As extreme weather events like hurricanes, tornados, and wildfires increase in frequency and intensity across the U.S., having enough home insurance coverage is more valuable than ever. But according to a recent survey by Kin Insurance, 18% of American homeowners say they’re “underinsured” because of the rising cost of home insurance — meaning their current policy doesn’t provide enough coverage to fully replace or repair their home in the event of a loss.

However, more than 1 in 3 (38%) homeowners say they don’t know how to determine if they have enough coverage — so the true underinsurance rate could be higher.

Key findings

-

18% of American homeowners say their current home insurance policy doesn't provide enough coverage to fully replace or repair their home in the event of a loss, because of the rising cost of home insurance.

-

However, 38% of American homeowners say they don’t know how to tell if they’re underinsured — meaning the real number of underinsured homes may be significantly higher.

-

25% haven’t taken any steps to make their home insurance more affordable — steps that could prevent them from being underinsured.

-

To make their home insurance more affordable, 22% have increased their deductible, 17% have switched insurance providers, 10% have removed optional coverages, and 9% have reduced their total coverage limit — the latter of which could lead to being underinsured.

-

More than half (59%) could not afford a deductible payment of $5,000 or more if their home was seriously damaged today. (Home insurance deductibles are usually fixed and range from as little as $500 to $10,000 or more.)

-

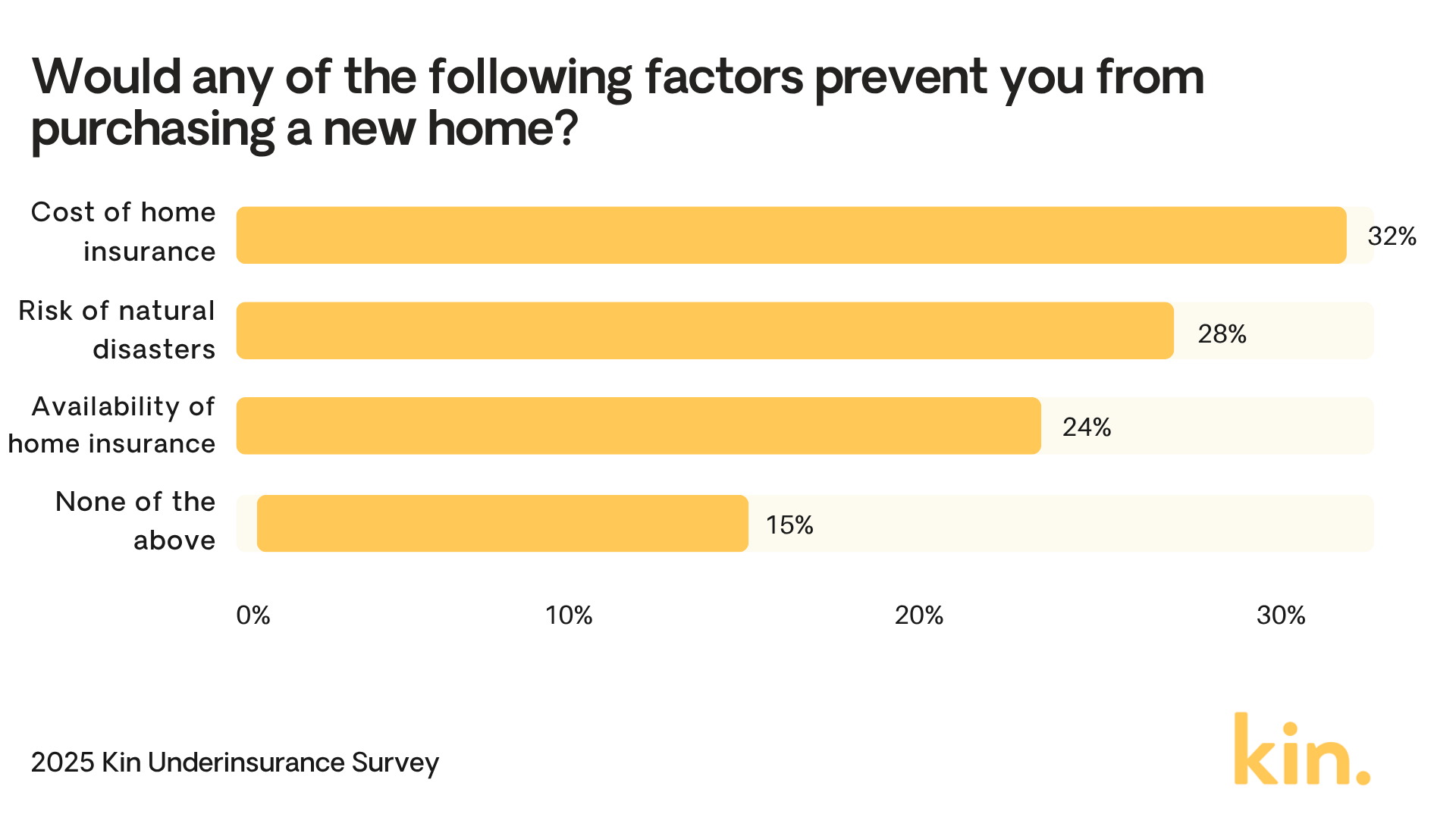

Nearly 1 in 3 (32%) would not purchase a new home because of the cost of home insurance.

At least 42 million American homeowners are underinsured

Kin's survey indicates 18% of U.S. homeowners are underinsured due to the rising cost of home insurance, which translates to over 42 million Americans who don’t have enough home insurance to fully replace or repair their homes in the event of a loss (based on the 2025 U.S. Census Bureau data indicating there are 234 million American homeowners).

The underinsurance rate is even higher in New England (27%) and the South Atlantic (21%), potentially due to the high cost of housing in New England and the home insurance availability crisis in the South Atlantic. There is also a stark contrast between homeowners with household incomes of less than $60,000 per year (25% underinsured) and those who make $60,000 per year or more (just 14% underinsured).

More than 1 in 3 homeowners don’t know how to tell if they’re underinsured

In addition to the American homeowners who know they’re underinsured, more than 1 in 3 (38%) say they don’t know how to tell if they have enough home insurance coverage to fully replace or repair their homes.

Kin’s Chief Insurance & Compliance Officer, Angel Conlin, says you need enough home insurance to cover 100% of the cost to rebuild your home in the event of a total loss, plus up to 80% more to cover other structures, personal property, loss of use, and other potential expenses.

Homeowners who don’t have enough coverage are responsible for paying any remaining repair or replacement costs out of their own pockets. However, more than half (59%) of American homeowners could not even afford a deductible payment of $5,000 or more if their home was seriously damaged today, according to the survey. Home insurance deductibles can range from as little as $500 to $10,000 or more, but most are between $1,000 and $5,000.

More than 1 in 3 homeowners haven’t taken steps to make their insurance more affordable

Most home insurance companies offer ways to increase a homeowner’s coverage amount, including options to make their home insurance more affordable. But 25% of U.S. homeowners haven’t taken any steps to make their home insurance more affordable — despite the fact that many of these steps could help prevent them from being underinsured.

Of the homeowners who have taken steps to make their home insurance more affordable, 22% have increased their deductible (the amount of money they would pay-out-pocket for repairs or replacements before their coverage kicks in), while 17% have switched insurance providers to find a more affordable policy. Both of these steps could help homeowners get more coverage for a lower cost, in addition to hardening their homes against damage.

However, 10% say they’ve removed optional coverages, and 9% say they’ve reduced their total coverage limit in order to make their policy more affordable — two steps that could lead to underinsurance.

Nearly 1 in 3 homeowners wouldn’t buy a new home because of the cost of home insurance

As home prices continue to rise across the U.S., the cost of home insurance has also increased significantly in recent years — due in part to “the costs of climate-related events,” according to the Department of the Treasury. Many experts say that high mortgage APRs are turning the housing market into a buyer's market for the first time since 2013, but insurance may be playing an unexpected role in that equation.

Now, 32% of U.S. homeowners say the cost of home insurance would prevent them from purchasing a new home. Rates were even higher in the East South Central (36%) and West South Central (37%) regions along the Gulf Coast, where homeowners are facing the same home insurance availability crisis mentioned above.

How to ensure you have enough home insurance

Every home and homeowner is different, so individual coverage needs depend on a variety of factors. But according to Kin’s Chief Insurance and Compliance Officer Angel Conlin, most U.S. homeowners should have enough home insurance to cover the following costs.

-

Dwelling coverage: 100% of the cost to rebuild the home.

-

Other structures: At least 10% of the dwelling coverage amount to cover the cost to rebuild other structures on the property.

-

Personal property: At least 50% of the dwelling coverage amount to cover the cost to replace personal belongings.

-

Loss of use: At least 20% of the dwelling coverage amount to cover living expenses if the home becomes temporarily uninhabitable after a covered loss.

-

Personal liability: At least $100,000 to $300,000 to cover any legal costs due to injuries or property damage.

-

Medical payments: At least $1,000 to $5,000 to cover any medical bills due to injuries sustained by guests on the property.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 25 and 75 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on May 12, 2025. Percentages were rounded to the nearest whole number.