Ever since the housing boom of the 1950s, owning a home has been part of the American Dream for millions of families — especially for members of the Baby Boomer generation who flocked the suburbs after World War II.

But in 2025, things have changed.

As U.S. household debt reaches new record highs, more than half (53%) of today’s American homeowners say debt freedom has replaced homeownership as their version of the American Dream, according to a recent Kin Insurance survey. As a result, more than a third (37%) of Gen Z homeowners say they plan on transitioning to renting sometime in the next five years.

Key takeaways

-

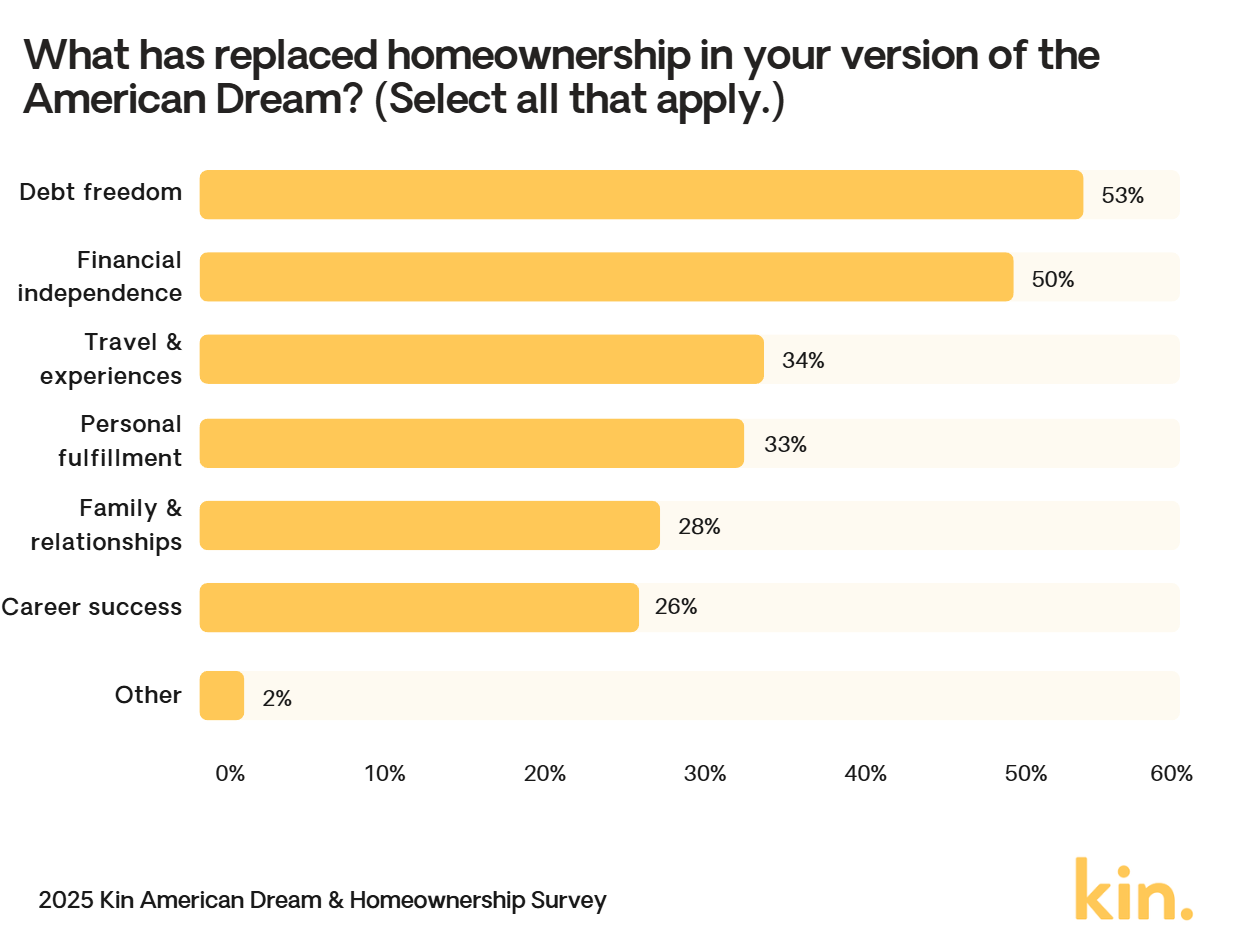

New priorities: 53% of American homeowners say “debt freedom” has replaced homeownership as their version of the American Dream.

-

Half (50%) also selected “financial independence,” while 34% said “travel and experiences,” 33% said “personal fulfillment,” 28% said “family and relationships,” and 26% said “career success.”

-

54% no longer consider homeownership “absolutely” part of the American Dream.

-

41% say it’s only “somewhat” part of the modern American Dream while 9% say “not really” and 3% say “not at all.” The remaining 45% say it is “absolutely” still part of the American Dream.

-

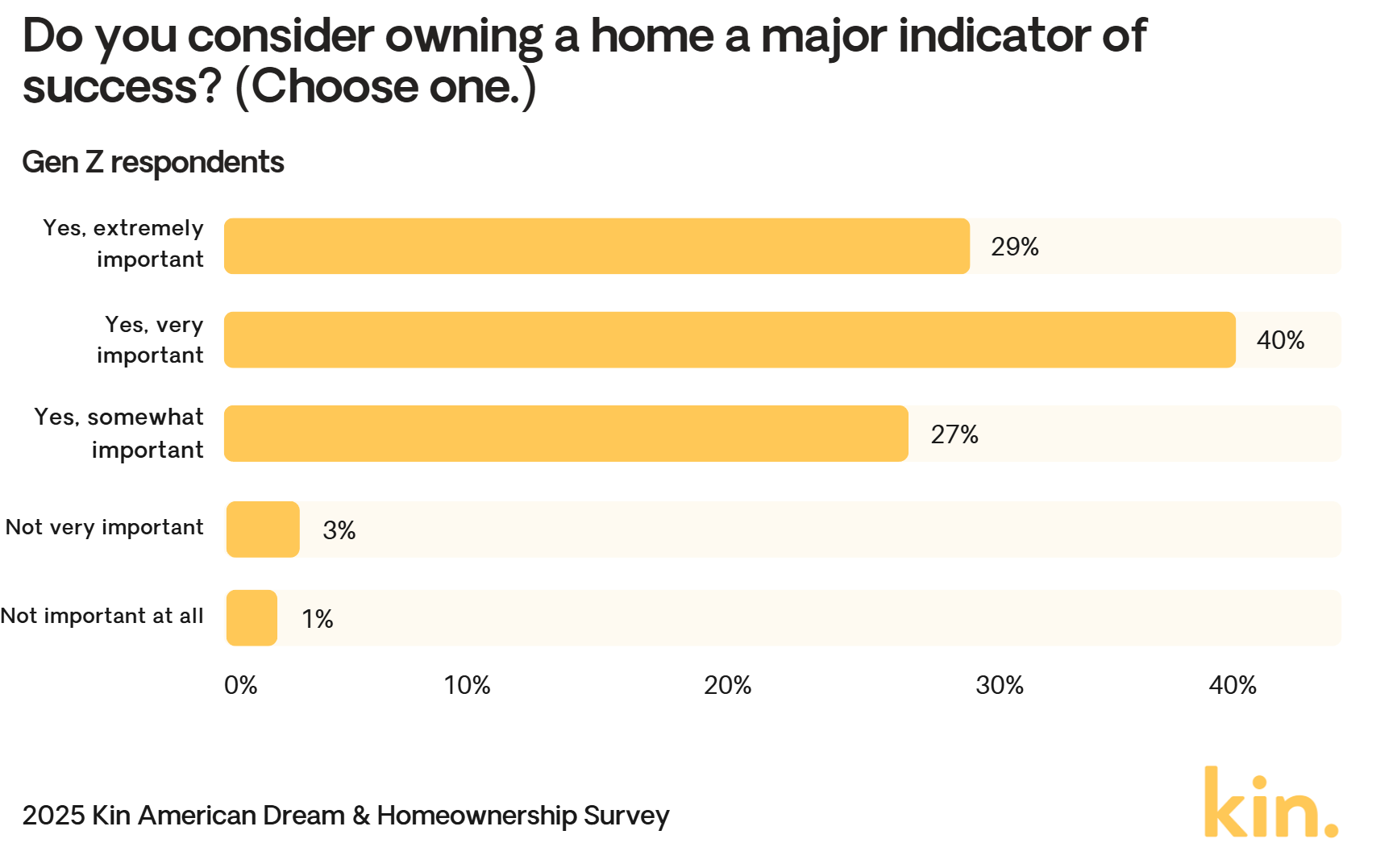

Success indicators: Gen Z homeowners are much more likely to see owning a home as a major indicator of success than their parents’ generation (Gen X).

-

29% of Gen Z homeowners see it as an “extremely important factor” compared to just 19% of Gen X.

-

Only 4% of Gen Z homeowners see it as “not very important” or “not important at all” compared to 11% of Gen X.

-

Market realities: 47% of Gen Z homeowners say starter homes are harder to find in today’s housing market.

-

Another 19% of Gen Z homeowners say starter homes are “mostly gone,” while 5% say they “don’t exist anymore.”

-

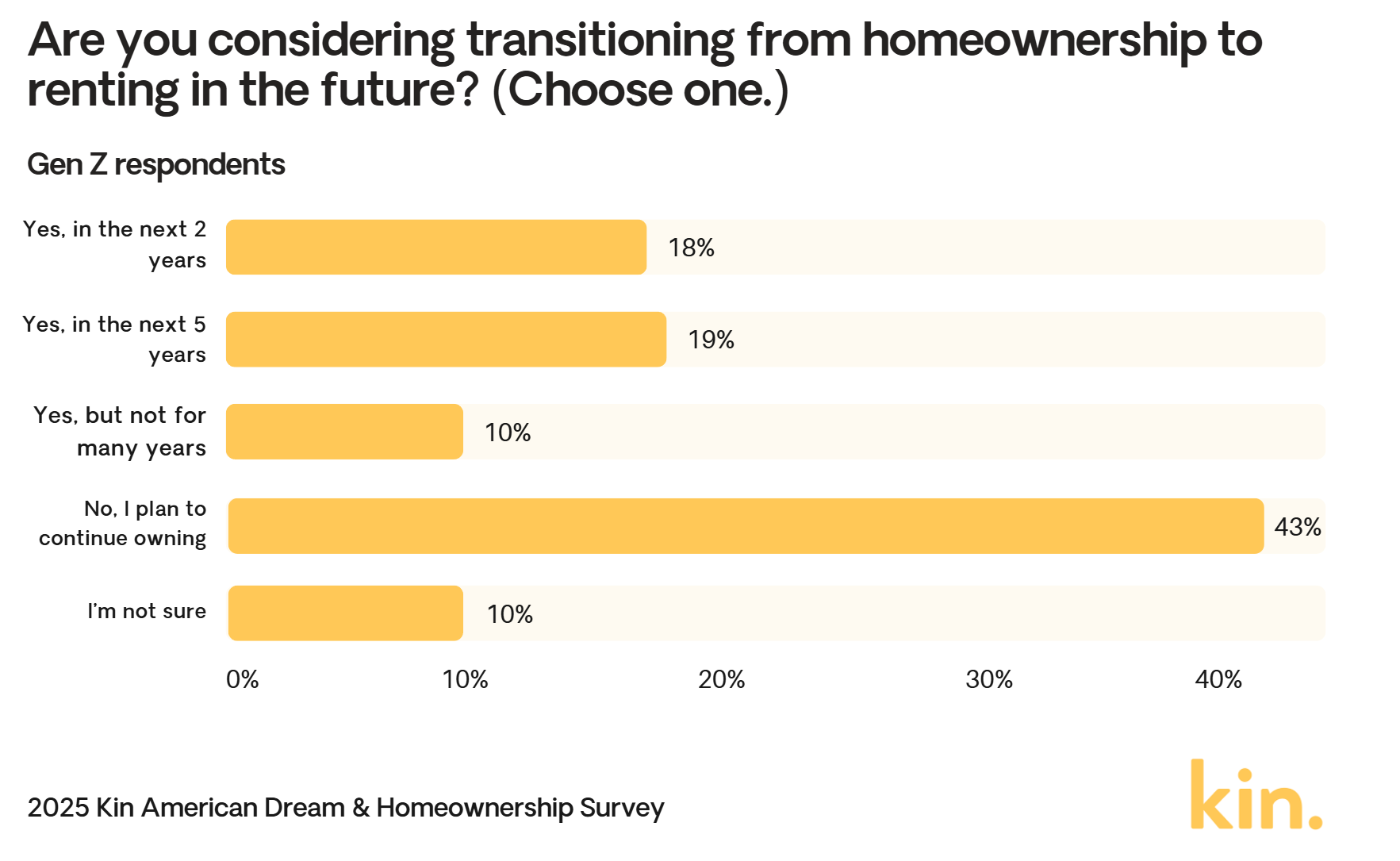

Future renters: 37% of Gen Z homeowners say they plan on transitioning to renting in the next five years — compared to just 18% of respondents of their parents’ age (Gen X).

-

An additional 10% of Gen Z homeowners say they plan on transitioning to renting at some point further in the future.

-

Underinsurance crisis: Only 44% of Gen Z homeowners say they maintain adequate home insurance coverage, compared to 54% of millennials and 65% of Gen X.

The American Dream has shifted away from homeownership

In the past, buying a home was a milestone that many Americans associated with achieving the American Dream. But today, the focus has shifted to financial flexibility and quality of life. More than half (56%) of American homeowners say freedom from debt has replaced homeownership as their vision of the American Dream.

This paradigm shift is even more dramatic when you look at different age groups: 68% of Gen Z homeowners say freedom from debt has replaced homeownership, compared to 50% of millennials and 48% of Gen X.

Meanwhile 50% of American homeowners also selected financial independence as having replaced homeownership, 34% said travel and experiences, and 26% said career success. On the lifestyle side of the spectrum, 33% of homeowners now define the American Dream as personal fulfillment, while 28% said family and relationships.

As homes become less affordable, Gen Z homeowners see owning a home as a higher indicator of success

Even though Gen Z is less likely than previous generations to see homeownership as part of the American Dream, they are significantly more likely to see owning a home as a major indicator of success than their parents' generation. In the survey, 29% of Gen Z homeowners see homeownership as an “extremely important” success factor compared to just 19% of Gen X, while only 4% of Gen Z homeowners see it as “not very important” or “not important at all” compared to 11% of Gen X.

The housing market for Gen Z today is fundamentally harder to enter than it was for Gen X in the 1980s and ‘90s, primarily due to the increased ratios of home price to income and down payment to income. As houses have become less affordable, owning one has become a greater status symbol for Gen Z.

In fact, 45% of American homeowners say starter homes are harder to find in today’s housing market. Another 18% say starter homes are “mostly gone,” and 6% say they “don’t exist anymore.”

“True starter homes are scarce for first-time buyers today,” Jenna Stauffer, an agent for Sotheby's Realty, told Good Housekeeping earlier this year. “The move-up market just doesn't exist like it used to. Between high prices, interest rates, taxes and insurance (a lethal combo), it makes upgrading tough.”

More than a third of Gen Z homeowners want to transition to renting in the next five years

While Gen Z homeowners are more likely to see owning a home as a major indicator of success, that doesn’t mean they want to remain homeowners forever. As they prioritize financial flexibility and other goals as part of the “new” American Dream, a surprising 37% of Gen Z homeowners say they plan on transitioning to renting in the next five years — compared to just 18% of Gen X homeowners. An additional 10% of Gen Z homeowners say they plan on transitioning to renting at some point further in the future.

Combined with the other survey findings, it’s clear that Gen Z has a more nuanced perspective on homeownership than previous generations: They’re more likely to see homeownership as a major indicator of success, but less likely to prioritize it as part of their own long-term American Dreams.

More than half of Gen Z homeowners are deliberately underinsured

As they attempt to balance the high price of housing, 53% of Gen Z homeowners are deliberately “under-insuring” their homes to save on the cost of their home insurance premiums — a strategy that can backfire spectacularly.

"Homeowners who underinsure their homes often think they're saving money upfront, but they're actually taking on serious financial risk," says Kin's Chief Insurance & Compliance Officer, Angel Conlin. "If your coverage isn't sufficient to fully rebuild, you're left making impossible choices — cut corners on construction quality, deplete your savings, or take on debt. These are the kinds of decisions that can affect your family's financial stability for years. Your home is likely your biggest asset, and it deserves protection that matches its true replacement value."

Conlin says all homeowners who aren’t able to bear this financial burden should prioritize having enough home insurance to cover the full cost to rebuild their home in the event of a total loss, plus adequate additional coverage for other structures, personal property, loss of use, and other potential expenses.

If you need to lower the cost of your home insurance premium, there are plenty of steps you can take instead of underinsuring your home, including:

-

Maintain and improve your credit score.

-

Look for available discounts.

-

Improve your home security with features like monitored alarm systems and smart locks.

-

Make disaster-resistant upgrades, such as impact-resistant roofing or storm shutters.

-

Raise your deductible, but make sure you have enough savings to cover the higher out-of-pocket expense if you need to file a claim.

-

Review your coverage needs annually to ensure you’re not paying for coverage you don’t need while maintaining adequate coverage.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 65 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on November 4, 2025. Percentages were rounded to the nearest whole number.