pick up your home and move it to a new location, you can opt out of adding things to your home that may raise your premium. For example, you might beat the average price of home insurance by not having:

-

Swimming pools usually raise the cost of your coverage because they increase your liability exposure.

-

Trampolines, while fun, are injuries waiting to happen. Trampolines raise your exposure to the risk of visitor injuries.

5. Make your home safer

Certain updates to your house not only make the home safer, but they can also cut your home insurance costs. For example, the following improvements may reduce your bill:

-

Fix your roof. Replacing your roof can substantially cut down on your insurance costs. Some areas may see savings up to 10%.

-

Mitigate wind risk. This is a big money saver if you live in hurricane-prone areas. In fact, in Florida, insurance providers are legally required to offer discounts for wind-resistant homes. Consider investing in stronger roof-to-deck and roof-to-wall attachments, storm shutters, fortified garage doors, and shatter-proof windows.

-

Upgrade your HVAC, electrical, and plumbing systems. Newer systems often fetch a substantial discount.

-

Get a generator. Some insurers offer a discount for homes that have a backup generator.

-

Invest in a burglar alarm. Depending on your insurer, you may see discounts of 5% or more when you have proof of a centrally monitored security system.

-

Install an automatic water shut off. Anyone who has experienced water damage knows just how expensive it can be. Mitigating your risk with a water detection device that automatically shuts off the water supply when a leak is detected often results in a discount.

Before making big investments, talk to your insurance agent to see what kind of discounts you can expect from each improvement. That can help you spend money that will be offset by savings down the road.

6. Boost your credit score

Most insurers can use your insurance score, which can be partially based on your credit history, as a factor to determine your premium. The logic is that the same factors that influence your credit score also predict how likely you are to make a claim (and subsequently, if you have a higher credit score, you often will qualify for lower rates).

To improve your credit-based insurance score and reduce your insurance bill, you can:

-

Pay your bills on time.

-

Don’t carry a balance from month to month.

-

Don’t use more than 30% of your credit limit.

-

Don’t take out more lines of credit than you need.

7. Review your policy when you renew

We get the impulse to buy and forget about your coverage, but a yearly review is a good practice for a few reasons:

-

You want to make sure your coverage still reflects the reality of your living situation. If you’ve started renting out your home, added a second floor, or bought some valuable new belongings, you want to make sure your policy still offers adequate protection.

-

You get to see if you qualify for more discounts. If you made security updates or upgraded your home’s systems, you may be eligible for lower rates.

-

You want the chance to get rid of coverage you no longer need. Got rid of that trampoline? Great! Before you renew your coverage, let your agent know about possessions you no longer need to protect and liabilities you no longer need to address.

8. Ask your insurance company for pro tips

Every insurance company offers different discounts, prices, and coverage. Luckily, they also typically offer assistance to help you figure these out. So while the tips here apply to most insurers, you’ll get the best insight from a provider who can give you the scoop on:

-

Safety and risk mitigation discounts.

-

Electronic policy discounts.

-

Claims-free discounts.

The bottom line

Understanding the factors that go into your premium is a good start to figuring out how to keep your homeowners insurance costs under control.