Every year, state governments, coastal residents, and insurance companies rely on Atlantic hurricane season forecasts from the National Oceanic and Atmospheric Administration (NOAA) and Colorado State University (CSU), with the hope of gaining a better understanding of what lies ahead.

However, according to an analysis by data experts at Kin, these pre-season predictions often underestimate reality, particularly in recent years.

Homeowners are encouraged to take immediate action to prepare for hurricane season between June and November, including reviewing their home insurance policy to ensure they have adequate financial protection.

Key takeaways

-

In recent years, Colorado State University and NOAA’s pre-season predictions have often underestimated the number of named storms, hurricanes, and major hurricanes that occur throughout the Atlantic hurricane season.

-

This year, NOAA predicts a 60% chance that 2025 will yield an above-normal hurricane season, with the potential for three to five major hurricanes with wind speeds of 111 mph or higher.

-

Though hurricane predictions serve as a baseline for seasonal expectations, homeowners should always be prepared for weather volatility as climate change creates less predictability and stronger hurricane conditions.

Annual hurricane predictions vs. outcomes

As we approach the official start of the 2025 Atlantic hurricane season (June 1 to November 30), NOAA and CSU are both predicting an above-normal season.

This year, NOAA predicts between 13 and 19 named storms, including six to 10 hurricanes (with 74 mph or higher winds) and three to five major hurricanes (with 111 mph or higher winds). CSU predictions largely align with NOAA’s: 17 named storms, nine hurricanes, four major hurricanes.

However, even with advanced forecasting models, initial predictions aren’t always accurate, and coastal communities should keep this in mind.

Evidence of this can be seen in NOAA’s prediction revisions, often released in August. The most dramatic recent examples occurred in 2020 and 2023, when NOAA increased the top of their named storm prediction range by 32% (2020) and 24% (2023) — and still fell short of reality by 17% in 2020.

Unlike NOAA, CSU does not release revised predictions later in the season. When compared to CSU’s named storm predictions, actual named storm activity exceeded expectations 90% of the time, while actual hurricane activity exceeded CSU predictions 60% of the time.

The variations between pre-season predictions and late-season revisions highlight how challenging the art of hurricane prediction can be — even among renowned experts— particularly as hurricanes become more intense alongside climate change.

The rising cost of hurricanes

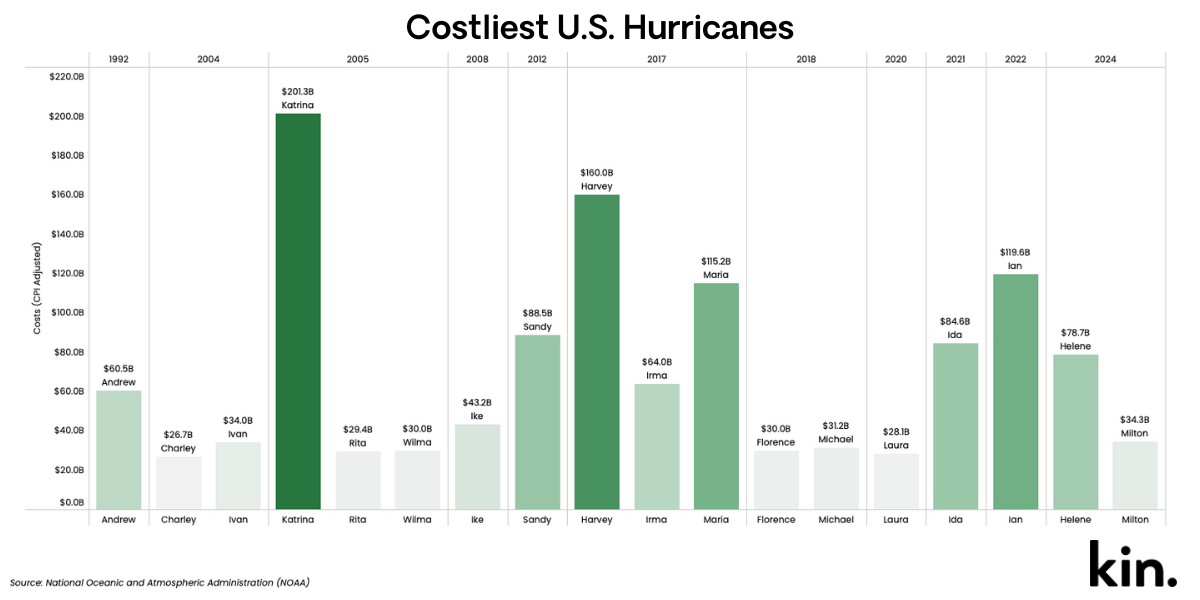

Among the top ten most costly hurricanes on record, six have occurred within the last decade, while four have occurred within the last five years. The chart below provides a snapshot of the costliest hurricanes, each exceeding the average cost of $23 billion per event, based on NOAA data.

Further, data indicates that the price tag associated with tropical cyclone events, which includes hurricanes, has steadily increased over the last several decades.

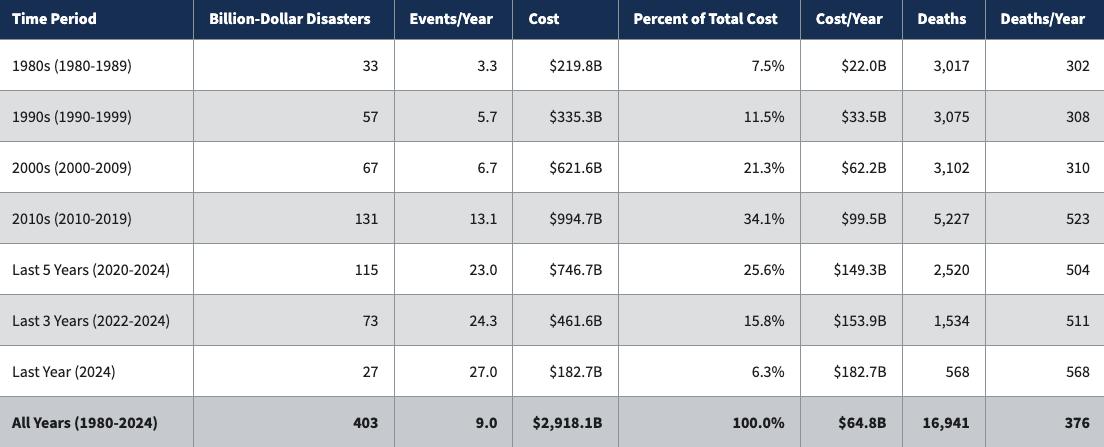

As indicated in the table below, tropical cyclones caused a total of $46.9 billion worth of damage from 1980 to 1989, when adjusted for inflation. In the decades to follow, the cost of storm-related damages skyrocketed, reaching $541.1 billion in 2010s — a whopping 1,053% increase. Damage from the 2024 hurricane season alone is more than double the cost of a decade’s worth of damage in the 1980s, with estimated costs exceeding $125 billion in just one year.

Cost of hurricanes between 1980 and 2024

Source: Costs of Hurricanes (Billion Dollar Events) - NOAA

Though there are several reasons costs have increased over time, frequency is a key factor. The period between 2016 and 2024 marked a significant shift, with every year experiencing at least one billion-dollar event, and the average number of events per year rising dramatically to 2.9 — a 143% increase from the earlier period between 2000 and 2015.

This upward trend has accelerated even further in the most recent five-year period (2020-2024), where the average number of billion-dollar events surged to 4.2 per year. This represents an even more substantial increase of 211% compared to the average of 1.35 events per year observed in the two decades leading up to 2020 (2000-2019). In all, this underscores a clear and rapidly intensifying trend towards more frequent and impactful economic disasters.

Increasing costs make home insurance more valuable than ever

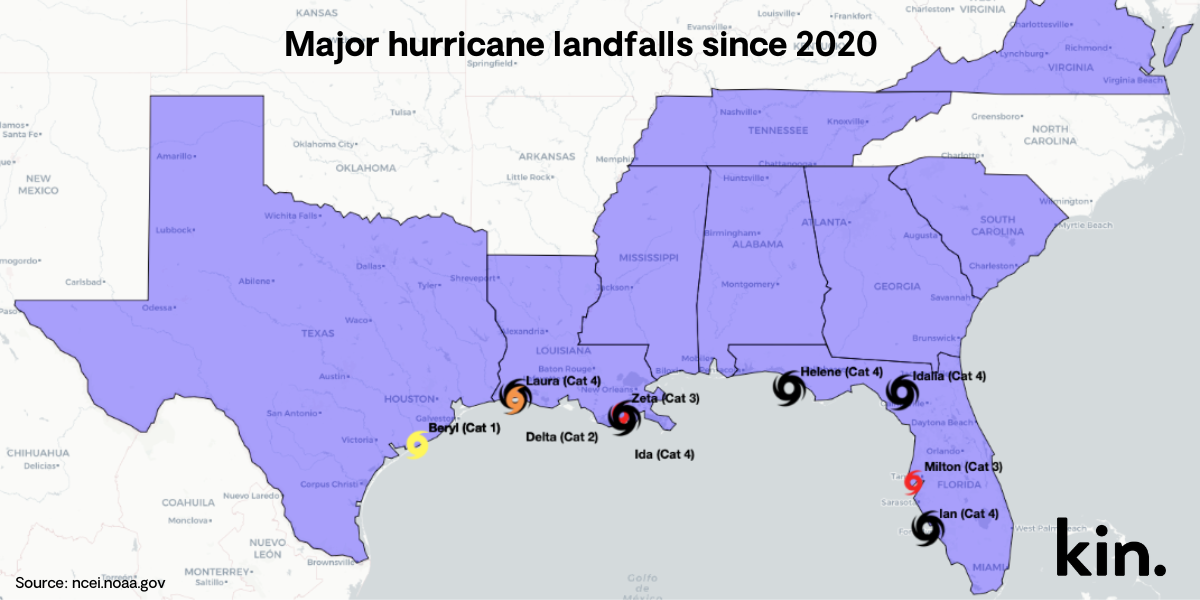

The potential devastation from the predicted weather events can lead to notable financial challenges, particularly in the face of rising inflation and higher rebuilding costs. This is especially true along the eastern and southern coasts, where population and housing growth have outpaced national trends and many of the costliest hurricanes have made landfall.

In light of the 2025 hurricane season predications, homeowners — especially those in coastal communities — are urged to review their home insurance policies to ensure they have adequate coverage for hurricanes and tropical storms.

Reviewing coverage now is essential, as most insurers and state regulations prohibit homeowners from purchasing new policies or making policy changes once an official hurricane warning or watch has been issued for their location.

Further, flooding is a common byproduct of hurricanes, but flood insurance policies often have a waiting period before coverage takes effect. While Kin’s policies are effective immediately, policies offered through the National Flood Insurance Program (NFIP), for example, have a 30-day waiting period, with some exceptions.

4 ways to make sure you’re covered this hurricane season

There are several steps you can take to prepare for hurricane season, including understanding your risks and how your home insurance does (or doesn’t) meet your needs. Here are four things to check before the season starts.

-

Make sure you have wind coverage. Though home insurance policies often include coverage against hurricanes, policyholders in high-risk areas may need to add a hurricane endorsement to their policy or purchase stand-alone hurricane coverage.

-

Review your dwelling coverage limit to ensure it properly protects your home. Your dwelling coverage limit should be enough to replace your home if it’s destroyed by a covered event. Being underinsured can lead to substantial out-of-pocket expenses after a hurricane.

-

Understand personal property coverage. Your personal property coverage protects the belongings inside your home. In most cases, coverage is issued for actual cash value, meaning your claim payout will reflect the depreciated value of the damaged items. If you want more coverage, consider adding replacement value coverage to your policy, which will cover the cost to replace damaged property with that of similar kind and quality.

-

Check your deductibles. Most home insurance claims are subject to a deductible, or the amount your insurer will subtract from your claim payout after a covered event. Homeowners in high-risk areas may have a separate deductible for damage caused by hurricanes or named storms. Review your deductibles to ensure you understand when they apply and that you can meet your financial obligations should you need to make a claim.

If your home is at risk for hurricanes, Kin has you covered. Kin Insurance, Inc., which specializes in home insurance for homes in high-risk areas, offers an array of coverages, including hurricane insurance and flood coverage, that can help homeowners cope with the potential risks associated with hurricane season.