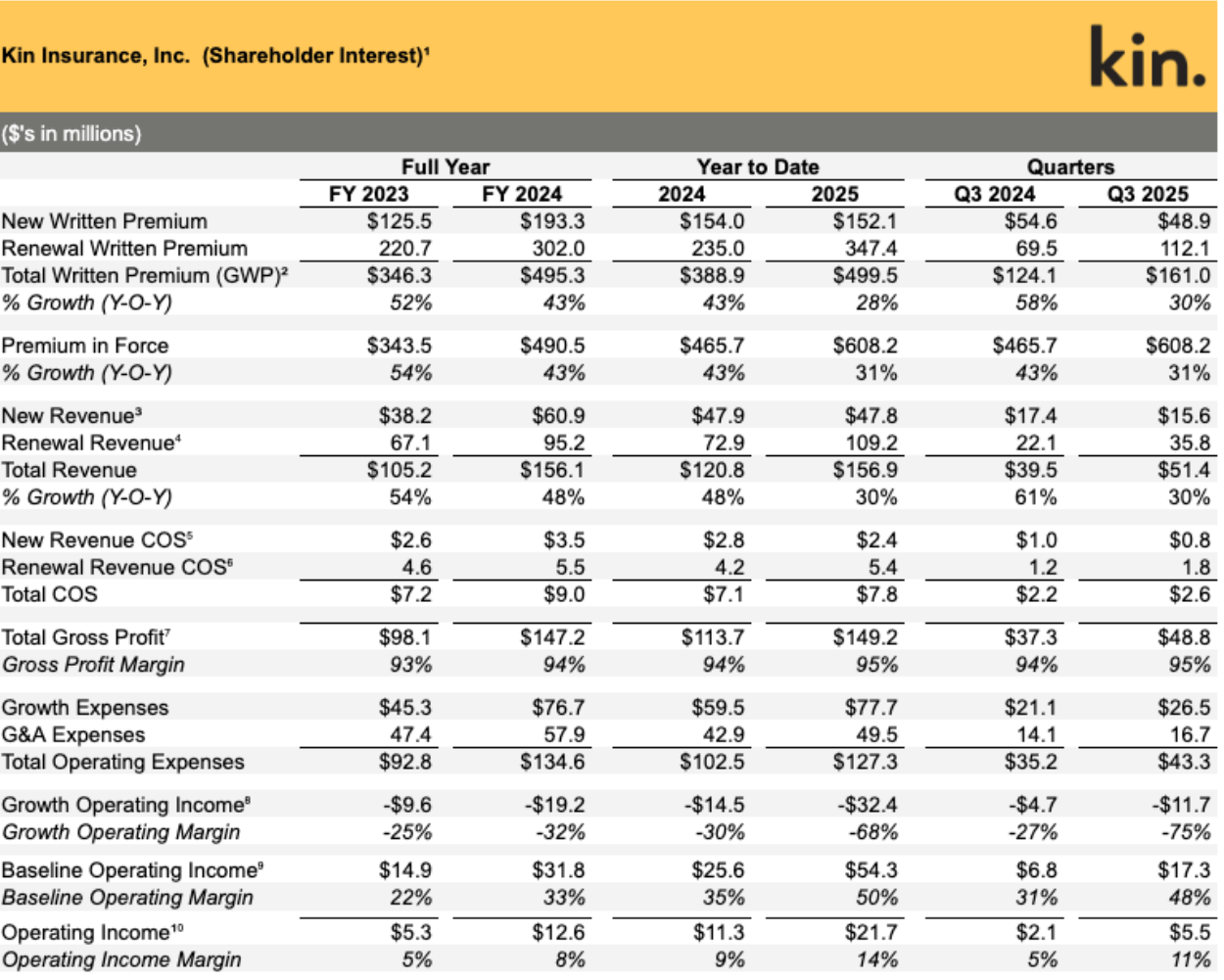

Kin achieves 30% YoY Q3 revenue growth, 48% baseline operating margin

Home insurance and financing provider doubles YoY operating income while minimizing operating expenses.

CHICAGO – December 1, 2025 – Kin, the direct-to-consumer digital home insurance and finance provider, today announces operating results for its third quarter and nine months ended September 30, 2025.

“We continue to push more volume through our technology platform, which is generating more operating leverage,” said Kin Founder and CEO Sean Harper. “Our baseline margins were 48%, the highest they’ve ever been in Q3, which is a lower-volume quarter for us. That underlying profitability enabled us to invest $26.5 million in new growth while still generating positive operating income. Our operating income more than doubled, which is a faster pace of growth than last quarter.”

“The insurance market softened this year. There are fewer shoppers and more competition for those shoppers, which reduced the efficiency of our growth relative to this quarter last year,” said Kin CFO Jerry Fadden. “However, the $26.5 million we invested in acquiring new customers generated $15.8 million in new annual recurring revenue (ARR). With our roughly 90% net retention rate, these customer cohorts turn profitable at their first renewal, 12 months later. The lifetime value of each customer (LTV) is still a significant multiple over the cost to acquire that customer (CAC).”

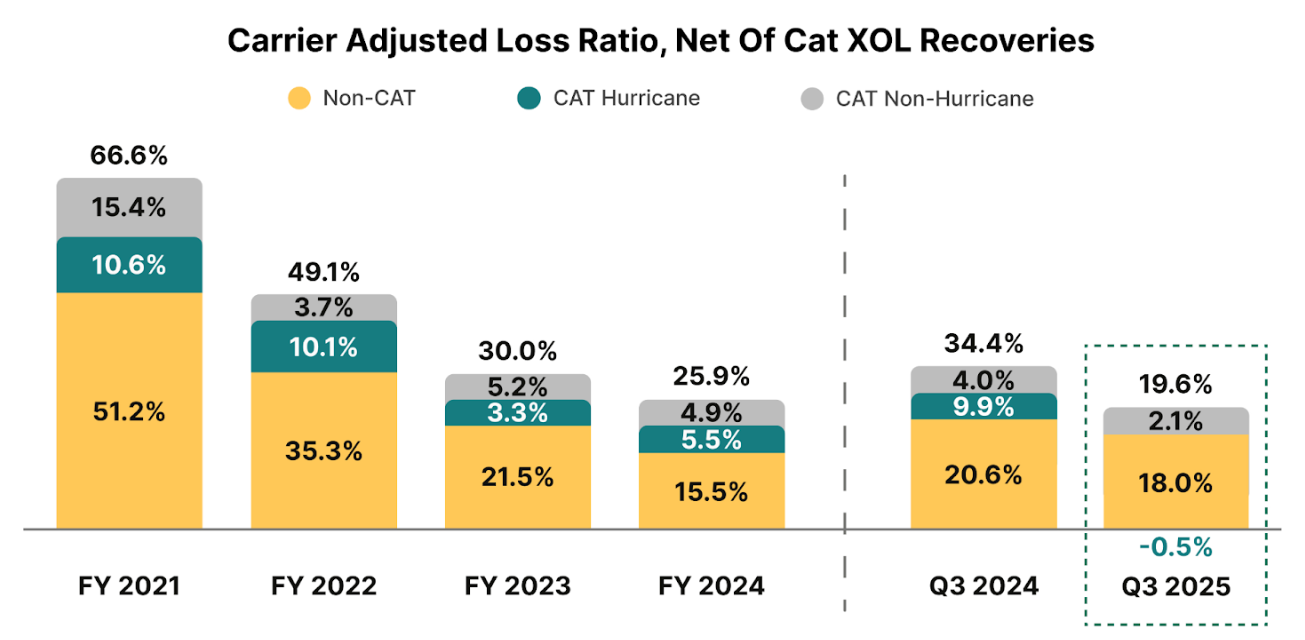

In the third quarter, Kin-managed reciprocal exchanges experienced a 14.8-point improvement in YoY adjusted loss ratios [11] after catastrophe excess of loss (XOL) reinsurance recoveries. Non-catastrophe adjusted loss ratio [12] also decreased from 20.6% in the prior year period to 18% in the third quarter.

“We were happy with the loss results of the reciprocals in Q3 2025. They digested reinsurance cost increases in 2022 and 2023 and reached solid profitability in 2024,” said Kin Chief Insurance Officer Angel Conlin. “This year was even better, which was largely a function of less catastrophic weather activity. The reciprocals don’t need a quiet weather year to generate positive results, but quiet weather is a nice bonus.”

Beyond insurance, Kin now offers a complete suite of home financing services, including mortgage loans, home equity loans, home equity lines of credit (HELOCs), and refinancing. “We have a direct and trusted relationship with our customers with review scores typically very close to 5 out of 5 on the major review sites,” added Harper. “As a result, our customers ask us to solve other problems for them and we’re leveraging our platform to do that with a variety of home lending products and, soon, even more services.”

Founded in 2016, Kin helps homeowners protect what matters most in Alabama, Arizona, California, Colorado, Florida, Georgia, Louisiana, Mississippi, Missouri, South Carolina, Tennessee, Texas, and Virginia. To get your personalized home insurance quote, visit kin.com/home-insurance. To explore home financing options in the state of Florida through Kin Financing, LLC and get personalized guidance, visit: kin.com/financing.

About Kin

Kin helps homeowners protect and leverage their most important investment — their home. Kin offers direct-to-consumer digital insurance and home finance services focused on supporting underserved homeowners in states with high catastrophic risk. Kin offers more convenient and affordable home insurance coverage by eliminating the need for external agents and analyzing thousands of data points about each property to provide accurate pricing. Kin offers home financing through Kin Financing, LLC with Kin-exclusive rates to help homeowners secure a better mortgage rate, refinance, or tap into their equity. Kin’s technology platform delivers a seamless user experience, customized options, and fast, high-quality service. To learn more, visit kin.com.

Footnotes

-

The financial information represents the GAAP consolidated results of Kin Insurance, Inc., excluding its variable interest entities (VIEs), which include its reciprocal insurance carriers and captive. Prior period full-year results reflect immaterial audit adjustments from prior presentations. Quarterly results are unaudited.

-

Gross Written Premium includes premiums written by the two reciprocals managed by Kin Insurance, Inc. and certain third-party carriers.

-

New Revenue is a non-GAAP measure defined as fee revenue calculated in proportion to New Written Premium as a percentage of Total Written Premium at Kin’s managed reciprocal exchanges.

-

Renewal Revenue is a non-GAAP measure defined as fee revenue calculated in proportion to Renewal Written Premium as a percentage of Total Written Premium at Kin’s managed reciprocal exchanges.

-

New Revenue Cost of Sales (COS) is a non-GAAP measure defined as the portion of customer servicing costs and internal claims labor expenses attributable to New Written Premium.

-

Renewal Revenue Cost of Sales (COS) is a non-GAAP measure defined as the portion of customer servicing costs and internal claims labor expenses attributable to Renewal Written Premium.

-

Total Gross Profit is a non-GAAP measure defined as Total Revenue less customer servicing costs and internal claims labor expenses.

-

Growth Operating Income is a non-GAAP measure defined as New Revenue minus New Revenue COGS and Growth Expenses; Growth Expenses include sales and marketing expenses, variable data costs, and other expenses associated with customer acquisition.

-

Baseline Operating Income is a non-GAAP measure defined as Renewal Revenue minus Renewal Revenue COGS and G&A Expenses; G&A Expenses is defined as operating expenses not associated with customer acquisition.

-

Operating Income is a non-GAAP measure defined as net income/loss attributable to Kin Insurance, Inc., excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, and other non-operating expenses.

-

The adjusted loss ratio is a non-GAAP measure defined as loss and loss adjustment expenses, net of catastrophe excess of loss reinsurance recoverables divided by earned premium and the “"earned”" portion of subscriber surplus contributions during the period and excludes claims management fees paid to the reciprocal exchange's attorney-in-fact.

-

The non-cat adjusted loss ratio is a non-GAAP measure defined as total loss and loss adjustment expenses, excluding loss and loss adjustment expenses from named storms and Property Claim Services (PCS) events as defined by Insurance Services Office, Inc. (ISO) divided by earned premiums and the “"earned”" portion of subscriber surplus contributions during the period and excludes claims management fees paid to the reciprocal exchange’s attorney-in-fact.