Miami, Florida, is iconic in the way few cities are. From the art galleries that pepper the Design District to the banyans adorning Coral Way, Miami has something to offer everyone while still feeling like one of the nation’s best kept secrets. The homeowners here know that better than most.

Unfortunately, they also know that living in Miami means contending with hurricanes,and flooding. These risks can make purchasing home insurance confusing and expensive.

So let’s simplify it. This guide can help you figure out the home insurance you may want to consider, the cost of coverage in Miami, and more.

How much does homeowners insurance cost in Miami

According to the most recent data from the Insurance Information Institute, the average cost of homeowners insurance in Florida is over $2,100 per year. And with Miami being home to some of the most expensive real estate in the country, it’s reasonable to expect that many homeowners pay even more than that for their policies.

It doesn’t help that Miami has faced increased risk of flooding in recent years, even after the city’s installation of a multi-million dollar pump system. Nor does it help that Florida insurance rates have been on the rise in the face of high reinsurance costs, litigation, and increased weather risks.

Long story short? You likely pay at least the state’s average – if not significantly higher. That’s partly due to your location on the Atlantic coast. Your high risk for hurricane damage means expensive home insurance.

Factors impacting the cost of home insurance in Miami

The cost of home insurance in Miami has been on the rise in recent years for a number of reasons. For one thing, the city ranks as the metro area with the greatest risk of damage from hurricanes.

In addition to weather-related risks, Miami’s crime rate impacts your premium, too. The city’s property crime rate is higher than the national median.

How to save money on your home insurance

One reason homeowners choose Kin is because of our technology. We use it to analyze granular insurance data, so we can fine tune your coverage to better match your risk. That doesn’t always mean a lower premium, but the average customer saves over $1,000 when they switch.

The next benefit is our discounts. You can earn discounts for:

Lastly, you may be able to reduce your home insurance costs by choosing a higher deductible. Most home insurance policies in Miami have two deductibles. The first is a standard deductible that applies to most perils your home faces. There is a hurricane deductible that only kicks in when your home is damaged by named-storm winds.

Additional coverage for Miami homeowners

Miami homeowners may need to consider other coverages as well. Perhaps the most important of these is flood insurance.

Miami flood insurance

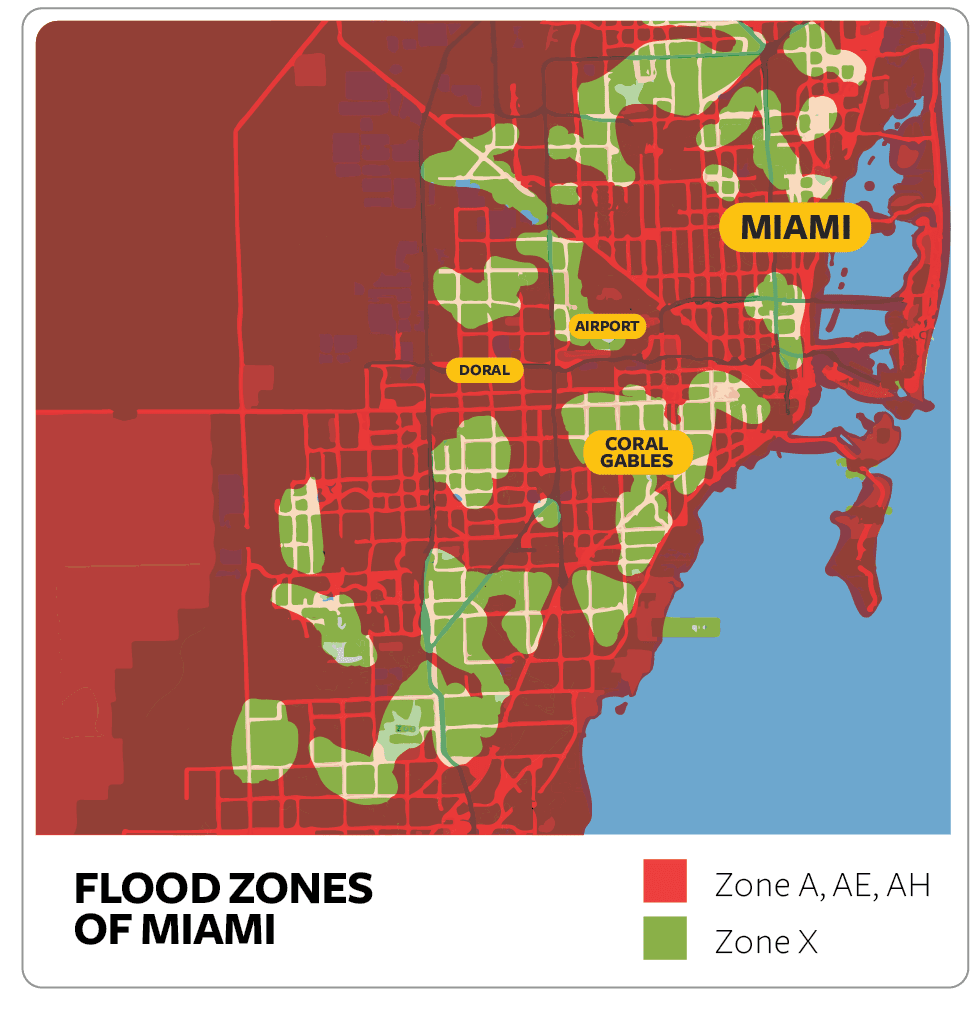

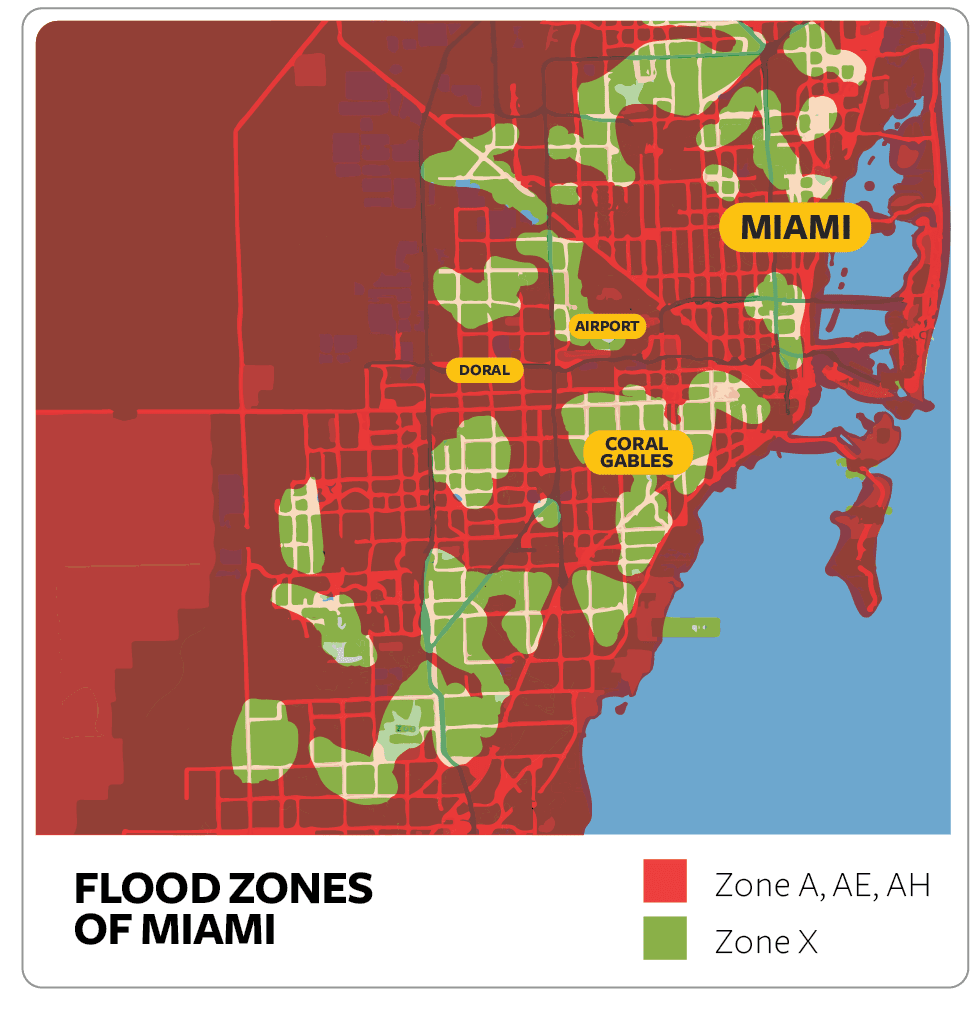

Home insurance seldom covers flooding – even when it’s caused by storm surge. According to flood maps, Miami has several areas designated as flood zones, including:

But the city’s hurricane risk isn't the only reason to get flood insurance. Even one inch of standing water can cost $25,000 in repairs. That could be enough to keep Miami homeowners from repairing their home if they don’t have the insurance to handle the financial burden.

“These low-lying areas are the natural spots where water used to flow from the Everglades to the ocean. Now developed, they experience worse flooding than surrounding areas – over and over again.” – Miami Herald

Sinkhole coverage

Miami may be less susceptible to sinkholes than other Florida cities, but that doesn’t mean you can ignore the risk entirely. The policies we offer in Florida have catastrophic ground collapse coverage that applies in specific situations. With more than 17 sinkholes reported in Florida each day, Miami homeowners may want to consider an endorsement that provides more sinkhole coverage.

While the rest of the state battles sinkholes caused by natural changes in the water table from fluctuation in rainfall, Miami faces increased sinkhole risk associated with new development.

When to get homeowners insurance in Miami

If your home has a mortgage, your lender likely requires you to have homeowners insurance in Miami. That’s why you should price your coverage as you shop for your home – it can help you anticipate how much to budget for your home expenses.

Also keep in mind that you usually can’t purchase homeowners insurance during a hurricane. Insurers can stop selling policies when a hurricane is on the way and for a few days after it has passed. In other words, if you need home insurance by a specific time, you want to act quickly, especially if you are shopping for coverage during Florida’s hurricane season.

Home insurance FAQs

By now, you probably have a good grasp of your basic home insurance needs. If you’d like to learn more about home insurance more generally, including what it covers and tips for picking a carrier, check out the guides below:

Home insurance guides for Florida cities

How to get home insurance in Miami

To buy home insurance in Miami, call one of our experts at 855-717-0022 or enter your address to get started building a free, no-obligation quote.