APR explained

The annual percentage rate is an important number on any loan because it tells you how much it costs to borrow the money. APRs include not just the interest rate but also all of the additional charges associated with closing the loan. For a mortgage, the additional charges that might be included in the annual percentage rate are:

- Broker fees

- Closing costs

- Rebates

- Discount points

The higher these costs are, the more expensive the loan is, and the higher the APR becomes. APR is common with mortgage loans, credit cards, and personal loans.

Annual percentage rate vs. interest rate

A loan’s annual percentage rate and interest rate are often confused, but it’s very important to know the difference. The interest rate is the straight cost of a loan or mortgage. It’s usually lower than the APR because it has no other costs associated with it. The APR adds other costs to the total amount borrowed, and that can give you a more accurate view of what the loan costs.

This difference is probably most apparent on mortgages where the APR considers closing costs, mortgage insurance, and other fees and so almost always higher than the interest rate. Two mortgages with the same interest rate can have two different APRs. The one with the higher APR is ultimately more expensive because of its extra charges.

Calculating the APR

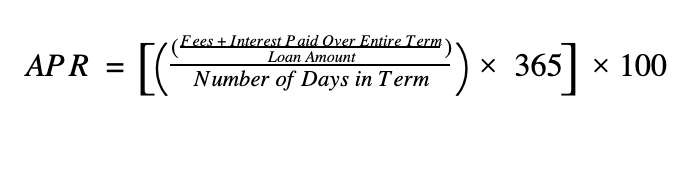

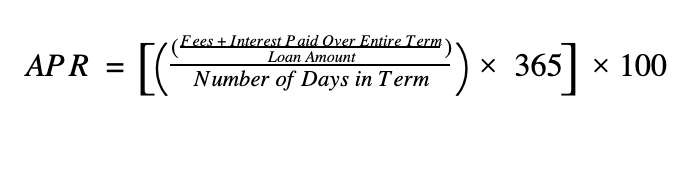

Let’s look at an example of how to calculate your annual percentage rate to see how the potential fees impact it. The formula to calculate APR is:

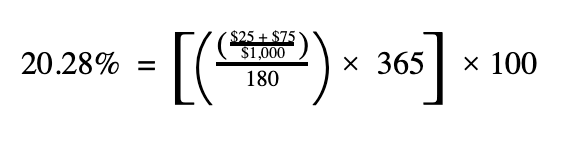

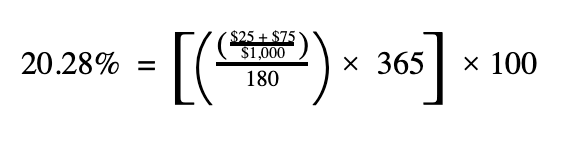

Assume you take out a $1,000 loan over a 180-day loan term. You pay $75 in interest over the life of the loan, and your lender charges a $25 origination fee. When we plug these numbers into the APR formula it looks like this:

Assume you take out a $1,000 loan over a 180-day loan term. You pay $75 in interest over the life of the loan, and your lender charges a $25 origination fee. When we plug these numbers into the APR formula it looks like this:

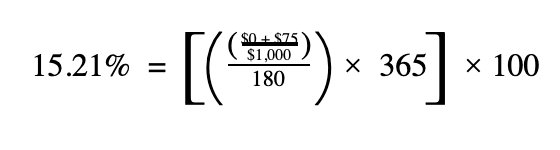

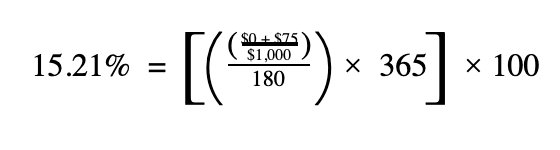

The APR on this loan is 20.28%. But what if you find a lender that doesn’t charge any fees? Granted, that would be miraculous, but if you did, the math would be like this:

Without the $25 fee, the interest rate goes down to 15.21%.

What is a good annual percentage rate?

A good APR is one that is as close to the nominal interest rate as possible because that means fewer fees are driving up the overall cost of the loan. You should also look for any discount points or rebate opportunities because they lower your costs. When points or rebates are added in, you can end up with an APR that’s lower than the interest rate. This, however, is uncommon.

Why the annual percentage rate matters

APR is important because it tells you the real cost of the loan, and that helps you compare offers. You might be misled about the cost of a loan if you only look at the interest rate. Predatory lenders may point to a good interest rate to convince you to take their offer without ever advising you of the additional fees that increase the overall price. This is why legislation now requires lenders to advertise the APR with the interest rate so that borrowers know how much a loan costs.

How to find lower APRs

Don’t always assume that the advertised APR is always the lowest one available. At the very least, you want to shop around for the lowest APR possible when borrowing money or taking out a credit card. But you may also be able to negotiate fees down, including the closing fees associated with the loan. Talk to each lender about lowering your APR so that you aren’t paying too many fees on top of the loan amount.

Assume you take out a $1,000 loan over a 180-day loan term. You pay $75 in interest over the life of the loan, and your lender charges a $25 origination fee. When we plug these numbers into the APR formula it looks like this:

Assume you take out a $1,000 loan over a 180-day loan term. You pay $75 in interest over the life of the loan, and your lender charges a $25 origination fee. When we plug these numbers into the APR formula it looks like this: