Since 2023, California has been hit by natural disasters like the Palisades Fire, the Eaton Fire, the Park Fire, and Tropical Storm Hilary, which collectively damaged or destroyed more than 19,000 homes and other structures. As a result, homeowners in high-risk parts of California have seen their premiums increase over the past few years, even though the state’s average home insurance premium is still among the lowest in America.

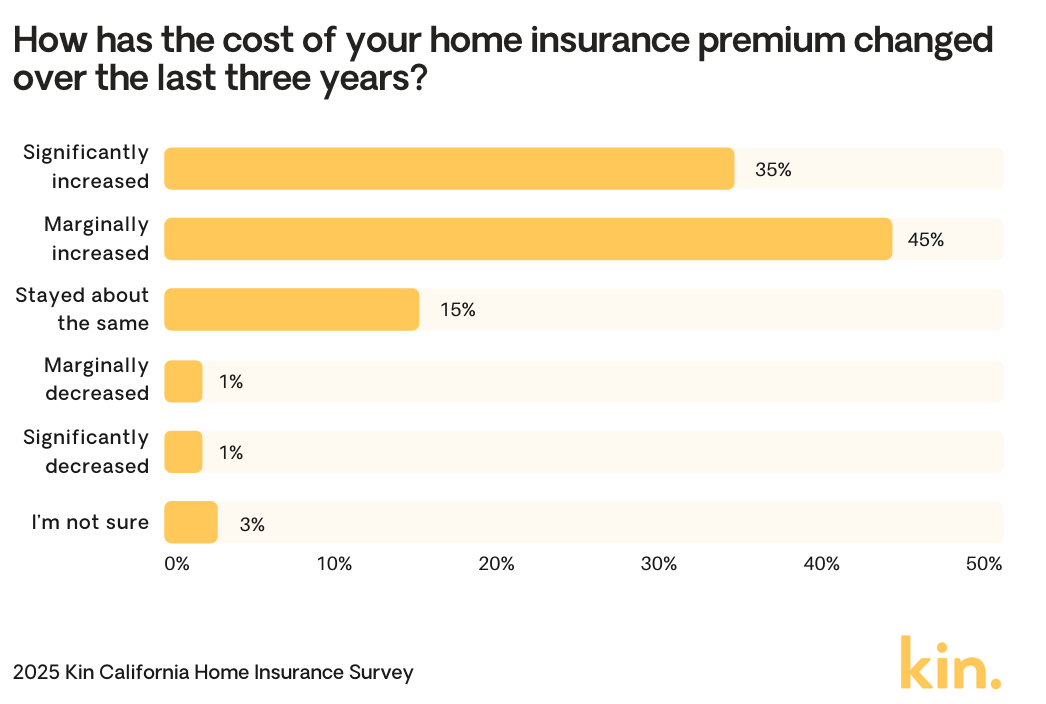

According to a new survey by Kin Insurance, 60% of California homeowners have struggled to find affordable home insurance over the last three years. Additionally, a third (34%) of California homeowners say their home insurance premiums have significantly increased over the same period, and another 45% say they have marginally increased.

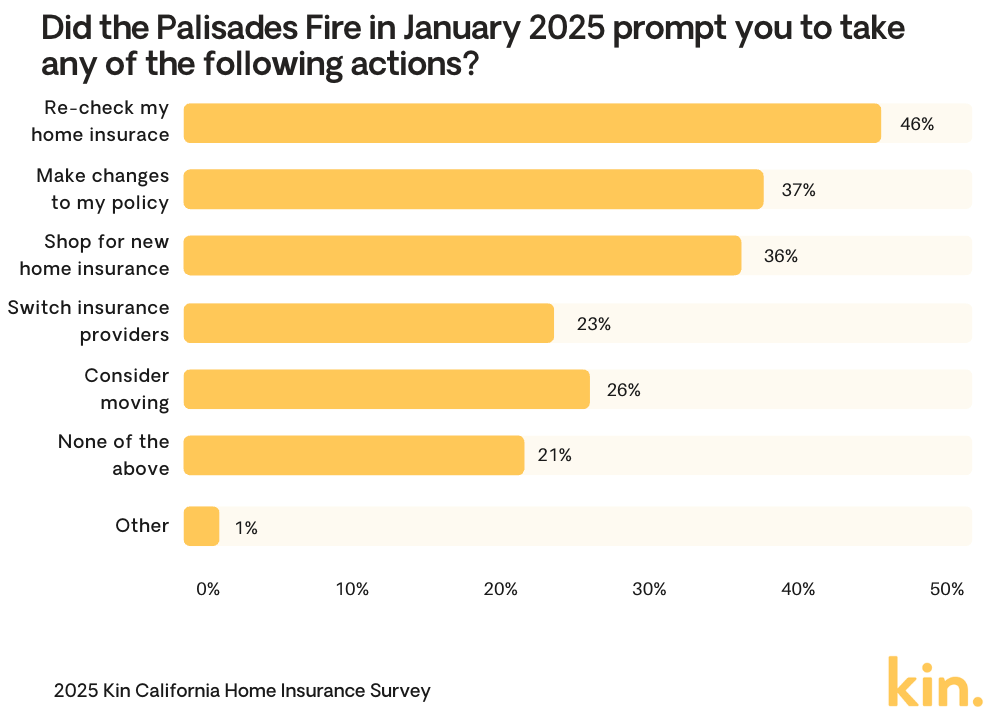

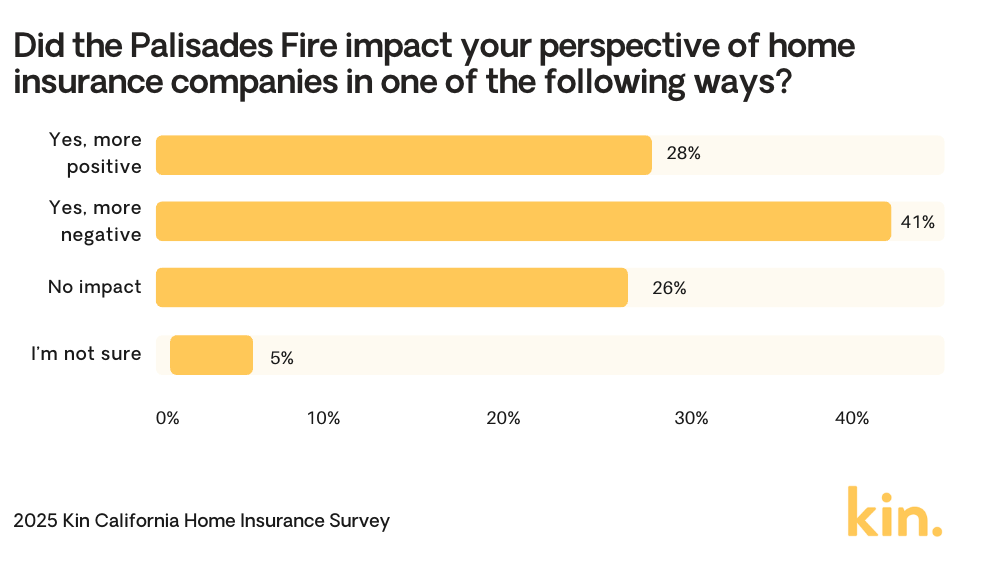

But the most dramatic natural disaster of the past three years — the Palisades Fire of January 2025 — made a massive impact on how California homeowners use insurance and perceive insurance companies. More than 3 in 4 (79%) California homeowners have taken actions to change or shop their insurance policies since the Palisades Fire, while 41% say the fire made their opinion of home insurance companies more negative than before.

Key takeaways

-

Home insurance is getting more expensive and scarcer in the Golden State.

-

60% of California homeowners report struggling to find affordable home insurance coverage over the last three years.

-

34% of California homeowners say the cost of their home insurance has “significantly increased” over the last three years, while another 45% say it has “marginally increased.”

-

1 in 3 California homeowners are “very concerned” home insurance companies will no longer operate their business in the state.

-

Despite this, California still has one of the lowest average premiums in the U.S.

-

61% of California homeowners aren’t aware that on average, California’s home insurance prices are some of the lowest in the country.

-

The Palisades Fire of January 2025 made a huge impact on how California homeowners see home insurance.

-

79% took some kind of action — such as making coverage changes, switching insurers, or shopping around — after the Palisades Fire of January 2025.

-

37% made changes to their home insurance policies

-

36% shopped around for a new home insurance policy

-

26% considered moving to a different home

-

23% switched home insurance providers

-

41% say the Palisades Fire made their opinion of home insurance companies “more negative” than before.

-

28% said it made their opinion “more positive,” while 26% said it didn’t impact their opinion.

-

A wide majority (81%) of California homeowners have taken actions to protect their homes from wildfire damage.

-

31% have removed vegetation and other combustible materials from around the home.

-

29% have sealed gaps around exterior wall penetrations (utility connections, pipes) with fire-resistant caulk or sealant.

-

27% have installed a Class A fire-rated roof (metal, tile, asphalt shingles).

-

27% have covered exterior vents (attic, foundation, under-eave) with metal mesh screening.

-

26% have replaced exterior walls with non-combustible or fire-resistant siding materials like stucco, brick, stone, or fiber-cement.

-

25% have added an accessible outdoor water source with a hose long enough to reach all areas of the property.

-

24% have used fire-resistant or non-combustible materials for decks (e.g., composite, concrete, or fire-retardant-treated wood).

-

20% have installed multi-pane windows (double or triple-pane) or tempered glass to help prevent breakage from intense radiant heat.

-

19% have enclosed areas under decks and porches with wire mesh to prevent debris and embers from accumulating.

Home insurance is getting more expensive — and scarcer — for many Californians

According to the Consumer Federation of America, the cost of California’s home insurance premiums increased by 25% between 2021 and 2024, while premiums in the Los Angeles metro area have seen an even higher 35% increase. As a result, 60% of California homeowners say they have struggled to find affordable home insurance coverage over the last three years, according to the Kin Insurance survey.

Additionally, 34% of California homeowners say the cost of their home insurance has significantly increased over the last three years, while another 45% say it has marginally increased. Only 15% and 8% say it has stayed the same or decreased, respectively.

However, according to the latest data available, California still has one of the 15 most affordable average home insurance premiums in the United States — a fact 61% of California homeowners say they weren’t aware of. For context, the national average for a homeowner with a mid-range credit score and a $350,000 home is $3,303 per year ($275 per month), while California’s statewide average is still just $1,724 ($144 per month) despite recent increases.

Nevertheless, 80% of California homeowners are concerned home insurance companies will no longer operate their business in the state, after some carriers paused new applications in 2023 and others announced non-renewals for thousands of California policyholders in 2025.

“Companies that are able to operate long-term in high-risk markets like California tend to be those that can price risk with a high degree of accuracy,” says Kin’s Chief Insurance & Compliance Officer, Angel Conlin. “That requires looking at detailed, property-level data. When you can fairly assess each individual home — its construction, location, and mitigation features — you can price it appropriately and mitigate volatility.”

The Palisades Fire was a polarizing moment for California homeowners

The Palisades Fire of January 2025, which burned roughly 5,000 homes in the Los Angeles metro area, was a wake-up call for many homeowners across the state of California. 79% took some kind of action after the Palisades Fire, including making changes to their home insurance policies (37%), shopping around for a new home insurance policy (36%), considering moving to a different home (26%), and switching home insurance providers (23%).

In addition, 81% of California homeowners have taken actions to protect their homes from wildfire damage. The most common actions are removing vegetation and other combustible materials from around the home (31%) and sealing gaps around exterior wall penetrations (utility connections, pipes) with fire-resistant caulk or sealant (29%).

“It’s very encouraging to see more California homeowners are taking meaningful steps to reduce wildfire exposure because this is so critical to keeping them safe,” says Conlin. “With the right mitigation in place, California homes are absolutely insurable, and coverage should remain accessible. Homeowners and homebuilders can support that goal by hardening homes against wildfire risks.”

Meanwhile, 41% of California homeowners say the Palisades Fire made their opinion of home insurance companies more negative than before. On the other hand, as some California homeowners received timely payouts and supportive experiences, 28% said the Palisades Fire made their opinion of home insurance companies more positive than before. An additional 26% said the fire didn’t impact their opinion one way or the other.

“Strong insurers start by assessing risk accurately and pricing it appropriately,” Conlin says. “When a wildfire or other disaster hits, they activate fast, technology-driven response plans to support customers. And they manage claims with consistency and transparency in collaboration with their customers. Companies that excel across all three phases are the ones that are likely to remain stable for the long term.”

“Strong insurers start by assessing risk accurately and pricing it appropriately,” Conlin says. “When a wildfire or other disaster hits, they activate fast, technology-driven response plans to support customers. And they manage claims with consistency and transparency in collaboration with their customers. Companies that excel across all three phases are the ones that are likely to remain stable for the long term.”

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 65 who currently own a single-family home in California. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on November 4, 2025. Percentages were rounded to the nearest whole number.

In California, Kin refers to Kin Insurance Services. Kin Insurance Services is a California surplus lines broker (license #0L32036). Coverage is underwritten by a company that is not licensed or regulated by the California Insurance Commissioner.