Members of Generation Z — who were born between 1997 and 2012 — were the first Americans to grow up with instant communication through texts, calls, and chats, as well as expedited shipping via Amazon deliveries. Perhaps it's understandable, then, that they might have similar expectations for their insurance carriers.

According to a recent Kin Insurance survey of American homeowners, Gen Z homeowners are significantly less satisfied with their insurance providers than millennials or Gen X. Even more surprising, Gen Z homeowners are less likely to cite the cost of their home insurance premium as their primary reason for dissatisfaction than earlier generations — but more likely to cite poor customer service and poor claims experiences.

Key takeaways:

-

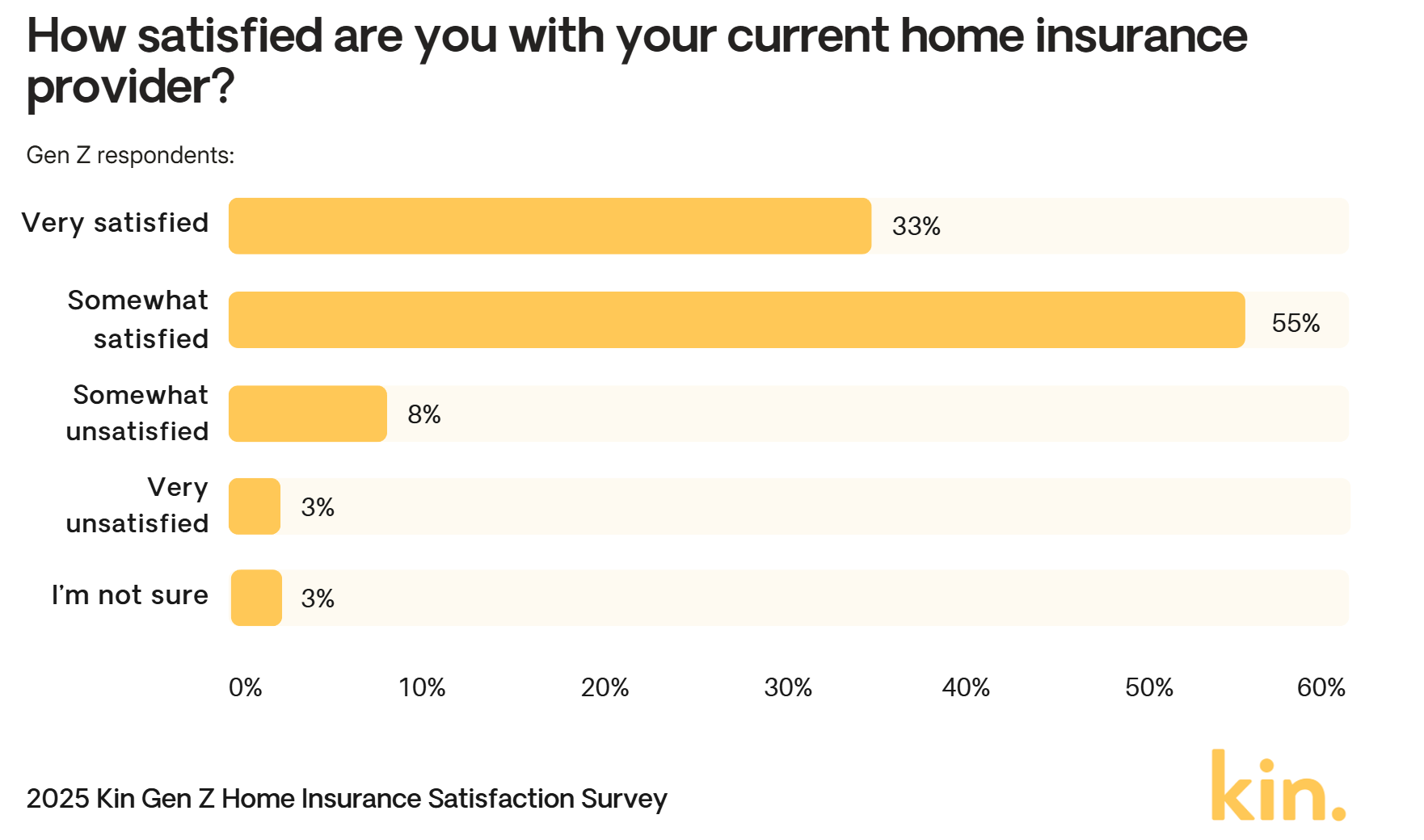

Only 32% of Gen Z homeowners are “very satisfied” with their insurance companies, compared to 45% of Gen X and 47% of millennials.

-

Gen Z homeowners are more likely to cite poor customer service (15%) and poor claims experience (28%) as their primary reason for dissatisfaction than older adults.

-

Of homeowners who have submitted a roof claim in the last 10 years, only 44% of Gen Zers were “very satisfied” with the outcome of their claims compared to 59% of millennials and 77% of Gen X.

-

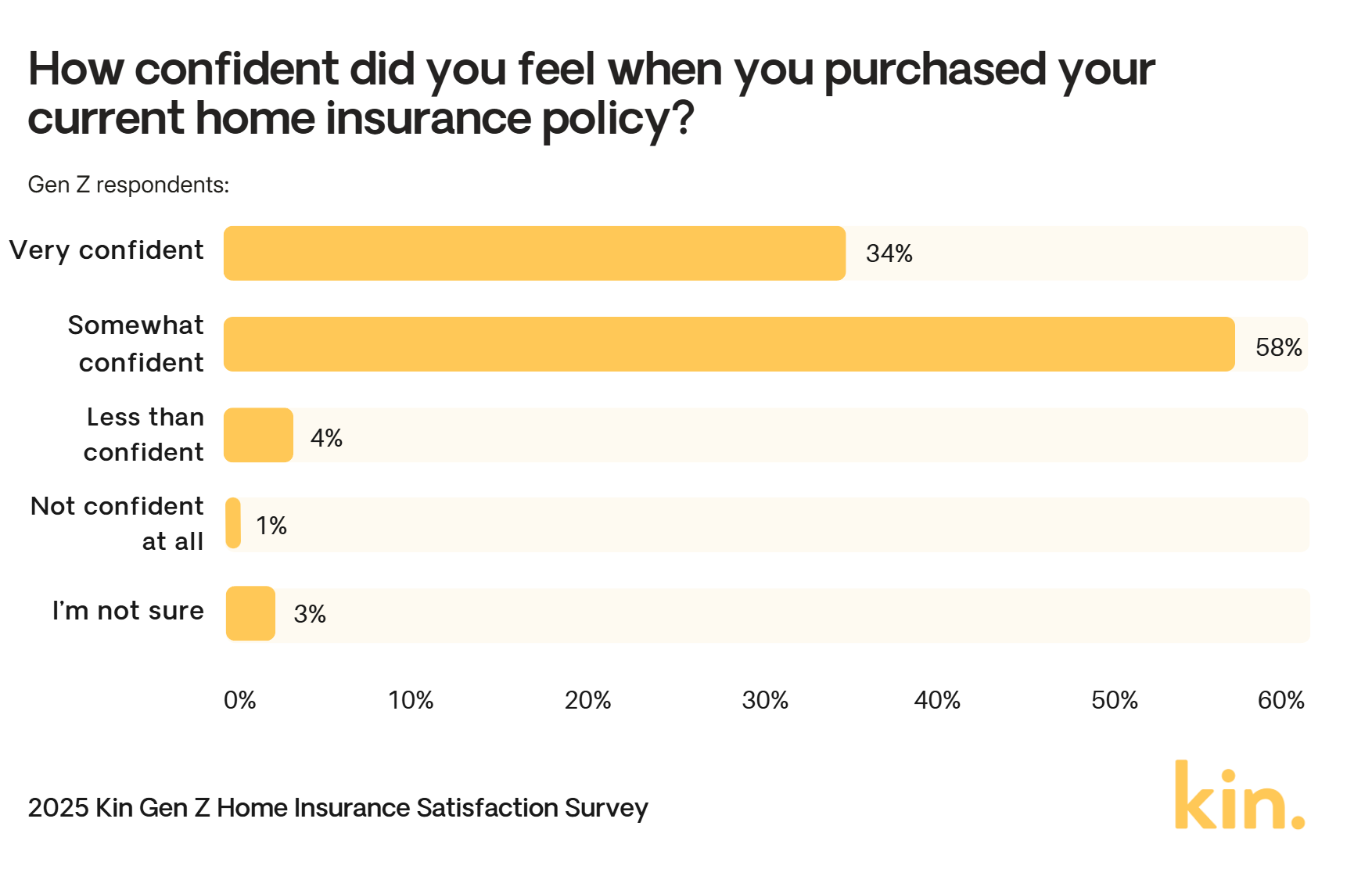

Only 34% of Gen Z homeowners felt “very confident” when purchasing home insurance compared to 45% of millennials and 42% of Gen X.

-

22% of Gen Z homeowners say "easier-to-understand language" would have helped them feel more confident when they purchase their home insurance policies, while 21% say cost calculators would have helped.

Why are Gen Z homeowners less satisfied with insurance companies?

Born between 1997 and 2012, Generation Z has grown accustomed to seamless, on-demand services controlled by their smartphones. As digital natives, their expectations aren’t being met by the often-analog nature of traditional insurance companies.

Only 32% of Gen Z homeowners are “very satisfied” with their insurance companies, compared to much higher rates of Gen X (45%) and millennial (47%) homeowners. While the leading reason for dissatisfaction among all generations is “my policy is too expensive,” Gen Z homeowners are more likely to cite poor customer service (15%) and poor claims experience (28%) as their primary reason for dissatisfaction than older adults.

Previous market research of U.S. homeowners by Kin found that homeowners who are frustrated with customer service and claims experiences cited poor communication from their insurance companies, including difficulty reaching the same representative over multiple calls, and conflicting instructions from multiple representatives.

“Some insurance companies outsource all of their customer service, which can lead to really poor alignment on communication between the insurance company, the customer service reps, and the policyholders,” says Sean Harper, CEO at Kin. “On the other hand, when insurance companies own the entire customer journey, they can prioritize clear and compassionate communication for every homeowner. By doing that at Kin, we've earned customer satisfaction scores far above the industry's average.”

Meanwhile, only 44% of Gen Z homeowners surveyed who have submitted a roof claim in the last 10 years were “very satisfied” with the outcome of their claims, compared to far higher rates of millennials (59%) and Gen X (77%).

Why were only 34% of Gen Z homeowners “very confident” when purchasing home insurance?

Historically, insurance companies have been really good at making funny Super Bowl commercials, but educating homeowners about what they are and are not purchasing when they buy home insurance is a completely different challenge.

As a result, only 34% of Gen Z homeowners felt “very confident” when purchasing home insurance compared to 45% of millennials and 42% of Gen X.

Since insurance policies can be dense and filled with jargon, they can also be intimidating to a first-time homebuyer. Gen Z homebuyers often turn to online shopping and research, where they value insurance websites and customer portals that provide clear and concise information.

In fact, 22% of Gen Z homeowners say “easier-to-understand language” would have helped them feel more confident when they purchase their home insurance policies, while 21% say cost calculators would have helped.

As noted above, the cost of home insurance premiums was the leading reason why Gen Z homeowners were dissatisfied with their insurers — and it’s easy to understand why. The average income for Gen Z homeowners is $81,000 according to a 2024 study by SmartAsset, while the average annual premium for a $350,000 home is $3,303 according to the Consumer Federation of America.

That means the average Gen Zer spends 4% of their annual income on home insurance on top of the cost of their mortgage. In fact, another recent Kin survey found that 39% of Gen Z homeowners spend a third or more of their income on housing costs, while 51% didn’t include the cost of home insurance when budgeting their housing costs.

This stark financial reality helps explain why Gen Z homeowners are anxious about making the right coverage choices when purchasing a home insurance policy.

How to compare home insurance companies — and switch

If you’re part of the 68% of Gen Z homeowners (or the 57% of all homeowners ages 18 to 60) who aren’t “very satisfied” with your current home insurance, know that you have the option to choose a new provider that can better meet your needs. Switching companies may sound like a hassle, but in the digital era it’s a fairly straightforward process.

Review your coverage needs

Before shopping around, read your current policy’s declarations page and take note of your coverage limits. Has anything changed since you last renewed your policy, such as major renovations, expensive belongings, or even a new dog? These changes could significantly impact the coverage you need.

Gather your information

To get accurate home insurance quotes, you’ll need a few details about your property on hand: your address, square footage, year built, roof age, and safety features like smoke detectors and security systems. You may also be asked about any claims you’ve submitted over the past five years.

Get a quote

These days, many people can get a quote online in a couple minutes from a wide variety of home insurance providers — although some homeowners, and some providers, may require a quick phone call. If you compare quotes from multiple companies, make sure you’re comparing “apples to apples” by using the same coverage limits and deductibles in each quote.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 60 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on July 18, 2025. Percentages were rounded to the nearest whole number.