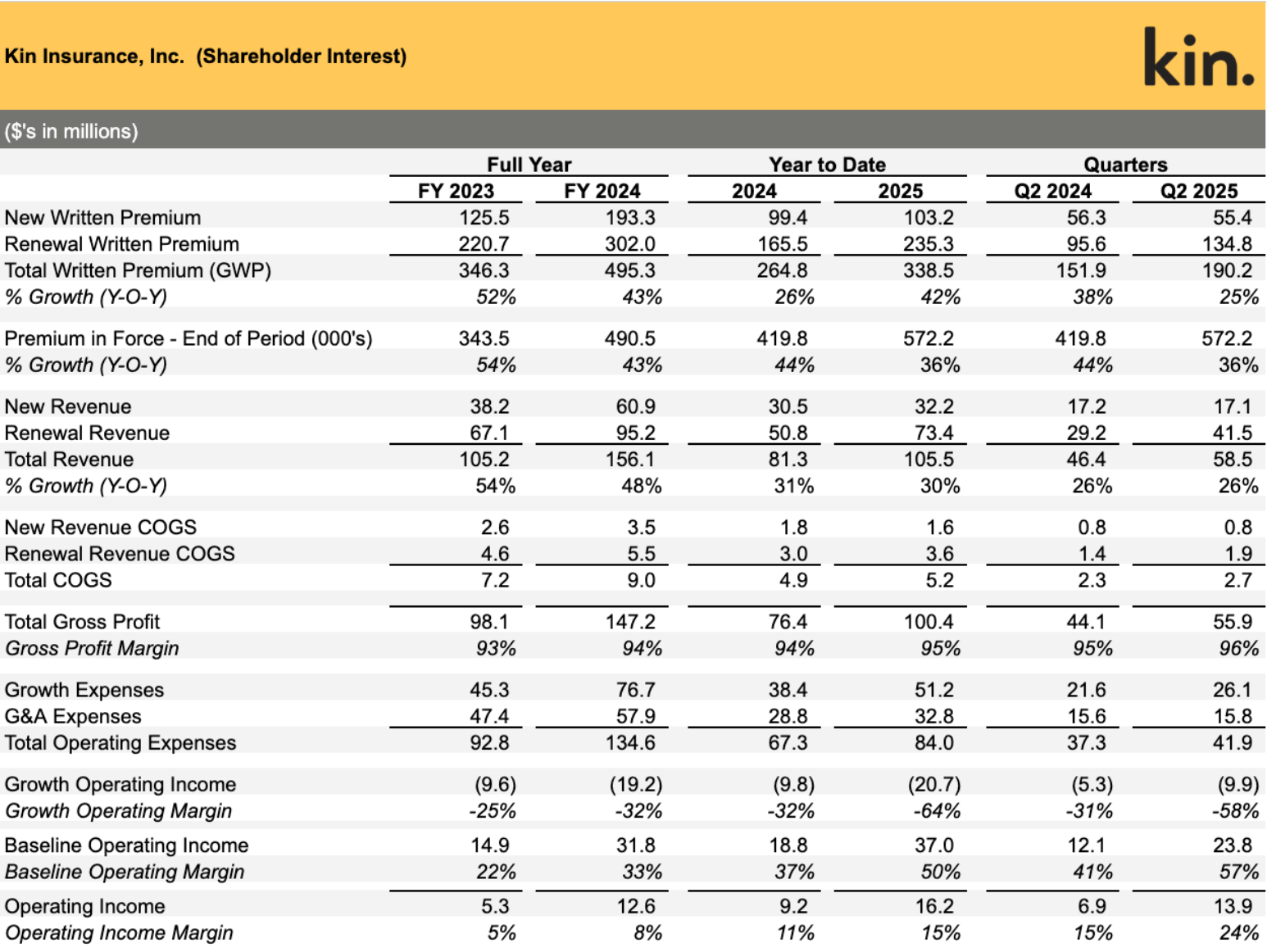

Kin reports 26% YoY revenue growth in Q2; Operating margin surges to 24%

Strong revenue growth and disciplined expense management drive record profitability.

CHICAGO, IL – September 15, 2025 – Kin, the pioneering, direct-to-consumer, digital home insurance provider, today announces operating results for its second quarter and six-months ended June 30, 2025.

"This quarter we continued to demonstrate the operating leverage of our unique high tech, direct to consumer business model, with our Baseline Operating Margin reaching 57% and our overall Operating Margin reaching 24%," said Kin Founder and CEO Sean Harper. "We see compounding benefits in our technology-driven approach that creates sustainable competitive advantages over traditional insurance distribution models."

Total revenue reached $58.5 million in the second quarter of 2025, up from $46.4 million in the second quarter of 2024, representing 26% year-over-year growth. The company generated $23.8 million of Baseline Operating Income and $13.9 million in Operating Income, up 96% and 101% respectively.

"You can really see the fruits of our investment in technology in the way that we are growing revenues so much faster than our expenses," said Kin CFO Jerry Fadden. "Most insurance distribution businesses are very heavily dependent on people and therefore have a lot of variable costs. Ours is more dependent on technology and the variable costs are much lower."

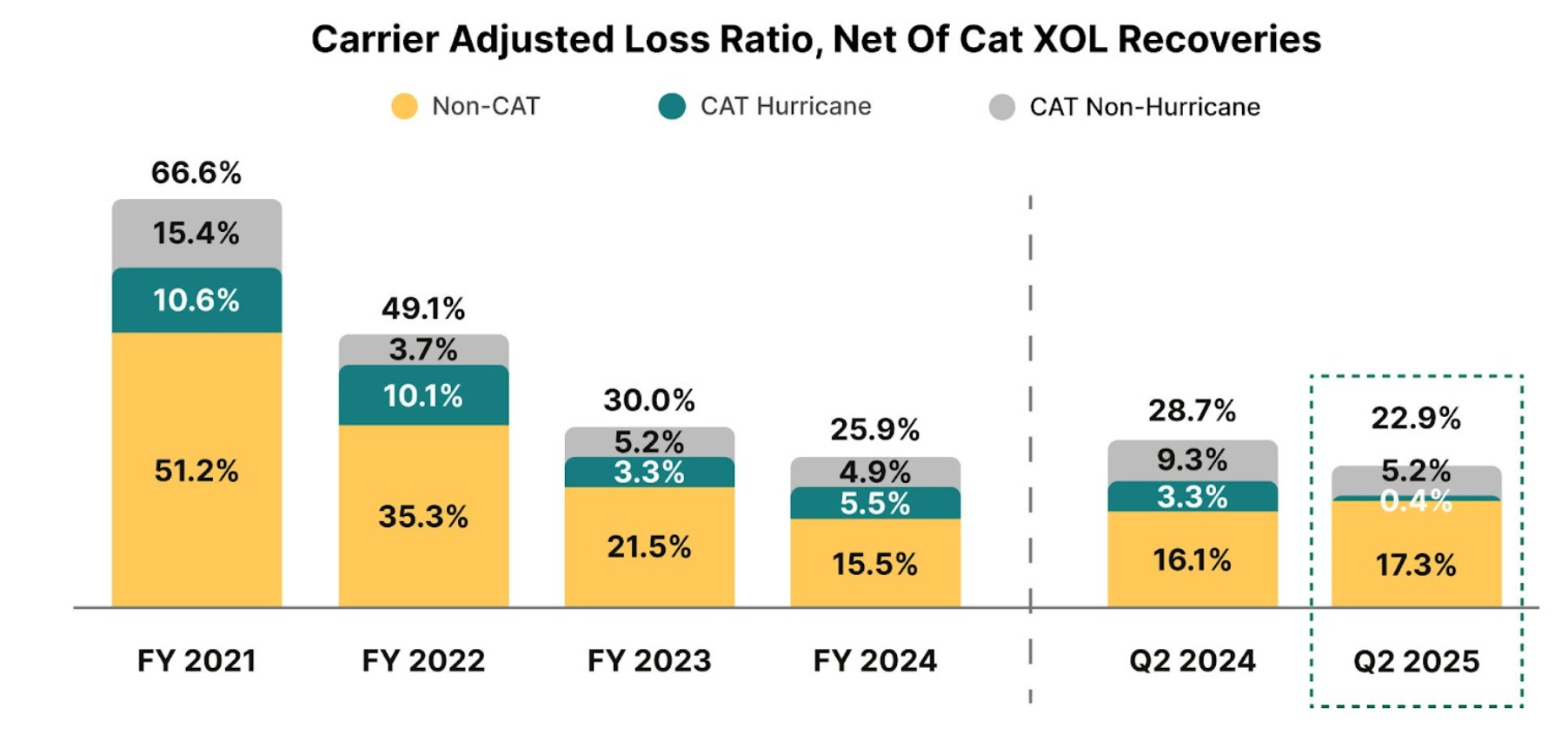

Kin-managed reciprocal exchanges achieved an adjusted loss ratio11 of 22.9% in the second quarter of 2025, after catastrophe excess of loss (XOL) reinsurance recoveries, marking an improvement from 28.7% in the same period last year. There were no XOL recoveries in either period. Concurrently, the non-catastrophe adjusted loss ratio remained strong at 17.3%, compared to 16.1% in the prior year period.12

"The reciprocals’ loss ratio continues to perform as expected," said Kin Chief Insurance Officer Angel Conlin. "In aggregate, the reciprocals are generating significant organic capital growth."

"In the early days we got a lot of questions about whether our business model would work in every area of the country," added Harper. "We are now active in more than 50% of the Total Addressable Market for homeowners insurance and continue to deliberately and carefully launch in new geographies. We’ve decisively proven that our capabilities are relevant in most areas of the country."

In June 2025, Kin entered its 12th state, Colorado, to deliver accessible, affordable protection in another underserved market increasingly affected by weather events. The company continues to invest in product innovation and geographic expansion, with more launches planned this year.

About Kin

Kin is the only direct-to-consumer digital insurance provider focused on the growing homeowners insurance market. Kin offers more convenient and affordable coverage by eliminating the need for external agents. Kin’s technology platform delivers a seamless user experience, customized options for coverage, and fast, high-quality claims service. Behind the scenes, Kin analyzes thousands of data points about each property to provide accurate pricing. To learn more, visit www.kin.com.

###

Contact:

BAM for Kin

press@kin.com

Footnotes

-

The financial information represents the GAAP consolidated results of Kin Insurance, Inc., excluding its variable interest entities (VIEs), which are its reciprocal insurance carriers and captive. Prior period full-year results reflect immaterial audit adjustments from prior presentations. Quarterly results are unaudited.

-

Gross Written Premium includes premiums written by the two reciprocals managed by Kin Insurance, Inc. and certain third-party carriers.

-

New Revenue is a non-GAAP measure defined as fee revenue calculated in proportion to New Written Premium as a percentage of Total Written Premium at Kin’s managed reciprocal exchanges.

-

Renewal Revenue is a non-GAAP measure defined as fee revenue calculated in proportion to Renewal Written Premium as a percentage of Total Written Premium at Kin’s managed reciprocal exchanges.

-

New Revenue Cost of Goods Sold (COGS) is a non-GAAP measure defined as the portion of customer servicing costs and internal claims labor expenses attributable to New Written Premium..

-

Renewal Revenue Cost of Goods Sold (COGS) is a non-GAAP measure defined as the portion of customer servicing costs and internal claims labor expenses attributable to Renewal Written Premium.

-

Total Gross Profit is a non-GAAP measure defined as Total Revenue less customer servicing costs and internal claims labor expenses.

-

Operating Income is a non-GAAP measure defined as net income/loss attributable to Kin Insurance, Inc., excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, and other non-operating expenses.

-

Growth Operating Income is a non-GAAP measure defined as New Revenue minus New Revenue COGS and Growth Expenses; Growth Expenses include sales and marketing expenses, variable data costs, and other expenses associated with customer acquisition.

-

Baseline Operating Income is a non-GAAP measure defined as Renewal Revenue minus Renewal Revenue COGS and G&A Expenses; G&A Expenses is defined as operating expenses not associated with customer acquisition.

-

The adjusted loss ratio is a non-GAAP measure defined as loss and loss adjustment expenses, net of catastrophe excess of loss reinsurance recoverables divided by earned premium and the "earned" portion of subscriber surplus contributions during the period and excludes Claims Management fees to the reciprocal exchange's attorney-in-fact.

-

The non-cat adjusted loss ratio is a non-GAAP measure defined as total loss and loss adjustment expenses, excluding loss and loss adjustment expenses from named storms and Property Claim Services (PCS) events as defined by Insurance Services Office, Inc. (ISO) divided by earned premiums and the "earned" portion of subscriber surplus contributions during the period and excludes Claims Management fees to the reciprocal exchange’s attorney-in-fact.

-

Policies in California are marketed and distributed through Kin Insurance Services (CA License #0L32036), a California surplus lines broker. California policies are underwritten by a non-admitted carrier in partnership with Kin.