Kin Insurance exceeds 2021 goal for total managed premium, achieves 320% year-over-year growth

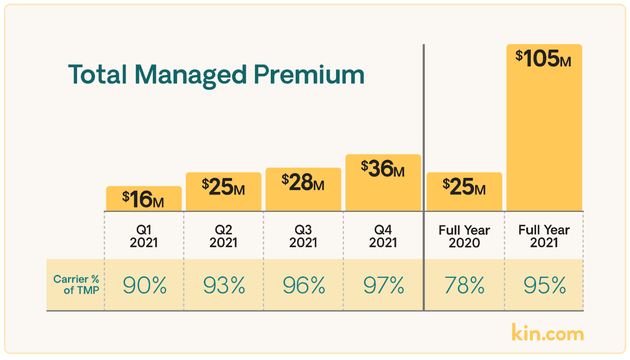

Kin finished 2021 with $104.8M in total managed premium, four times higher than the $25M of total managed premium at the end of 2020

CHICAGO, IL – January 20, 2022 – Kin, the direct-to-consumer home insurance company built for every new normal, today announced select preliminary operating results through the fourth quarter ended December 31, 2021:

- Kin finished 2021 with $104.8 million in total managed premium, four times higher than the $25.0 million of total managed premium at the end of 2020.

- $99.2 million (95%) of total managed premium in 2021 was written through the Kin Interinsurance Network (the “Carrier”), a reciprocal exchange managed by Kin Insurance, Inc.

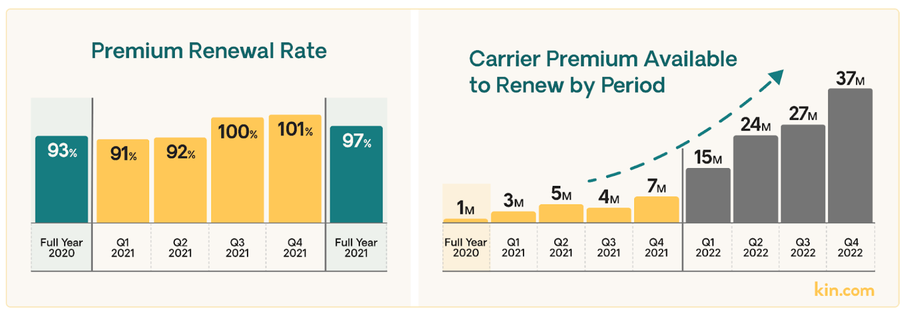

- Premium renewal rate on the Carrier remained strong at 102% in December 2021, increasing the premium renewal rate to 97% in 2021, a 400 basis point increase over 2020.

“Kin achieved several remarkable milestones in 2021 – we exceeded our annual goal for total managed premium by 7%, increased our premium renewal rate to 97%, and tripled the number of customers we serve,” said Sean Harper, CEO of Kin. “These results differentiate our business model and signal that our value proposition continues to resonate with people who want more simplicity and customization when it comes to securing essential and affordable coverage.”

“Kin is winning with fast growth, great unit economics, and loyal customers,” said Josh Cohen, CFO of Kin. “We’re equally, if not more excited, about our future growth trajectory as we plan to expand into more geographic markets that will help us reach a larger portion of the approximate $110 billion aggregate home insurance market.”

These preliminary results through December 31, 2021 are based on the information available to us at this time. There are material limitations inherent in making estimates of our results prior to the completion of our normal financial closing procedures and our actual results may vary from the estimated preliminary results presented here due to the completion of our financial closing procedures and final adjustments. The estimated preliminary results have not been audited or reviewed by our independent registered public accounting firm. These estimates should not be viewed as a substitute for our full audited financial statements. Accordingly, you should not place undue reliance on this preliminary data.

About Kin

Kin is the home insurance company for every new normal. By leveraging proprietary technology, Kin delivers fully digital homeowners insurance with an elegant user experience, accurate pricing, and fast, high-quality claims service. Kin offers homeowners, landlord, condo, and mobile home insurance through the Kin Interinsurance Network (KIN), a reciprocal exchange owned by its customers who share in the underwriting profit. Because of its efficient technology and direct-to-consumer model, Kin provides affordable pricing without compromising coverage. To learn more, visit www.kin.com.