The dream of homeownership is still a reality in America — but that reality is more stressful than it used to be.

Over the last 20 years, the median home price has skyrocketed from $288,500 to $503,800, and according to a new study by Kin Insurance, the high cost of mortgages is the number-one reason why Gen Z homeowners are more likely to experience “buyer’s remorse” than millennials or Gen X.

A shocking 42% of Gen Z homeowners say they have some degree of “buyer’s remorse” — 27% more than millennials or Gen X. However, that doesn’t mean the two earlier generations have escaped unscathed: Nearly half of all homeowners in the study say owning a home has increased their stress levels.

Key takeaways:

-

42% of Gen Z homeowners have experienced buyer’s remorse after purchasing a home, which is 27% higher than millennials and Gen X.

-

For Gen Z and millennial homeowners, the number-one reason for remorse is the cost of their mortgage, while Gen X homeowners are more likely to regret the cost of their property taxes.

-

48% of US homeowners say owning a home has increased their stress.

-

Gen Z is more likely (52%) to experience increased stress than millennials (47%) or Gen X (46%).

-

39% spend a third or more of their income on housing costs.

-

51% didn’t include the cost of home insurance when budgeting their housing costs.

Nearly half of homeowners say ownership stresses them out

While homeownership provides a level of security, it’s also a source of stress for many Americans and the most expensive asset they’ll ever own.

In general, 48% of Americans say homeownership has increased their stress levels. However, stress is most prominent among the youngest homeowners. Over half (52%) of Gen Z homeowners say homeownership has increased stress. Millennials (47%) and Gen X (46%) are slightly less stressed.

40% of homeowners spend a third or more of their income on housing costs

What’s fueling the stress plaguing some homeowners? One major factor can be the cost of a mortgage.

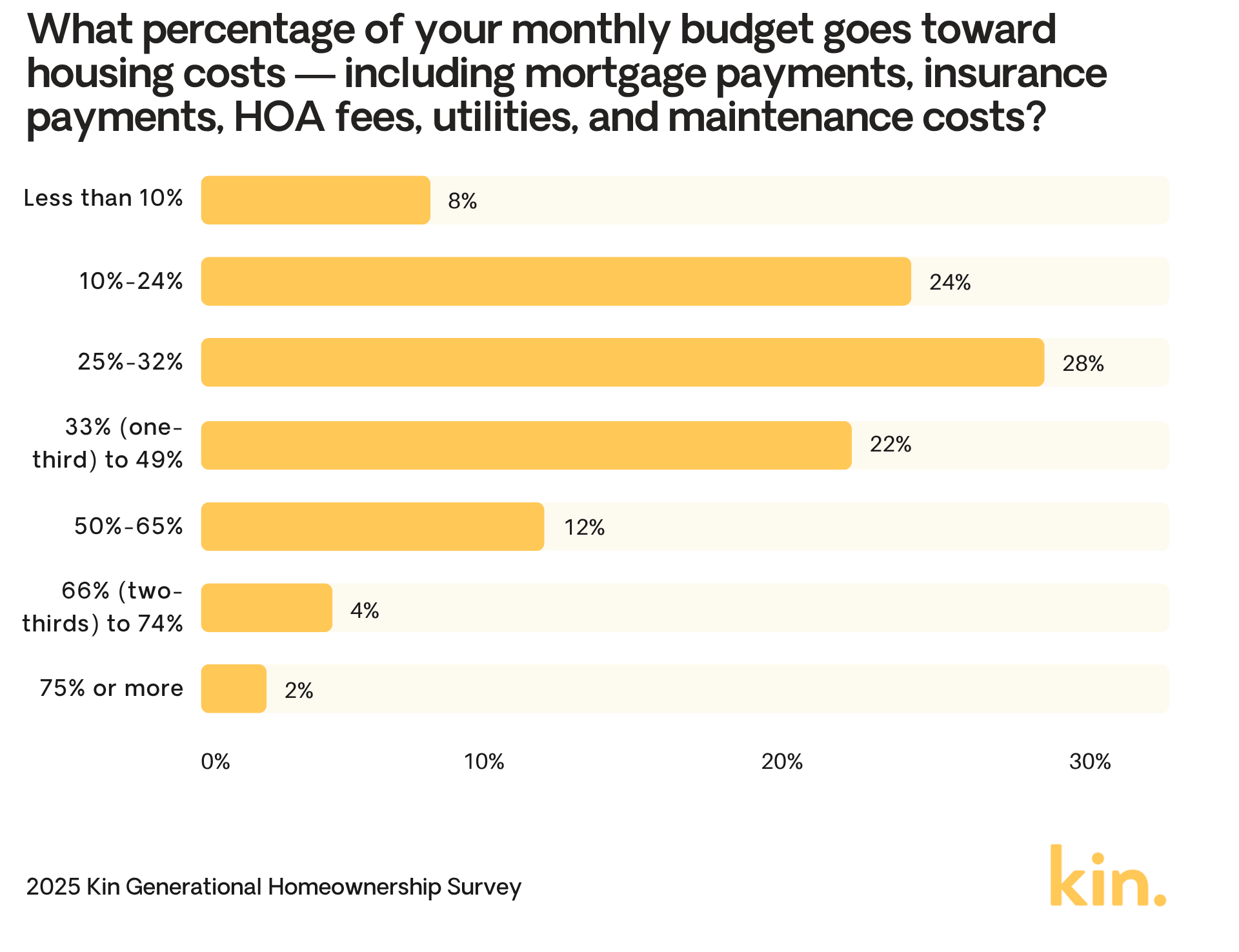

A widely cited rule of homeownership suggests that your housing expenses — including your mortgage, insurance, and utility costs — shouldn’t exceed 30% of your income. However, 40% of American homeowners say they spend 33% or more of their income on housing.

While Gen Z may be experiencing more stress around homeownership, millennials are spending a larger portion of their income on housing costs. More than 40% of millennial homeowners are spending a third or more of their income on housing costs.

Gen Z, on the other hand, is less likely to overextend their budgets, with only 35% indicating that their costs exceed a third of their income. Gen X falls squarely in the middle with 39% reporting housing costs that exceed a third of their income.

Gen Z homeowners are 27% more likely to experience buyer’s remorse

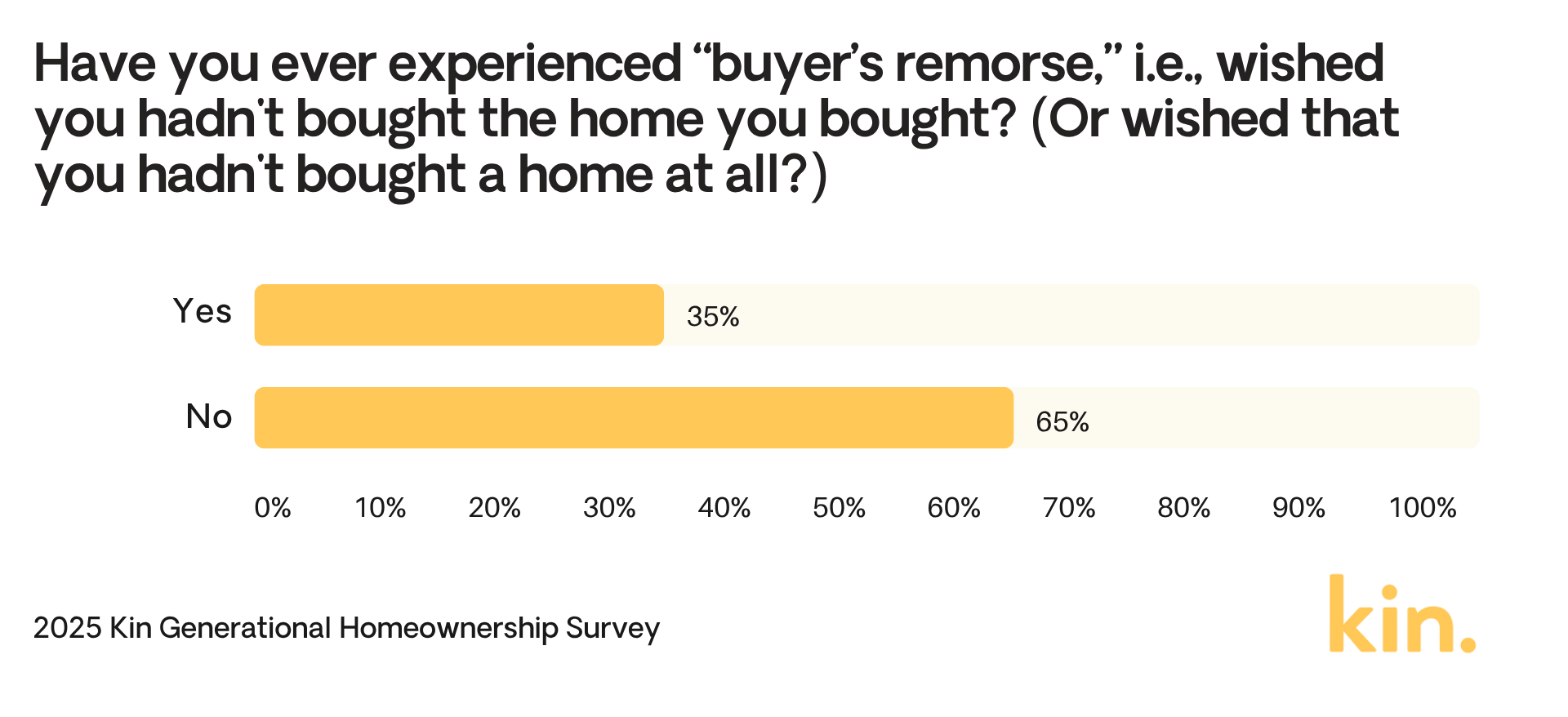

Among all generations surveyed, about 35% of respondents say they’ve experienced some degree of regret over buying their home, but Gen Z is most likely to suffer from buyer’s remorse.

Two out of five Gen Z homeowners say they’ve suffered from buyer’s remorse. Millennials and Gen X, when combined, experience significantly less remorse, with only 32% indicating that they’ve second-guessed their dwelling purchase.

Mortgage costs are a leading regret across all generations. However, Gen Z homeowners are more likely than other generations to regret prioritizing home characteristics, specifically style and location, over affordability.

Millennials aren’t free from similar regrets — about one in four say they regret prioritizing location and size over affordability. Gen X, on the other hand, is more confident on that front. Regrets of prioritizing location, size, and style aren’t among the top five named by Gen X. In fact, nearly 30% say they don’t even carry the weight of big home purchase regrets. Only 16% of millennials and Gen Z can say the same.

More than half of homeowners didn’t account for home insurance when budgeting their housing costs

Mortgage is a significant part of a homeowner’s budget, but it’s not the only factor. Home insurance, which most lenders require, is another essential cost. However, more than half of US homeowners failed to account for their home insurance premiums when budgeting for housing costs.

Among respondents, Gen X was the least likely to budget for homeowners insurance, with 58% indicating they didn’t factor the cost of coverage into their homeownership expenses.

According to a recent report by the Consumer Federation of America (CFA), the average cost of home insurance for a property with a replacement cost of $350,000 is $3,303 per year, or $275 per month. However, that number can be significantly higher for homeowners in high-risk states.

For instance, homeowners in Florida often see the highest home insurance rates, with an average cost of a standard policy equal to about $9,426 ($786/month) — which is 185% higher than the national average. In Louisiana, residents pay an average of $6,939 per year ($578/month), the second-highest rate in the nation.

In both cases, location is a significant factor in the cost of coverage, as both states are particularly vulnerable to major storms and hurricanes that increase the risk and severity of home insurance claims. The same applies to other high-risk states like California, Colorado, and Texas.

3 ways to manage the cost (and stress) of homeownership

Today’s housing market can make living out the American dream challenging, but it’s not impossible. You can keep stress (and regrets) at bay with a little planning and budgetary review.

Budget beyond your mortgage

Your mortgage might be your largest monthly expense, but it’s far from the only one. Property taxes, homeowners insurance, maintenance costs, utilities, and even HOA fees can add up quickly. And, depending on your down payment, you may even need to factor in the cost of private mortgage insurance (PMI).

“When determining affordability beyond the mortgage payment, be sure to factor in all types of property taxes and insurance,” says Bruce McClary, senior vice president of membership and communications at the National Foundation for Credit Counseling (NFCC). McClary adds that “A commonly used benchmark for anticipated yearly maintenance expenses is about 1% to 3% of your home’s value.”

“Another way to budget is to get a home insurance quote,” says Angel Conlin, Kin’s Chief Insurance & Compliance Officer. Whether you're about to purchase a home or you've owned one for some time, a home insurance quote can help you get a personalized look at how much it will cost to insure your property based on its location, construction, build, and unique features or risks.

Conlin advises potential homeowners to “explore their coverage options and the associated costs for each coverage, with the goal of building a package of coverages that match what the homeowner needs without paying for unnecessary items.” This helps to further pin down a common line item in household budgets. It can sometimes be helpful to speak with a licensed insurance agent if a homeowner has questions about the right coverages.

Maintain a cash cushion

Life happens, and for homeowners, illness, injuries, job loss, or unexpected home repairs can quickly drain bank accounts and increase stress levels. Having an emergency fund gives you the flexibility to address these issues without detailing your finances.

How much of a cushion should you have?

“The minimum savings goal should be to have 3 to 6 months of net income available for unexpected events like illness, injury, or job loss,” says McClary. “A stretch goal and more ideal amount would be 6 to 9 months.” He adds that keeping emergency savings separate from other funds, like the money you’ve earmarked for home repairs, is helpful.

Make sure your home is properly covered

A cash cushion can help you manage some unexpected household expenses, like replacing a water heater or fixing an outdated electrical system, but it may not be enough to cover substantial damage caused by events like fires, storms, or flooding.

A home insurance policy can help you cover the cost of repairing, rebuilding, or replacing your property, including the structure of your home, detached structures on your property (e.g., sheds, pool houses, or detached garages), and your personal belongings.

“There are several steps you can take to determine your exact coverage needs, but the easiest way is often to work with a carrier that allows you to test different quotes and coverage options in their system. Another option is to speak with a licensed insurance agent,” says Conlin. They can quickly determine the estimated replacement cost of your home, which is used to determine your dwelling coverage limit and acts as a basis for other coverage limits in a standard policy, like personal property insurance.

Beyond that, Conlin reminds homeowners to keep their liability insurance needs in mind. “Personal liability insurance steps in if someone is injured on your property and you're at fault, if you or a covered household member damages someone else’s property, and in other potential liability situations as well. It can also help cover your legal expenses, including settlements and judgements, if you’re sued after the incident.”

Even with a cushion, covering the cost to rebuild your home after a fire or paying for a guest's medical expenses after an incident on your property can be daunting. The right home insurance policy can alleviate the financial burden and provide you with peace of mind.

Shop within limits

Getting preapproved for a loan is a smart first step, but treat that figure as a ceiling, not a starting point. “Consider the pre-approval amount to be an absolute maximum, which would likely make your current budget a little more challenging to manage,” advises McClary.

His advice? Run the numbers. Plug in all ownership-related costs (not just your projected mortgage), and test whether your current budget can absorb them while still leaving room for savings. “You may have to adjust the total mortgage amount downward until you are able to comfortably afford your current expenses,” he says.

As we mentioned above, the rule of thumb is to keep your housing costs under 30% of your gross income. McClary says to aim a little lower.

“Understanding that any homeowner typically carries other debt, it is better to set maximum housing costs a little below 30%.” He notes that your combined housing and debt payments should ideally not exceed 35% to 36%, a number that is not only more manageable but will likely be viewed more favorably by lenders if and when you look for financing options, like a mortgage, in the future.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 60 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on July 18, 2025. Percentages were rounded to the nearest whole number.