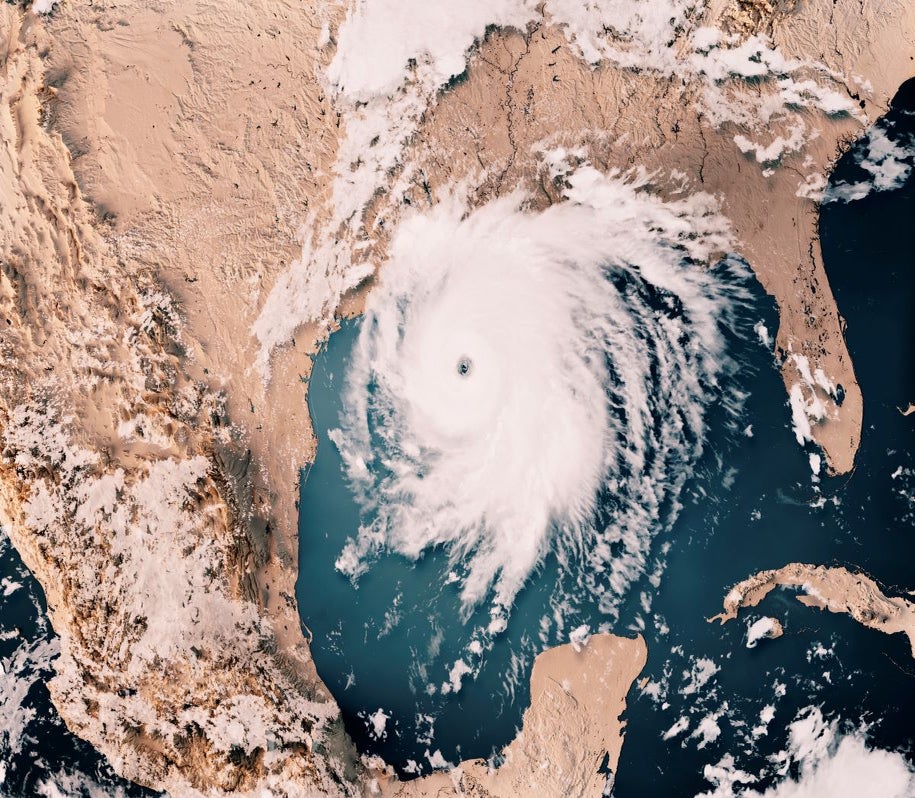

Alabama’s white sandy beaches are just one of the big draws for plenty of people seeking their forever home. But living near the Gulf Coast means homeowners have to be ready for hurricanes.

That’s where we come in. We work with quality insurers to get you Alabama home insurance with hurricane coverage that helps you protect your most valuable asset.

What is Alabama hurricane insurance?

Hurricane insurance in Alabama is usually not a separate insurance policy. Instead, your homeowners policy likely covers hurricane damage and kicks in if your home sustains damage from hurricane winds after you pay your hurricane deductible. However, not every insurance company offers home insurance that covers wind damage.

Luckily, our carrier partners offer a unique policy to Alabama homeowners called House & Property insurance. This new type of home insurance is designed to be incredibly customizable to fit how you use your home, whether you live in it year round or rent it to others.

What does hurricane insurance in Alabama cover?

House & Property insurance, the homeowners insurance our partners offer in Alabama, includes hurricane coverage. This means your home is protected if winds from a named storm cause damage.

Commonly covered

-

Your dwelling

-

Other structures on your property (e.g., your garage)

-

Your personal belongings (e.g., furniture)

-

Temporary relocation and other costs above your normal living expenses if hurricane wind damage makes your home uninhabitable

Usually excluded

Water damage that occurs because of a covered peril like wind damage can sometimes be covered. So if rain damages your belongings because the wind has taken off a portion of your roof, your home insurance may help with repairs.

Does hurricane insurance cover flood damage?

The hurricane insurance in your Alabama homeowners insurance probably excludes damage caused by storm surge and other hurricane-related floods. For that damage, you can get private flood insurance or flood insurance offered by the National Flood Insurance Program (NFIP), a federal program created by Congress to help protect homeowners from the financial devastation of floods.

How much is hurricane insurance in Alabama?

Your Alabama home insurance premium includes the cost for damage caused by hurricanes. But the risk of hurricanes is one of the reasons that home insurance may be more expensive anywhere South of the 31st parallel in Baldwin and Mobile counties.

Alabama has seen 101 federally declared disasters since 1953, including 24 hurricanes. As a result, insurance premiums in Alabama can be quite high in certain areas. In fact, the Insurance Information Institute ranks the Cotton State as 10th in the nation for home insurance costs.

Windstorms and hurricanes aren’t the only factors that impact your home insurance premium in Alabama. Other factors may include:

Our carrier partnres analyze these and many other factors to better understand the risks your home faces. By collecting so much insurance data, they can usually offer rates that more accurately reflect your unique situation.

Tips to lower your insurance premium

Alabama homeowners who harden their homes against wind damage can earn premium discounts. Our partners also offer discounts for installing water detection devices, fire alarms, and security systems and managing your policy completely online.

Want to see if you can save money? Enter your address now or give us a call at 855-717-0022.

What is the deductible for hurricane insurance in Alabama?

A hurricane deductible is the part of your loss that you’re responsible for if a named storm damages your home. Alabama is one of 19 states that allows for hurricane deductibles.

Our partners offer both flat-rate and percentage hurricane deductibles, so you can choose the deductible that best fits your circumstances. Percentage deductibles are a percentage of your Coverage A limit. For example, if you have $300,000 in dwelling coverage and a 2% hurricane deductible, your out-of-pocket expense for a hurricane claim would be $6,000.

Hurricane deductibles

Flat-rate options:

- $500

- $1,000

- $2,500

- $5,000

- $7,500

- $10,000

Percentage options:

Do you need hurricane insurance in Alabama?

Fortunately, hurricane insurance isn't something you should have to purchase separately (unless you live in those areas where coverage for wind is typically excluded). Your standard Alabama homeowners insurance policy likely covers hurricane wind damage - and that’s a good thing considering how common hurricanes and severe storms are in your state.

You also want to get your home covered sooner rather than later. If you wait until a storm has been named or reaches a similar coverage trigger, you may be subject to an insurance moratorium. This is an official hold on issuing new policies or changing coverage for existing policies in response to an already approaching storm.

Alabama storm facts

Alabama homeowners have had to deal with various declared disasters over the years, the most common being hurricanes and severe storms. Here's how some recent hurricanes were disastrous for Alabama residents:

-

Hurricane Katrina in August 2005 caused widespread damage in Alabama due to hurricane-force winds, flooding, and tornadoes. Twenty-two counties in Alabama spanning a 400-mile area were declared Federal disaster areas.

-

Hurricane Irma in September 2017 brought record-breaking rain and strong winds. A state of emergency was declared, and 25,000 residents lost power.

-

Hurricane Nate in October 2017 brought high winds, rain, storm surge, waterspouts, flash flooding, and tornadoes.

-

Hurricane Zeta in October 2020 produced 91 mph wind gusts in Mobile, AL, causing widespread damage and power outages.

Sources: Wikipedia. List of Alabama hurricanes.

Forbes Advisor. Best Homeowners Insurance In Alabama 2023. Jan. 3, 2023.

Now is the time to protect your Alabama home from hurricanes. Get a quick quote today.