Between 2021 and 2024, the average home insurance premium increased by 24% in the United States. As a result, many American homeowners are looking for ways to save money on home insurance. But according to a new survey by Kin Insurance, more than a third of U.S. homeowners (36%) aren’t bundling their home and auto insurance with the same insurer — even though bundling usually results in a major discount.

Sometimes called a multipolicy or multiline discount, bundling is one of the easiest ways to qualify for discounted coverage and typically offers more significant savings than any other type of discount. Most insurance companies that offer both homeowners insurance and car insurance offer a discount to customers who “bundle” both policies with them, instead of going with a different carrier for one of the two policies. Savings vary by insurer, with some companies offering up to 20% off the cost of coverage.

Key takeaways:

-

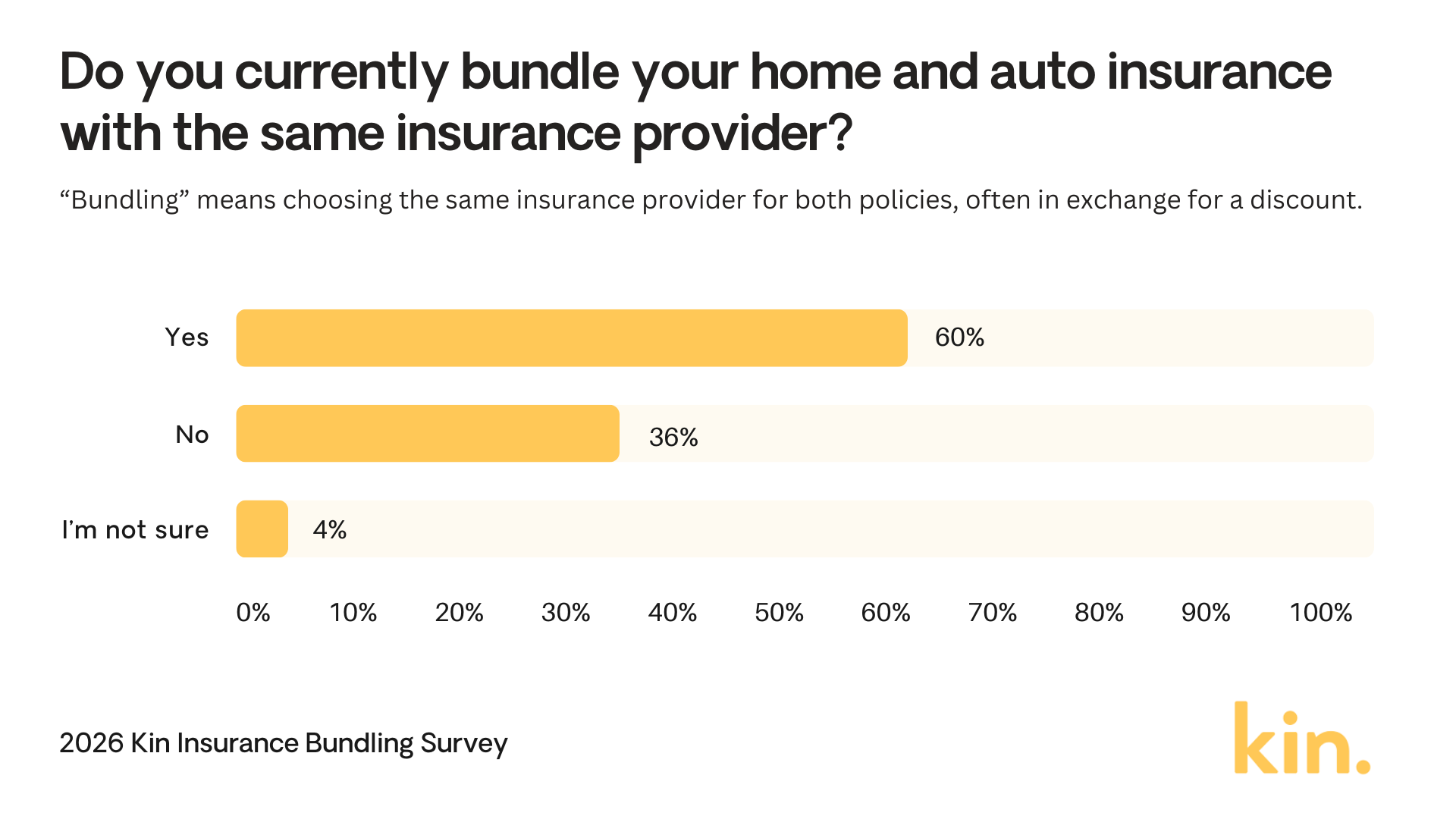

61% of American homeowners bundle their home and auto insurance policies with the same carrier, while 36% do not (and 4% aren’t sure).

-

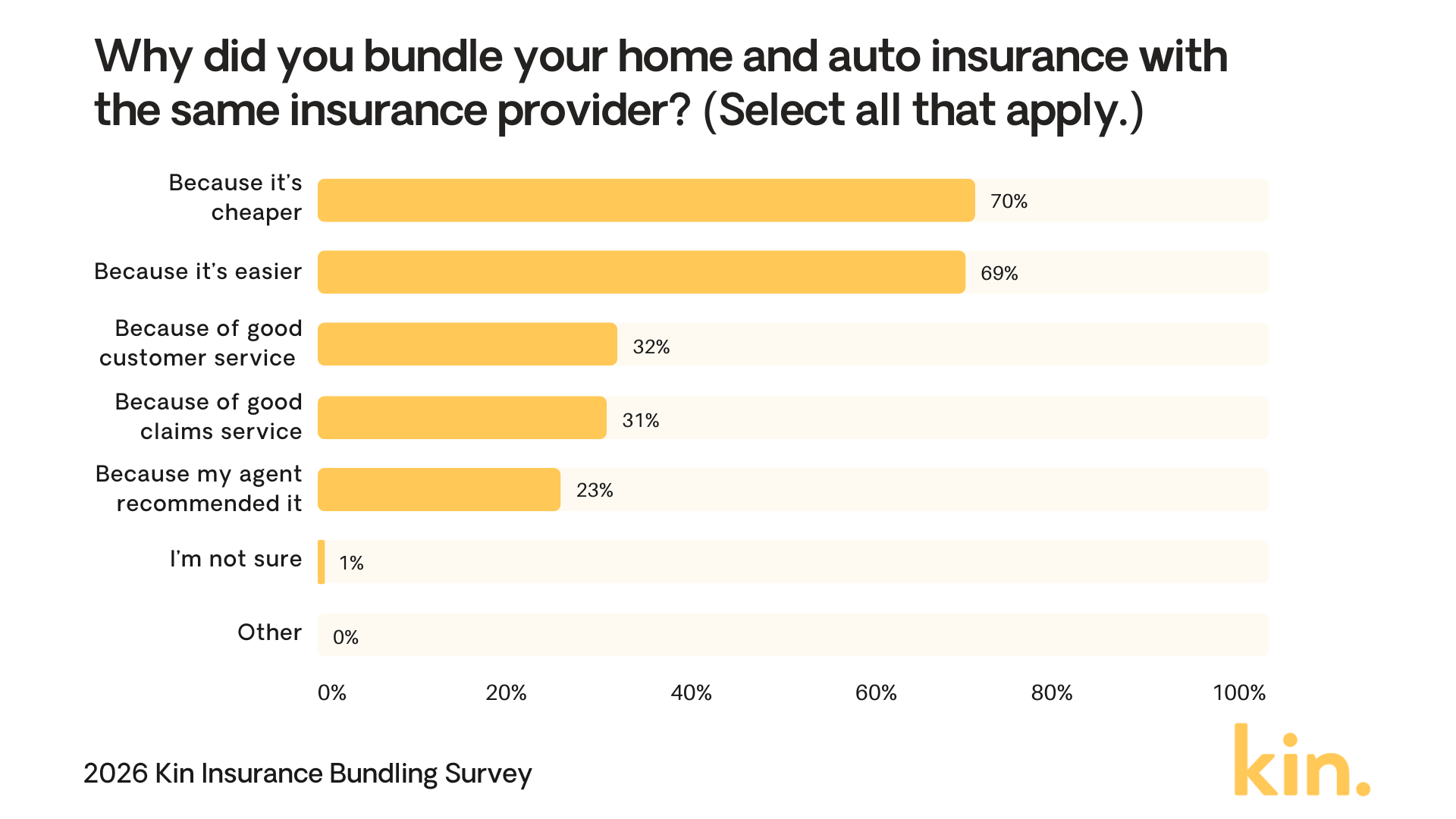

The most common reasons policyholders bundle are “because it's cheaper” (70%), “because it’s easier” (69%), but also because of their experiences with their insurance providers, including “good customer service” (32%) and “good claims experience” (31%).

-

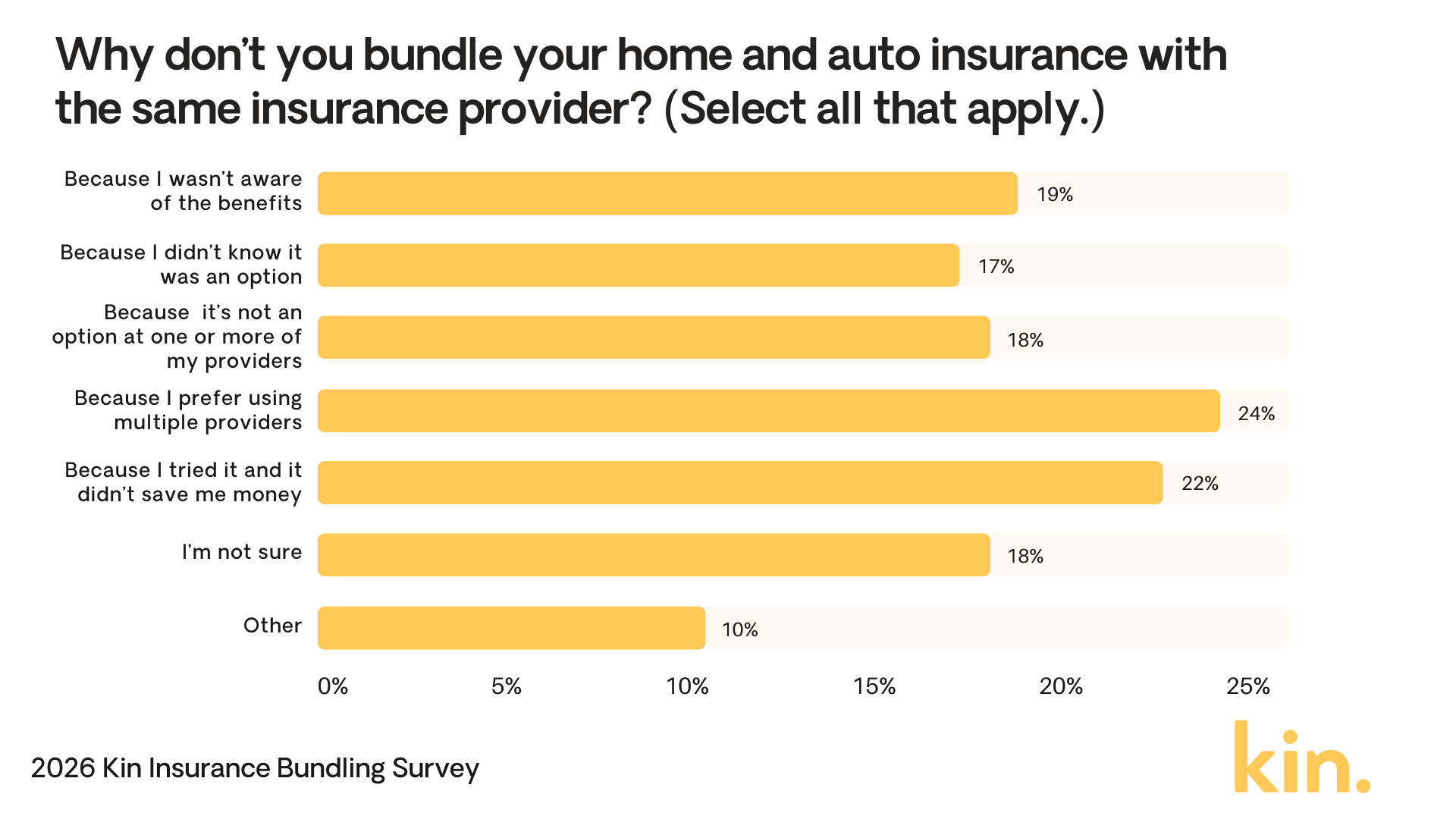

Among American homeowners who don’t bundle, 19% were “not aware of the benefits” while 17% “didn’t know it was an option.” An additional 24% say it’s because they “prefer using multiple providers” despite the convenience of using a single one.

-

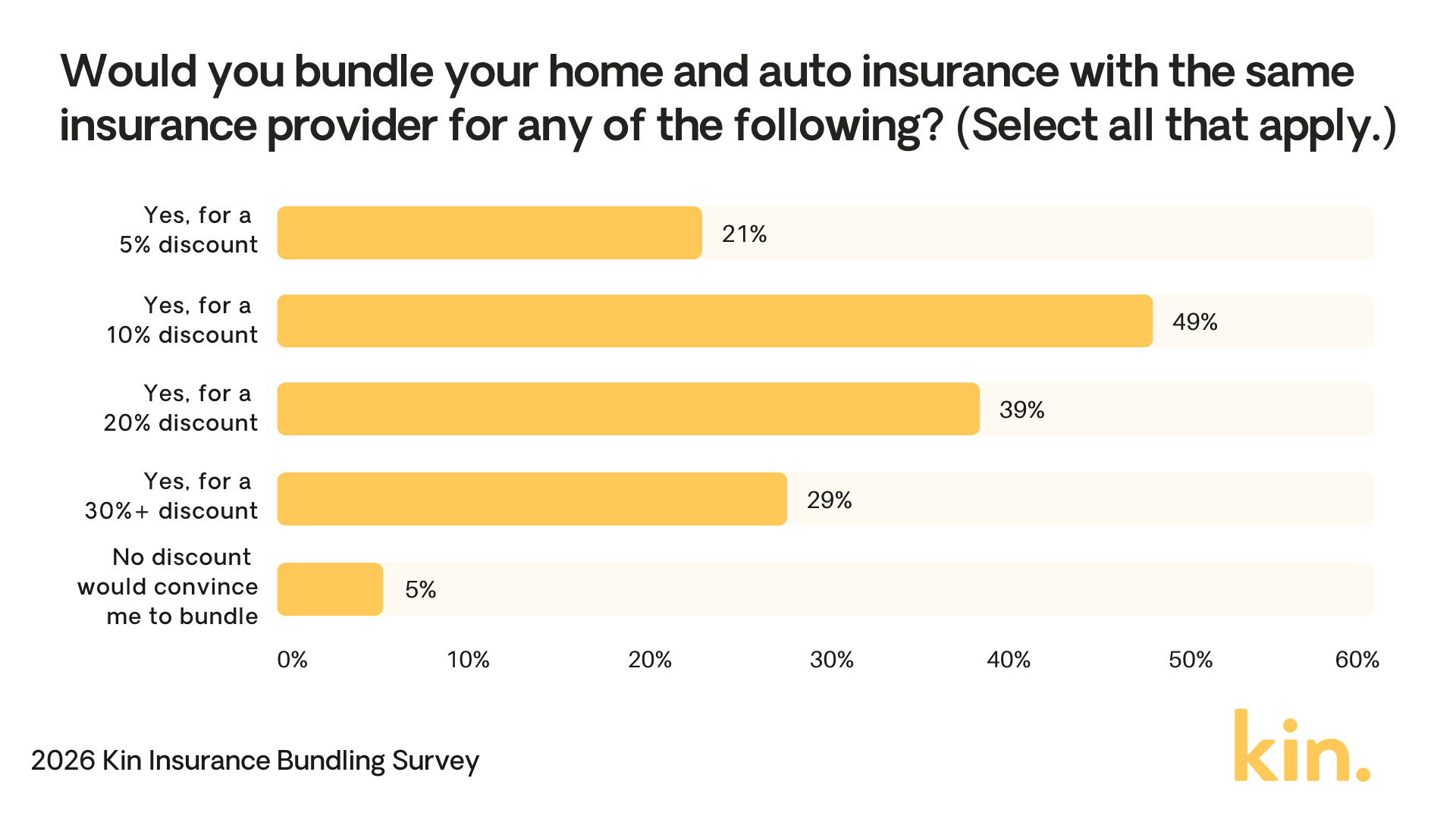

Almost half (49%) of U.S. homeowners say they would bundle for a 10% discount, while 21% would do it for a 5% discount. A small segment of respondents (5%) say no amount of savings would convince them.

Homeowners say the benefits of bundling go beyond discounts

Bundling multiple insurance policies with the same company is extremely popular in the U.S., with 61% of American homeowners bundling their home and auto policies together.

"With insurance premiums rising over the last few years, homeowners are increasingly looking more closely at policy options such as bundling when reviewing their coverage,” says Angel Conlin, Kin’s Chief Insurance & Compliance Officer. “However, our data study shows that a significant portion of homeowners may not be fully aware of available multipolicy options.”

Perhaps unsurprisingly, the most common reason homeowners cited for bundling is “because it’s cheaper” (70%), as most insurance carriers offer a discount for policy bundling. But almost just as many homeowners (69%) bundle “because it’s easier” to work with a single provider. Additionally, many homeowners stay loyal to a single insurance company due to the quality of their interactions, including “good customer service” (32%) and “good claims experience” (31%). Finally, nearly a quarter (23%) bundled policies because their insurance agents recommended it.

(Note: Survey respondents could select multiple reasons depending on how many applied to their decision to bundle.)

Why some homeowners choose not to bundle

For U.S. homeowners who don’t bundle their home and auto policies, the most common reason cited is “because I prefer using multiple providers” (24%). For these homeowners, purchasing policies from two or more different insurance companies may have been cheaper than bundling them with a single provider, even with a discount. In fact, a very similar percentage of non-bundling homeowners (22%) say “I tried it and it didn’t save me money,” despite discounts. Another 18% say bundling isn’t currently an option at one or more of their current providers.

However, many American homeowners are still unaware of the benefits of bundling, or even the fact that it’s an option. Around 17% of non-bundling homeowners say they “didn’t know” bundling was an option, and another 19% say they were “not aware of the benefits.”

“When homeowners haven’t revisited their insurance options in a few years or aren’t aware of multipolicy discounts, they may continue to hold separate home and auto policies, and could potentially be paying more for their coverage as a result,” says Conlin.

What would it take to get more homeowners to bundle?

Most insurance companies that offer multiple insurance products offer a multipolicy discount for customers who bundle, but the savings amount can vary wildly from company to company and homeowner to homeowner.

39% of American homeowners say a discount of 20% is enough to convince them to bundle, while 49% say a 10% discount would be enough. For 21% of homeowners, a 5% discount would suffice, but 5% say “no discount” of any percentage would convince them to bundle.

How to decide if bundling is right for you

Compare the total price tag

While bundling discounts are often the most affordable option for home and auto policies, in some cases, a specialized auto insurance company combined with a separate, specialized home insurance company could still be cheaper overall than a bundled policy from a carrier that offers both. Before switching carriers for a bundle, request a bundled quote and compare the total annual premium against the sum of what you’re currently paying for separate policies, and ensure the math works in your favor.

Review coverage details carefully

Don’t sacrifice the coverage you need for a multipolicy discount (or any discount for that matter). When moving a policy to a new carrier to bundle, ensure the new policy meets or exceeds your current coverage limits and deductibles. If the bundled option offers a lower price but significantly reduces your liability limits or removes key endorsements (like water backup or roof replacement coverage), the short-term savings could cost you more in the long term if you have to file a claim.

Factor in the convenience premium

As the survey noted, 69% of homeowners bundle their home and auto policies because it’s easier. If you value simplicity — like having a single login, one renewal date, and one point of contact — bundling is likely the right choice for you, especially if it saves you money.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 65 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on December 10, 2025. Percentages were rounded to the nearest whole number.