Kin’s inaugural Homeownership Trends Report offers unique, data-based insights on how American homeowners are responding to economic trends as they prioritize their financial goals for the year ahead.

Executive summary

As we enter 2026, climate concerns and rising homeownership costs are changing the way American homeowners make financial decisions — including where they live, when they purchase homes, and how they insure them.

Last year, despite avoiding major hurricane damage, the United States was deluged by record-breaking natural disasters like the Palisades and Eaton fires in California, the “ghost storm” floods in Texas, and the tornado outbreaks in Missouri and Illinois.

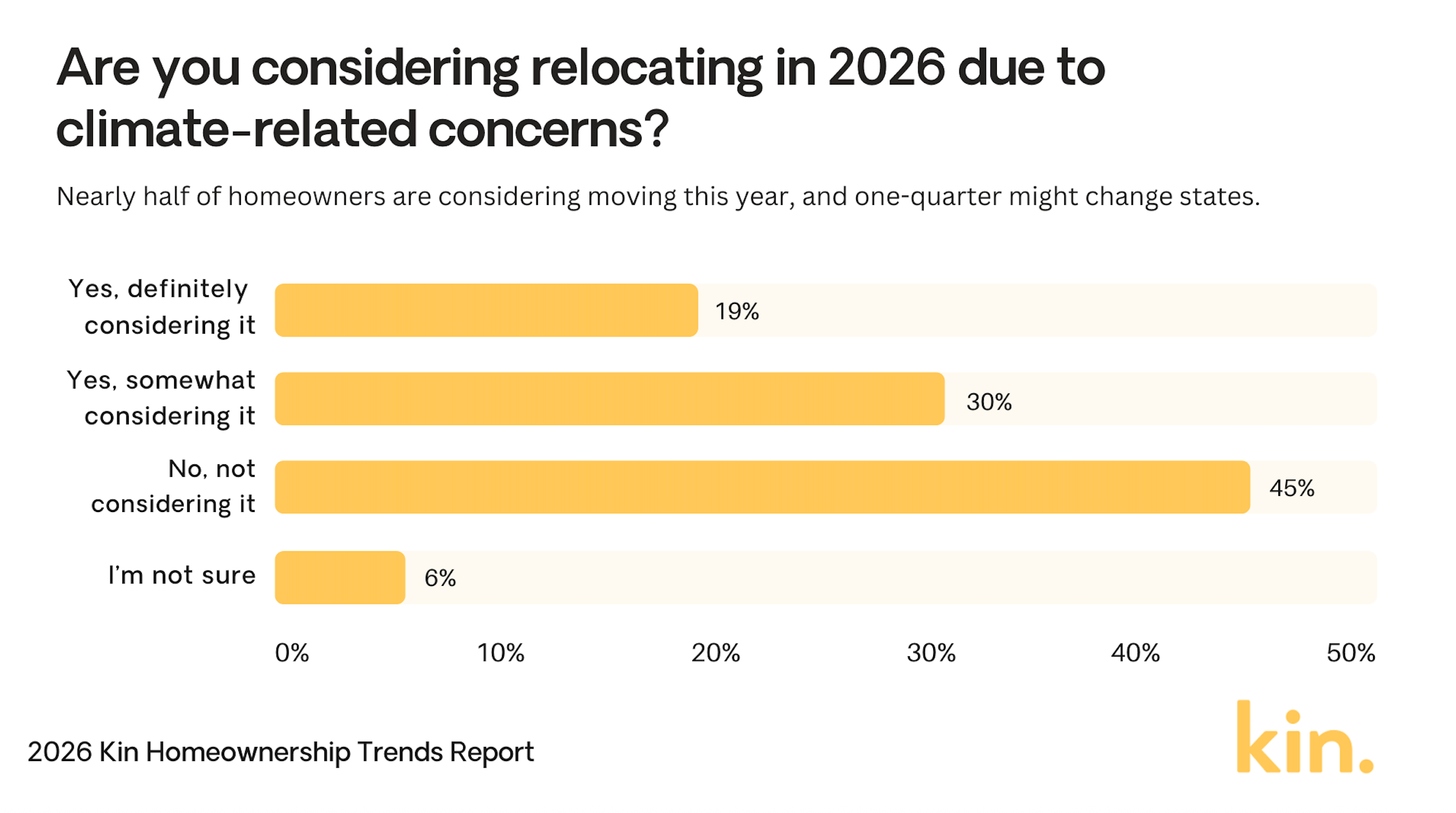

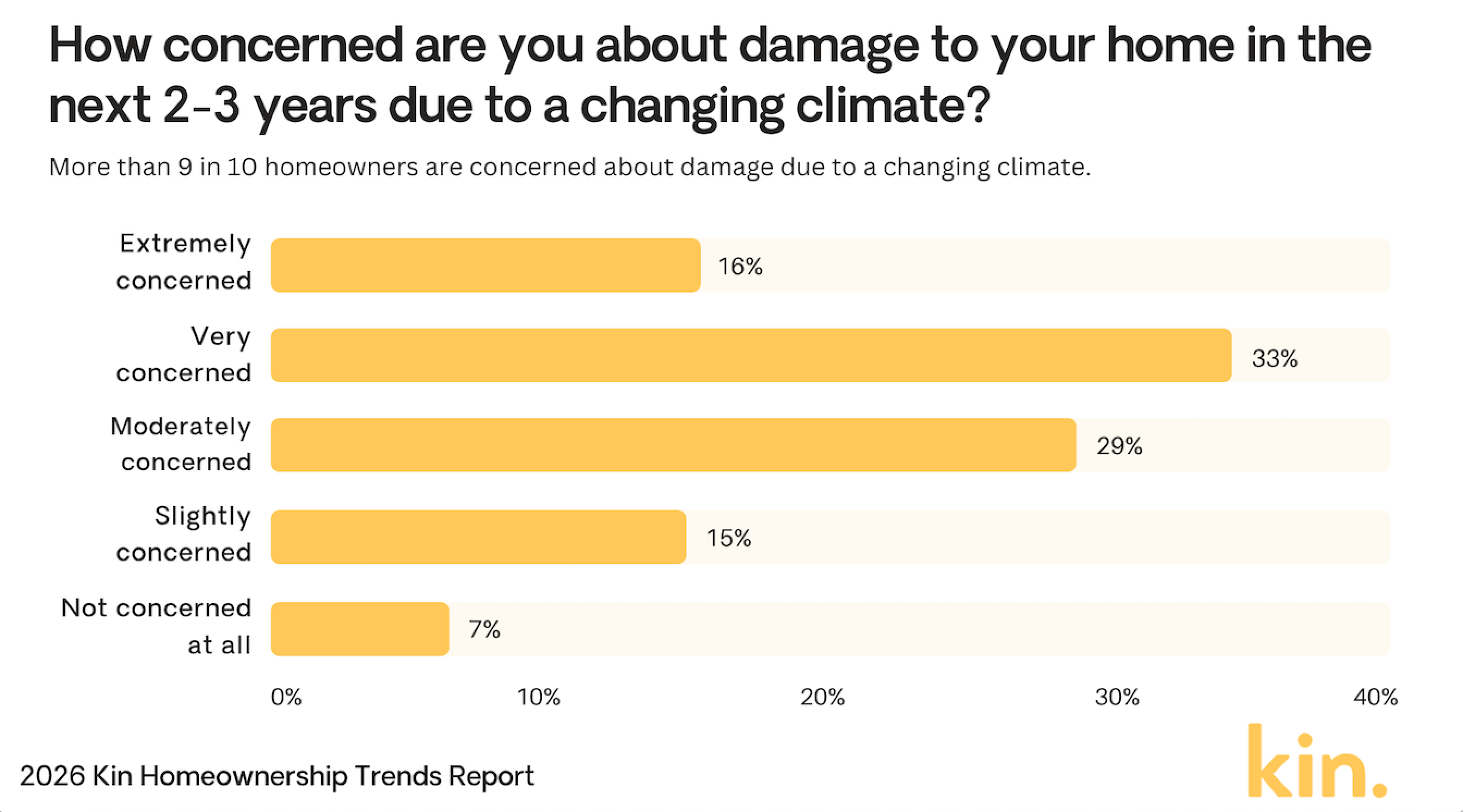

According to our survey, nearly all (93%) of American homeowners expect future extreme weather events driven specifically by the changing climate to damage their homes over the next three years — and a surprisingly high percentage (49%) are considering moving this year due to climate-related concerns.

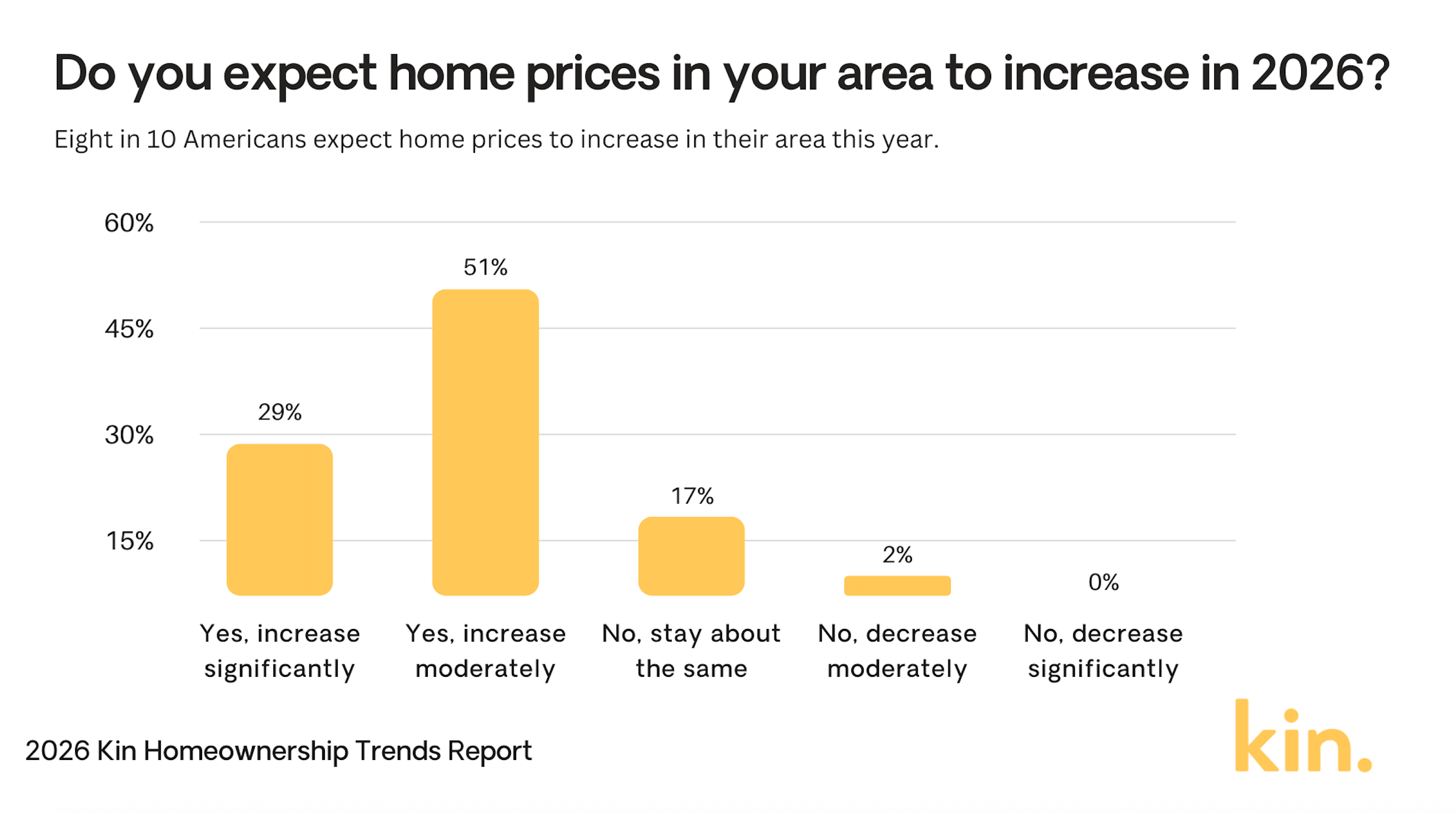

At the same time, U.S. home prices have consistently increased over the past 14 years — and this year, a majority (80%) of American homeowners expect that trend to continue. Meanwhile, after the average home insurance premium increased by 24% between 2021 and 2024, a large majority of American homeowners (82%) now expect their premium to increase in 2026.

Key takeaways

-

Climate concerns are driving relocation decisions for many American homeowners.

-

Nearly half (49%) of American homeowners are considering moving in 2026 due to climate-related concerns.

-

Nearly all (93%) of American homeowners are bracing for extreme weather and expect it to damage their homes in the next three years due to a changing climate.

-

68% of American homeowners expect the frequency of extreme weather events in their area to increase in 2026 compared to last year.

-

The rising costs of homeownership are impacting when Americans purchase new homes.

-

80% of American homeowners expect home prices to increase in their area in 2026.

-

The same number (80%) of American homeowners expect home repair and maintenance costs to increase in 2026.

-

32% of American homeowners believe that interest rates will “meaningfully drop” in 2026

-

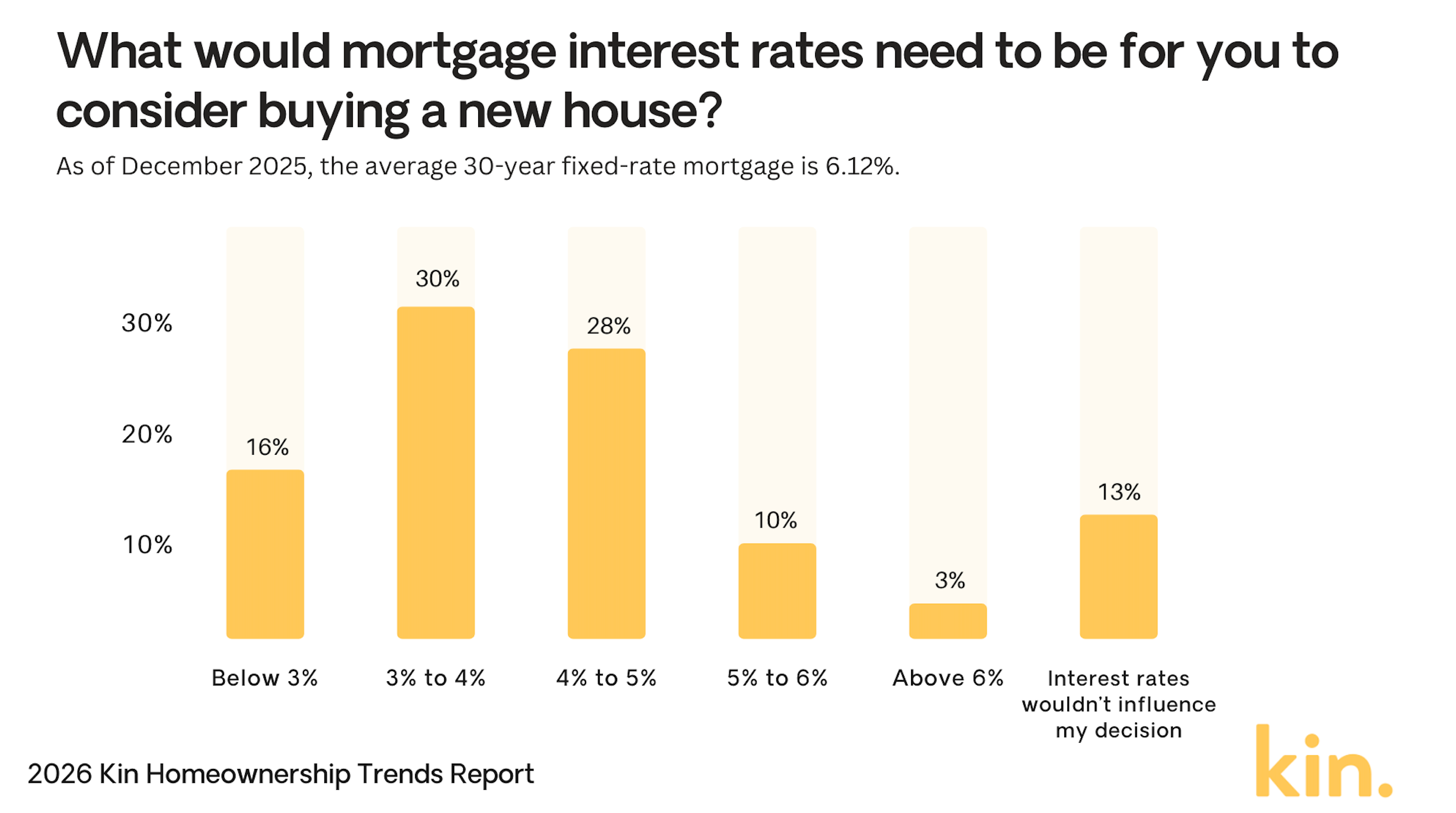

Nearly 1 in 3 (30%) homeowners say mortgage interest rates would need to be between 3% and 4% (rates not seen since 2021) for them to consider buying a new home.

-

The rising cost of home insurance is also impacting how American homeowners make financial decisions.

-

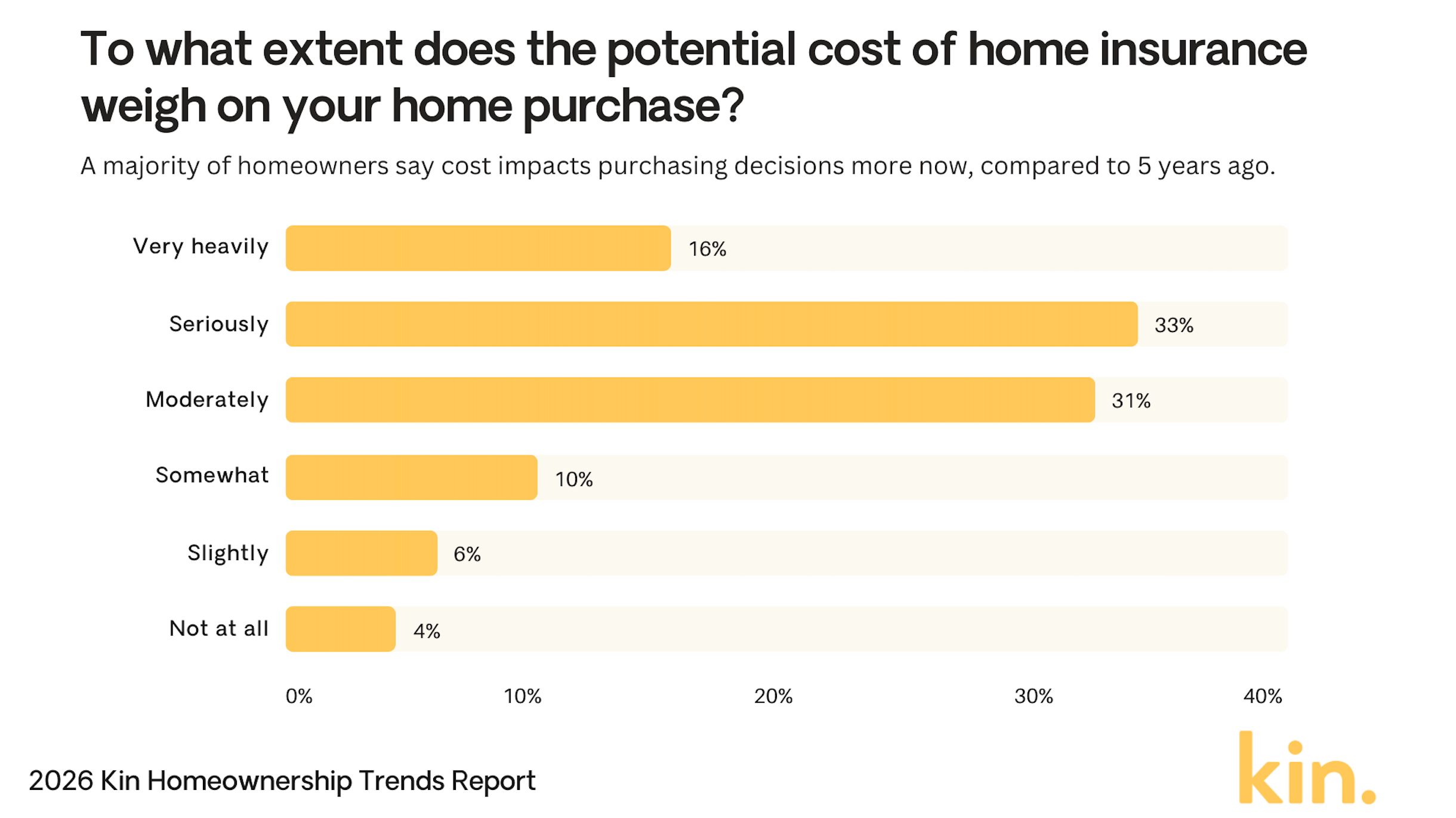

Nearly half (49%) of American homeowners say the cost of home insurance weighs “very heavily” or “seriously” on their home purchasing decisions. Another 31% say it weighs “moderately” on their decisions.

-

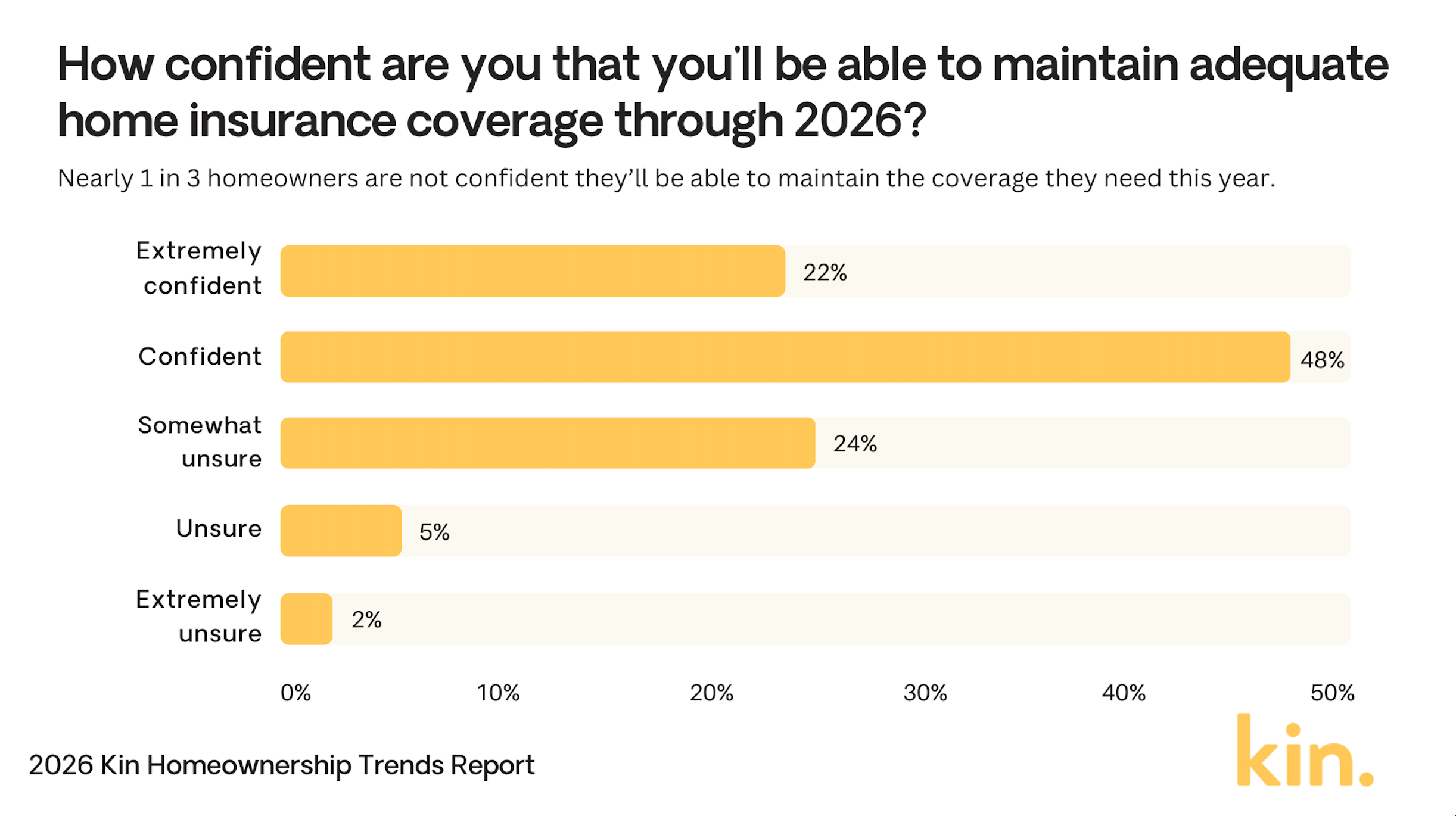

43% of American homeowners expect their home insurance premiums to increase by 1% to 5% in 2026, while 31% aren’t confident they’ll be able to maintain adequate home insurance coverage through 2026.

-

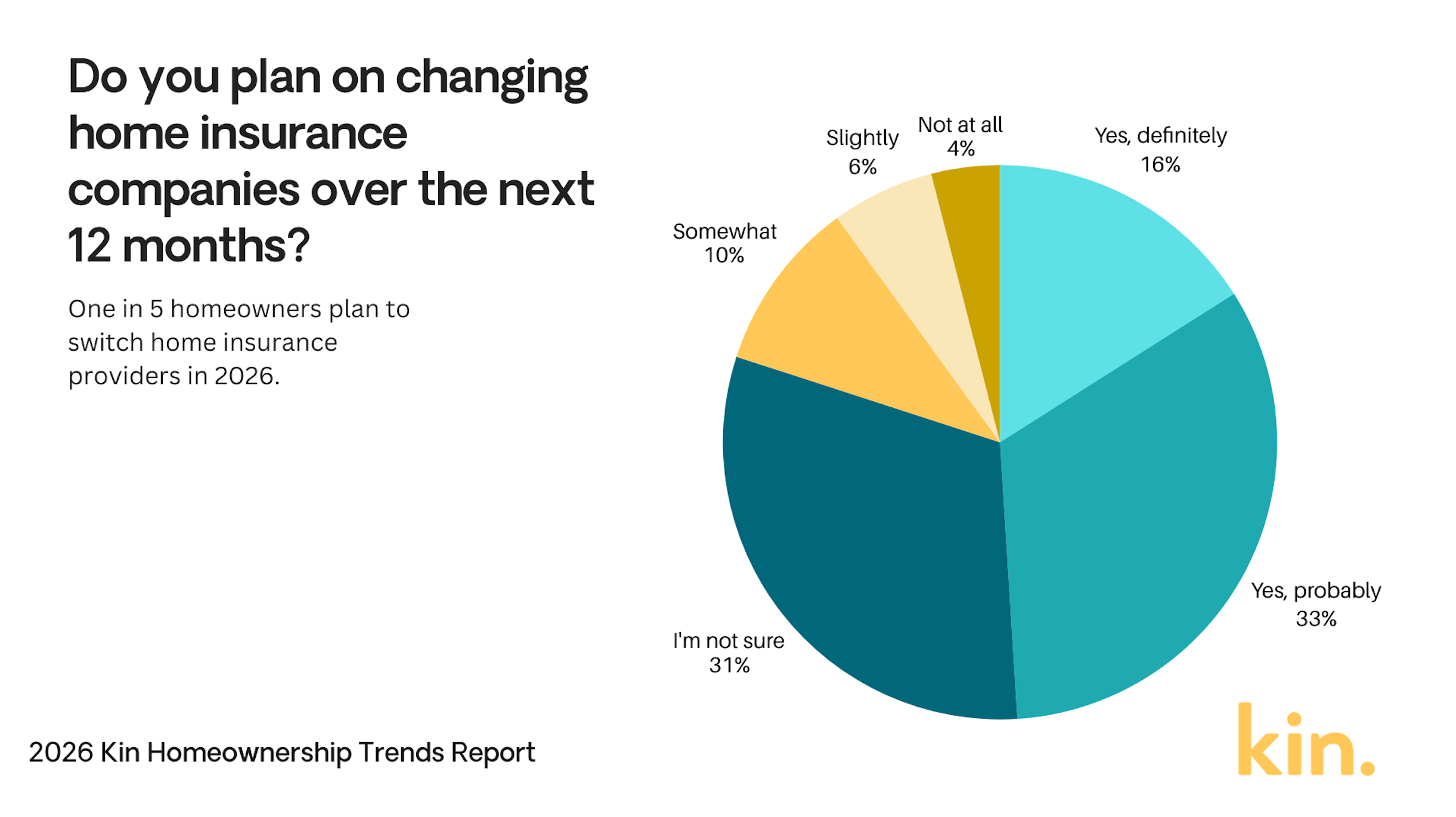

Nearly 1 in 5 (19%) of American homeowners plan on switching home insurance providers in 2026.

Climate concerns

As extreme weather events become more frequent and intense in certain parts of the United States, nearly half (49%) of American homeowners are considering moving at some point in 2026 due to climate-related concerns.

Of the homeowners who are considering moving, 25% are considering moving to another state, but even more want to stay closer to their current homes. 35% are considering moving to a different city or community within their current state, and 41% are considering moving within their current city or community. Last year, homeowners who suffered catastrophic losses in the Los Angeles wildfires followed a similar pattern when they “ended up in neighborhoods at least a half-hour’s drive away” from their previous homes.

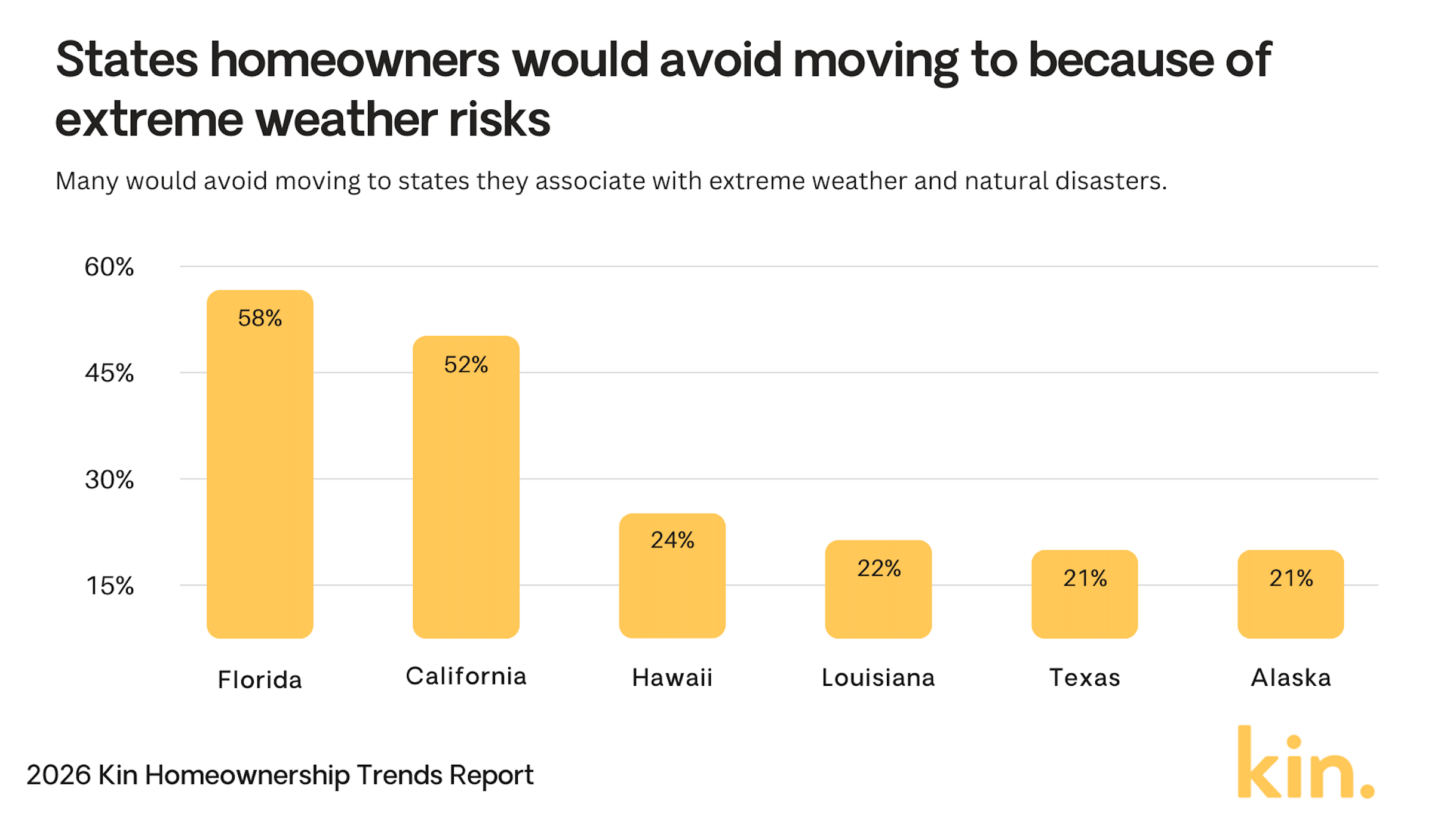

However, many homeowners would avoid moving to certain states they associate with extreme weather and natural disasters. Florida (58%) and California (52%) are the most common states homeowners say they would avoid moving to because of extreme weather risks, while Hawaii (24%), Louisiana (22%), Texas (21%), and Alaska (21%) were the other most common states that respondents say they would avoid moving to because of extreme weather risks.

The least common states homeowners say they would avoid moving to were Vermont (2%), New Hampshire (3%), Delaware (3%), Connecticut (3%), Pennsylvania (3%), Oregon (3%), Utah (3%), and South Dakota (3%).

Whether they’re considering a move or not, nearly all (93%) of American homeowners are bracing for extreme weather and expect it to damage their homes over the next three years specifically due to a changing climate. Meanwhile, after last year’s “hurricane drought,” 68% of American homeowners expect the frequency of extreme weather events in their area to increase in 2026 compared to last year.

Rising home prices

According to a study by the Federal Housing Finance Agency, home prices increased by 2.2% year-over-year in 2025 — and in fact, U.S. home prices have consistently increased over the past 14 years according to the same study.

According to our survey, 80% of American homeowners expect home prices to further increase in their area in 2026. Another 17% expect home prices to stay about the same, while just 3% expect them to decrease.

Most experts have predicted moderate growth for home prices in 2026, with Fannie Mae’s Economic and Strategic Research (ESR) Group forecasting a 1.3% year-over-year increase and the National Association of Realtors predicting a 4% lift.

The same percentage (80%) of American homeowners expect home repair and maintenance costs to increase in 2026 alongside the price of homes. Only 19% expect repair and maintenance costs to stay about the same, while just 1% expect them to decrease.

In 2025, the Federal Reserve kept its benchmark rate steady at 4.25%-4.50% for the first eight months before enacting three consecutive cuts to bring the target range down to 3.50%-3.75% by year-end. As a result, mortgage rates dropped from 7.04% in January 2025 to 6.12% in December 2025. This downward trend was welcome news for homeowners hoping to refinance a mortgage they purchased at a higher rate, or homebuyers who were waiting on rates to drop before purchasing a new home.

However, 32% of American homeowners believe that interest rates will “meaningfully drop” again in 2026, compared to 34% who say “maybe” and 34% who say “probably not” or “definitely not.”

Additionally, 74% of American homeowners say mortgage interest rates would need to be 5% or less for them to consider buying a new home — significantly lower than the current average above 6% for a 30-year fixed mortgage, according to Freddie Mac. As a result, some homeowners feel trapped in their current homes and mortgages until rates drop further, but economic forecasters don’t think we’ll see them fall all the way to 5% or lower anytime soon.

“As we go into next year, the mortgage rate will be a little bit better,” says Lawrence Yun, chief economist at the National Association of Realtors, who predicts it will decrease slightly to 6%. “It’s not going to be a big decline, but it will be a modest decline that will improve affordability.”

Rising home insurance rates

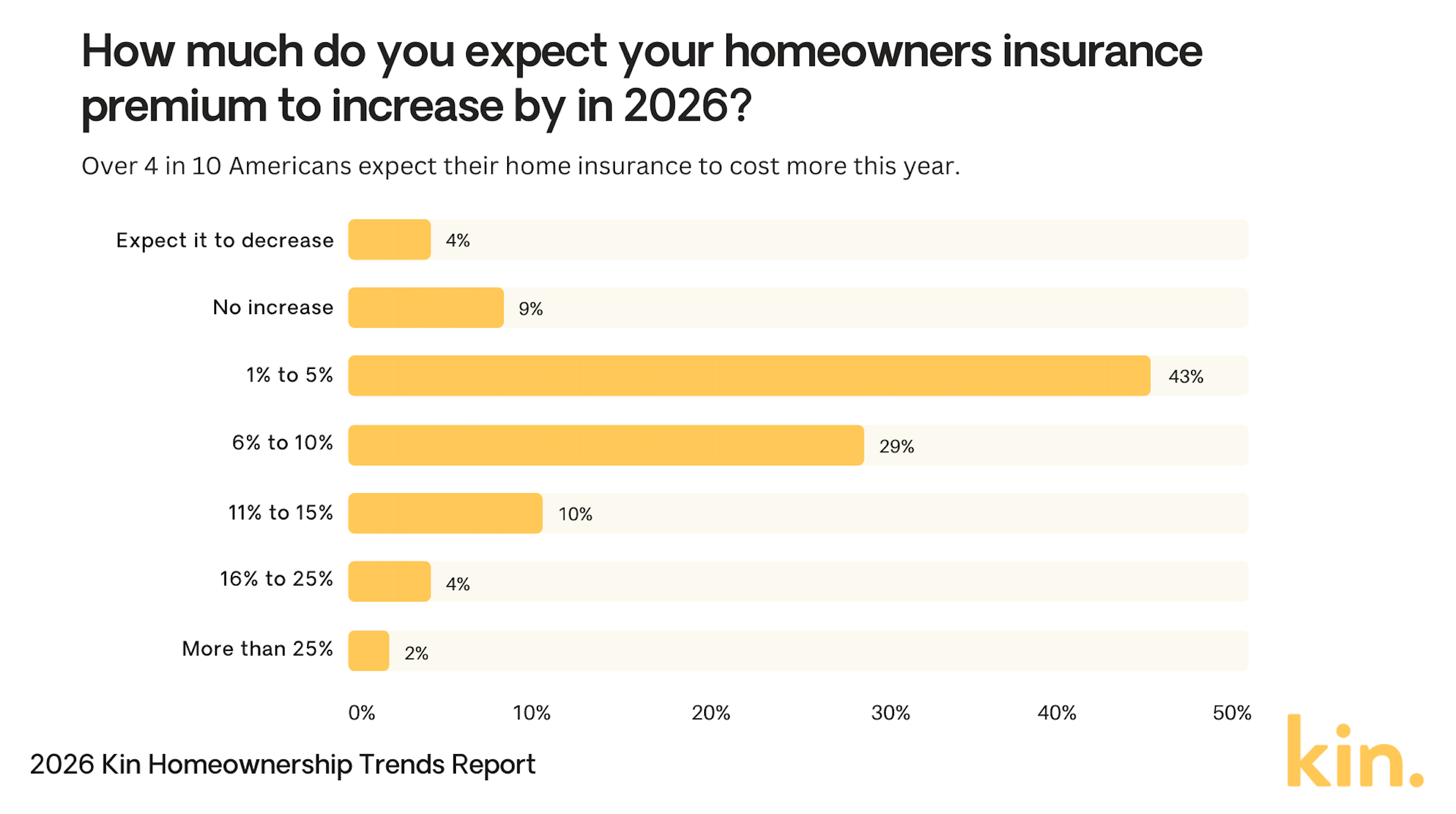

According to the latest data available from the Consumer Federation of America, the average home insurance premium in the United States increased by 24% between 2021 and 2024 — which was 11% higher than the rise of inflation over the same period. This year, according to our survey, 43% of American homeowners expect their home insurance premiums to increase by 1% to 5% in 2026. More than a quarter (29%) of American homeowners expect it to increase by 6% to 10%, while 16% expect it to increase by more than 10%.

However, the rising cost of home insurance over the last few years isn’t just impacting policies — it’s also changing how Americans make homebuying decisions. Nearly half (49%) of American homeowners say the cost of home insurance weighs “very heavily” or “seriously” on their home purchasing decisions. Of those respondents, 11% live in California, 9% live in Texas, and 8% live in Florida.

Another 31% of American homeowners say the cost of home insurance weighs “moderately” on their home purchasing decisions. Just a few years ago, those percentages would have been lower, as 70% of American homeowners now say the cost of home insurance weighs more heavily on their home purchasing decisions than it did five years ago.

In a previous survey earlier this year, we found that only 32% of Gen Z homeowners are “very satisfied” with their insurance companies. Perhaps it’s no surprise, then, that nearly 1 in 5 (19%) American homeowners plan on switching home insurance providers in 2026.

In another survey, we found that only 44% of Gen Z homeowners say they maintain adequate home insurance coverage (enough to cover the current replacement value of their home), compared to 54% of millennials and 65% of Gen X. In our new survey, nearly 1 in 3 (31%) of American homeowners say they aren’t confident they’ll be able to maintain adequate home insurance coverage through 2026.

Conclusions & predictions

Three trends are clear: Many American homeowners are considering relocating due to climate concerns, and they believe the price of homes and the cost of home insurance will rise in 2026.

But are homeowner expectations aligned with expert predictions? When it comes to climate concerns, the answer is yes: study after study — including the Fifth National Climate Assessment (NCA5), which was peer-reviewed by the National Academies of Sciences, Engineering, and Medicine — has confirmed that “extreme events are becoming more frequent and intense.”

The costs of homeownership are harder to predict, but Sean Harper, Founder and CEO of Kin, says most homeowners should expect greater stability this year when it comes to home-related expenses. “We went through a period of economic instability, but it was driven by macroeconomic factors like inflation and interest rates that have since been absorbed.”

Harper also predicts a more stable market for home insurance premiums in 2026. “Elevated inflation was one of the big drivers of premium increases in previous years, but inflation is now occurring at a more predictable pace. Substantial premium increases were the story in 2024, but they weren't the story in 2025 except in a few places like California. And they won’t be the story in 2026.” Last month, another Kin survey found that 60% of California homeowners have struggled to find affordable home insurance over the last three years.

“Since prices won’t be fluctuating as much in 2026, shopping behavior is going to be driven by customer service,” predicts Harper. “You’ll have more choices, so you should use this year as an opportunity to improve your position as a consumer. Look for insurance companies that have the best customer reviews.”

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 65 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on December 10, 2025. Percentages were rounded to the nearest whole number.