It’s hard to get through the day without talking about the weather. Every day, billions of us look to the sky and wonder what will fall from it (if anything), and whether or not it will fall on them. And then there are meteorologists, who know exactly what will fall from the sky and exactly when it will happen.

And then (stay with us) there are forensic meteorologists, a subset of weather sleuths who can figure out not only what’s going to fall from the sky but how various weather patterns impact property damage or a crime scene.

Their job is basically CSI: Weather and they’re playing an increasing role in how your property insurance claims are handled. Why? Because the weather is getting more extreme.

The good news: by understanding not only how to prepare for extreme weather but also how to think like a forensic meteorologist to prepare for your next weather-related insurance claim, you can ensure your next serious weather event goes as smoothly as possible.

What exactly is a forensic meteorologist?

For one thing, it’s a job title that’s hard to spell in a hurry. Beyond that, forensic meteorologists are weather investigators who specialize in reconstructing past events (hence the comparison to CSI).

And while the whole idea of forensic meteorology may sound like some tech-age buzz, people have in fact been relying on it since at least the 1800s, according to court records. In one famous example, a young lawyer named Abraham Lincoln discredited a witness using meteorological evidence.

His source? The 1857 Farmer’s Almanac. Sure, that probably wouldn’t hold up in court today, but at the time it was considered a slam dunk.

Maybe the most important takeaway here: Lincoln was not a forensic meteorologist. But by learning to think like one, he won his case and went on to become US President (though we are obligated to say here that results may vary).

When do forensic meteorologists get involved in property claims?

The typical process of making a property insurance claim goes something like this: your property is damaged, you call your insurance provider, they send out a claims adjuster to look at the damage, and you get paid to repair or replace your damaged property according to the terms of your insurance policy.

A forensic meteorologist might enter the picture if your property damage is weather-related and there’s some uncertainty in the matter. For example:

- Your house has holes on the northern exposure that look like hail damage – but there was no hail all day downtown where you work. Was it a microburst? Maybe. Your insurance provider might send a forensic meteorologist to check as part of processing your property insurance claim.

- Your house floods – but it’s not clear whether the water came from the rising river (which would likely be covered by your flood insurance) or from a sewer that backed up because of groundwater (which would likely be covered by your homeowners' insurance, if you have the right endorsement). Again, a forensic meteorologist might be called out to look for clues as to what happened.

- A tree branch falls on your roof while you’re on vacation. The neighbor says it was because of a bad storm that happened – but you (and your insurance provider) suspect that the neighbor’s haphazard trimming was to blame. A weather sleuth might be put on the case.

And because the biggest trend in weather in recent decades has been the increasing intensity of events, the demand for forensic meteorology is growing.

In Florida in particular, property insurance claims are on the rise, and forensic meteorologists are increasingly being called in to help settle these cases.

A forensic meteorologist might help settle uncertainty in a weather-related property claim.

How forensic meteorologists help reduce insurance fraud

So why would an insurance company call in a forensic meteorologist when it has an agreement with you, the homeowner, to cover certain types of property damage? Trust us, there’s a good answer.

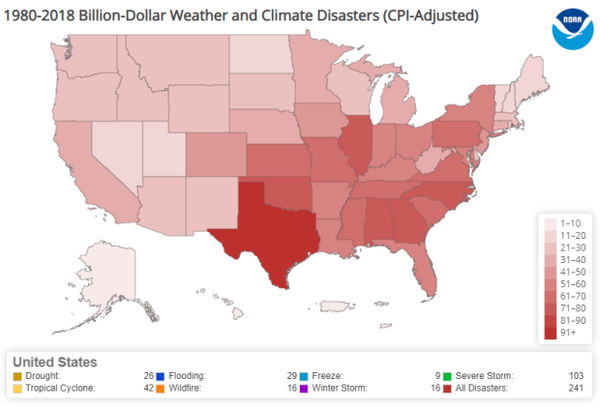

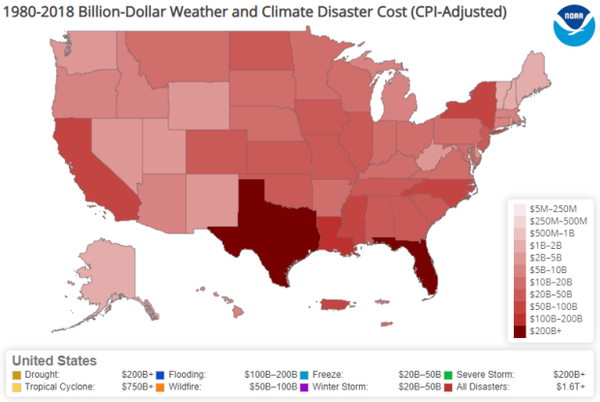

Property insurance claims are both the most common and the most expensive insurers have to handle. That’s the first piece of the puzzle. Then consider the increase in extreme weather and the rise in recent years of billion-dollar weather events.

(Of note to Kin customers: these events have been particularly hard on residents of Florida and Texas, thanks to their large coastal exposure. That's one reason homeowners insurance in Florida is so expensive.)

Source

Now consider that fraudulent claims account for about 10 percent of the property-casualty insurance industry’s losses each year.

Boom. All of a sudden, the weather is causing more property damage than ever and is therefore costing insurance companies more money than ever. And, as costs overall go up, it stands to reason that the costs from fraudulent claims are going up – even if fraud overall remains a relatively small portion of costs.

So the simplest way to reduce costs even as weather damage increases is to minimize the number of fraudulent claims insurance companies pay by doing better to sniff out fraud.

To answer that question from the start of this section: insurance providers are increasingly calling in forensic meteorologists to investigate weather-related property insurance claims as part of their overall cost-control measures.

Employing these weather sleuths, in other words, is one-way insurance companies can ensure that they’re only paying out on legitimate property insurance claims. This, in turn, means they can keep a lid on premiums that homeowners have to pay.

Weather is causing more property damage than ever.

A closer look at extreme weather

As a homeowner, one of your jobs is to prepare for the weather events most likely to affect your region. That’s why it’s important to understand the ways weather is changing.

One trend to keep an eye on is that it’s getting rainier. The National Oceanic and Atmospheric Association (NOAA) compiled a report on extreme weather events that shows huge increases in extreme rainfall in the United States since the 1950s.

If you live in Houston, you got an all-too-real illustration of this trend when Hurricane Harvey struck in 2017, bringing record rainfall. The U.S. Geological Survey’s report on that storm called it “the most significant rainfall event in United States history in scope and rainfall totals since rainfall records began during the 1880s.” As the chart above shows, things are only likely to get rainier from here.

Meanwhile, most cities face the same challenge Houston faced: there was nowhere for all of that water to go, which led to historic flooding.

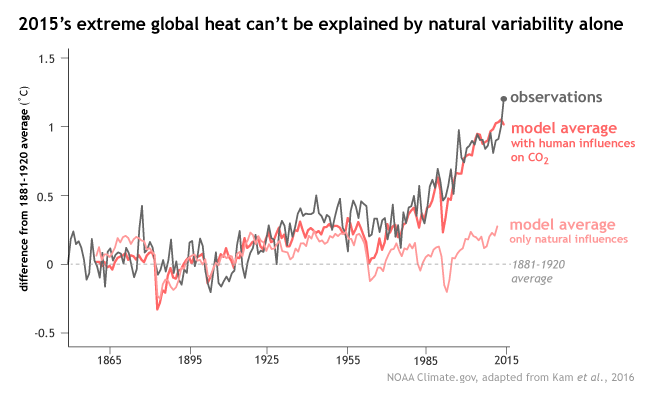

But rainfall isn’t the only type of extreme weather that’s increasing. It’s getting hotter, too, which can lead to drier conditions and more fires.

And as mentioned earlier, other types of harsh weather are also on the rise. So given the new realities of extreme weather events, how can homeowners protect their houses and possessions? Glad you asked.

Protect your home from weather with insurance & diligence

Protecting your home from extreme weather is a two-part job: physically prepare as best you can for bad weather (by making sure your roof can handle strong hurricane winds, for example) and invest in the insurance policies that will compensate you if your home is damaged by an extreme weather event.

This is where it’s important to know which disasters are covered by which insurance policy.

If you’re not sure which kinds of coverage you’re most likely to need, check your flood risk as a starting point. Or you can reach out to your homeowners' insurance agent and ask for their recommendations.

Now for the physical preparation part. In any region, there are a few common-sense steps you can take to prepare your property for severe weather:

- Keep your trees trimmed and away from your windows and roof.

- Make sure your roof is in good repair and sturdy enough for high winds (if you’re in a high-wind area).

- Add a lightning rod to lower the likelihood that your house will be struck.

- Secure or store any outdoor furniture when not in use. Strong wind can turn it into projectiles!

- Keep your cars and bikes sheltered in the garage or under the carport.

In the event of weather damage, think like a forensic meteorologist

Even the best-prepared and best-protected homes, however, can be damaged by bad weather. In the event that there is damage to your property, think like a forensic meteorologist to make it easy for your insurance carrier to process your claim quickly:

- Document the damage. Take pictures of the damage and make notes about things you notice. The sooner you capture all this, the better.

- Communicate with your insurance provider. If they reach out, respond as quickly as you can. If they send an expert to inspect your property, be sure to give them whatever access you need to make a report.

- Stay safe. Some weather damage can make your home dangerous to be in. Never jeopardize your own safety to document damage; instead, contact your insurance provider and they’ll send an expert (or a drone, as Kin did after Hurricane Irma).

Still, have questions about weather-related property insurance claims? Check out our FAQ page.