Kin grows total written premium by 230% year-over-year

Kin exceeds expectations in first quarter 2022, moves closer to $250M annual goal

Kin exceeds expectations in first quarter 2022, moves closer to $250M annual goal

CHICAGO, IL – May 5, 2022 – Kin, the direct-to-consumer home insurance company built for every new normal, today announced select preliminary operating results through the first quarter ended March 31, 2022:

“We’re off to an incredible start having beat our quarterly goal for gross written premium by nearly 16%,” said Sean Harper, CEO of Kin. “While we’re growing faster than ever, we’re doing it very efficiently and generating attractive unit economics, including a 8.0x LTV/CAC ratio and a premium renewal rate that’s trending above 100%.”

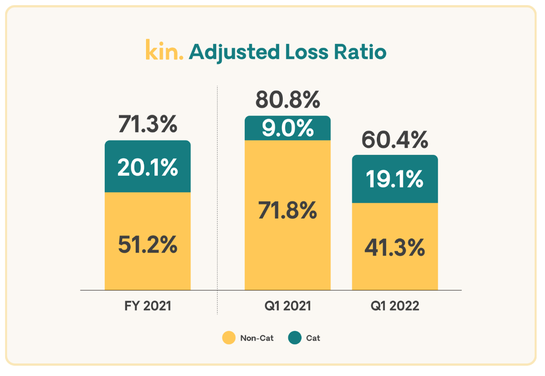

Kin’s early success will enable the company to focus more on decreasing its adjusted loss ratio and accelerate its path to profitability. Through the first quarter of 2022, Kin’s adjusted loss ratio decreased to 60.4% from 80.8% in the prior-year period. Non-cat adjusted loss ratio was 41.3% in the first quarter of 2022, and has decreased on an inception to date basis each of the last four quarters.

“In four of the last five years, the average combined loss ratio has been above 100 across the U.S. homeowners industry, and it’s been even worse in some of the catastrophe-exposed states where we operate,” added Kin’s Chief Insurance Officer Angel Conlin. “In difficult times like these, we believe our DNA as a technology company enables us to respond to changes in the market faster and ultimately achieve better results.”

Harper noted that the current challenging homeowners environment is one that plays to Kin’s strengths as a direct-to-consumer company. “Inflationary periods are not generally good for insurance companies, as rate increases usually lag loss-cost increases,” said Harper. “However, inflation is good for insurance agents, because premiums increase without increasing the amount of work necessary to service a policy. With our direct model, we have an advantage in this environment because we combine the economic profile of the agent with that of the carrier, which offset each other.”

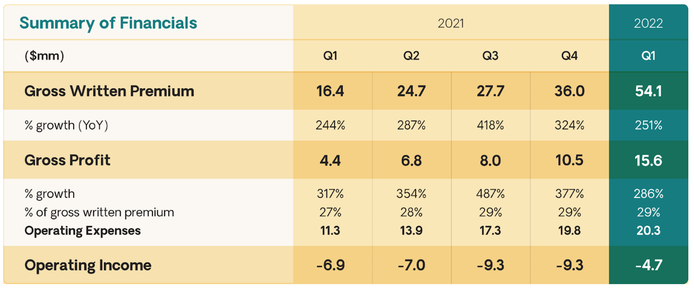

Kin’s operating leverage also improved in the first quarter of 2022, as gross profit grew over three times faster than operating expenses on a year-over-year basis.

“We showed meaningful operating leverage as we experienced revenue growth and narrowed our operating loss,” said Josh Cohen, CFO of Kin. “We’re well-positioned to not just hit our annual goal of $250 million in gross written premium, but also make further progress towards our financial goals that prioritize profitability.”

About Kin

Kin is the home insurance company for every new normal. By leveraging proprietary technology, Kin delivers fully digital homeowners insurance with an elegant user experience, accurate pricing, and fast, high-quality claims service. Kin offers homeowners, landlord, condo, and mobile home insurance through the Kin Interinsurance Network (KIN), a reciprocal exchange owned by its customers who share in the underwriting profit. Because of its efficient technology and direct-to-consumer model, Kin provides affordable pricing without compromising coverage. To learn more, visit www.kin.com.