Over the last decade, home renovation shows have become one of the most popular TV genres on streaming platforms. But according to a new survey by Kin Insurance, these shows have given 3 out of 4 American homeowners misleading expectations about the costs and timelines required to complete DIY repair and renovation projects.

In fact, the cost of repairs remains the biggest surprise and greatest fear for a majority of American homeowners, which emphasizes the gap between TV portrayals and the reality of home maintenance.

Key takeaways:

-

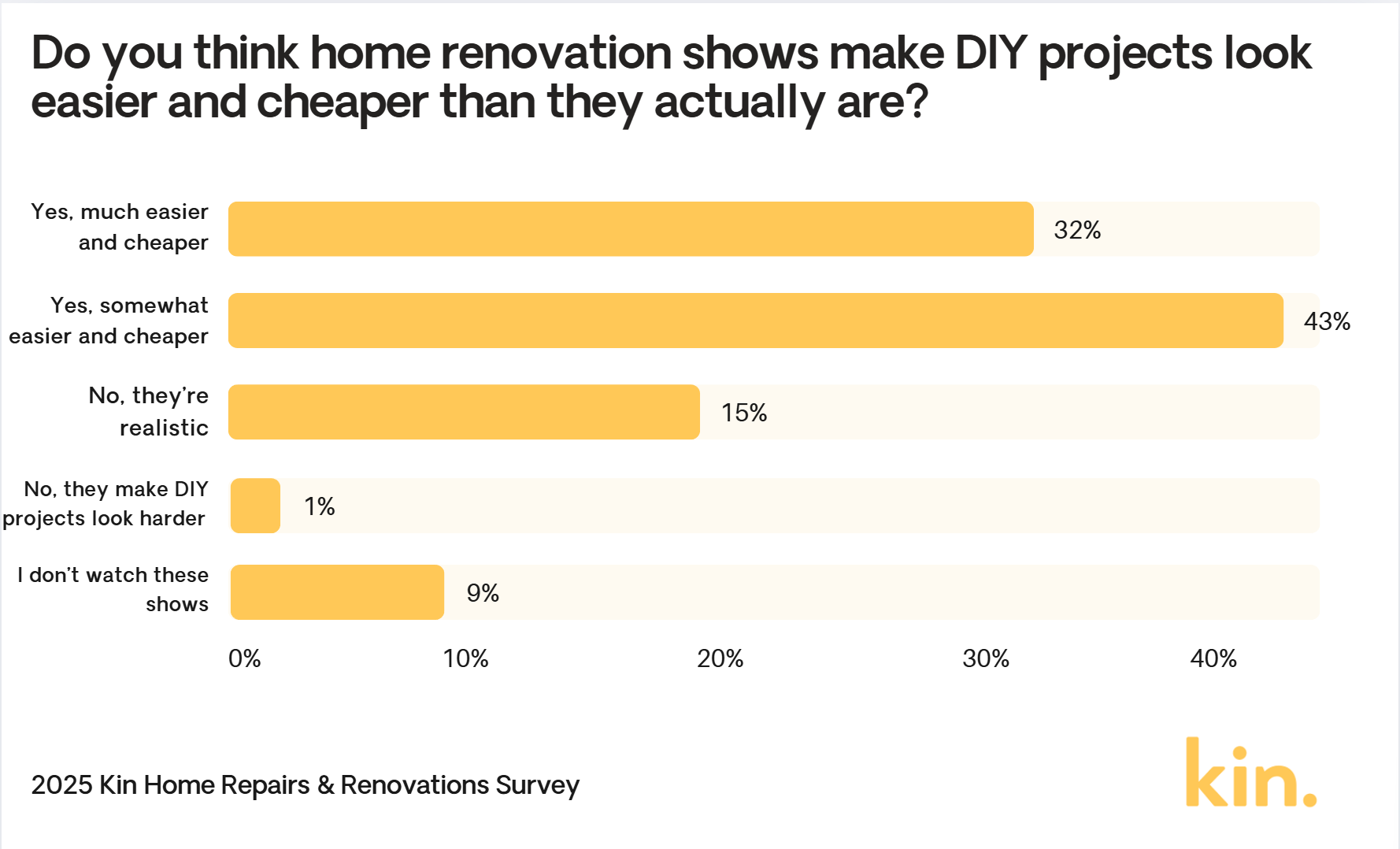

D-I-Y or C-R-Y?: 75% of American homeowners say watching home renovation and repair shows made DIY projects look “much” or “somewhat” easier and cheaper than reality.

-

Nearly half (47%) say their most recent home project was more expensive than they expected, while 8% say it cost at least double what they expected.

-

42% say their most recent home project took longer than they expected, while 12% say it took at least double the amount of time they expected.

-

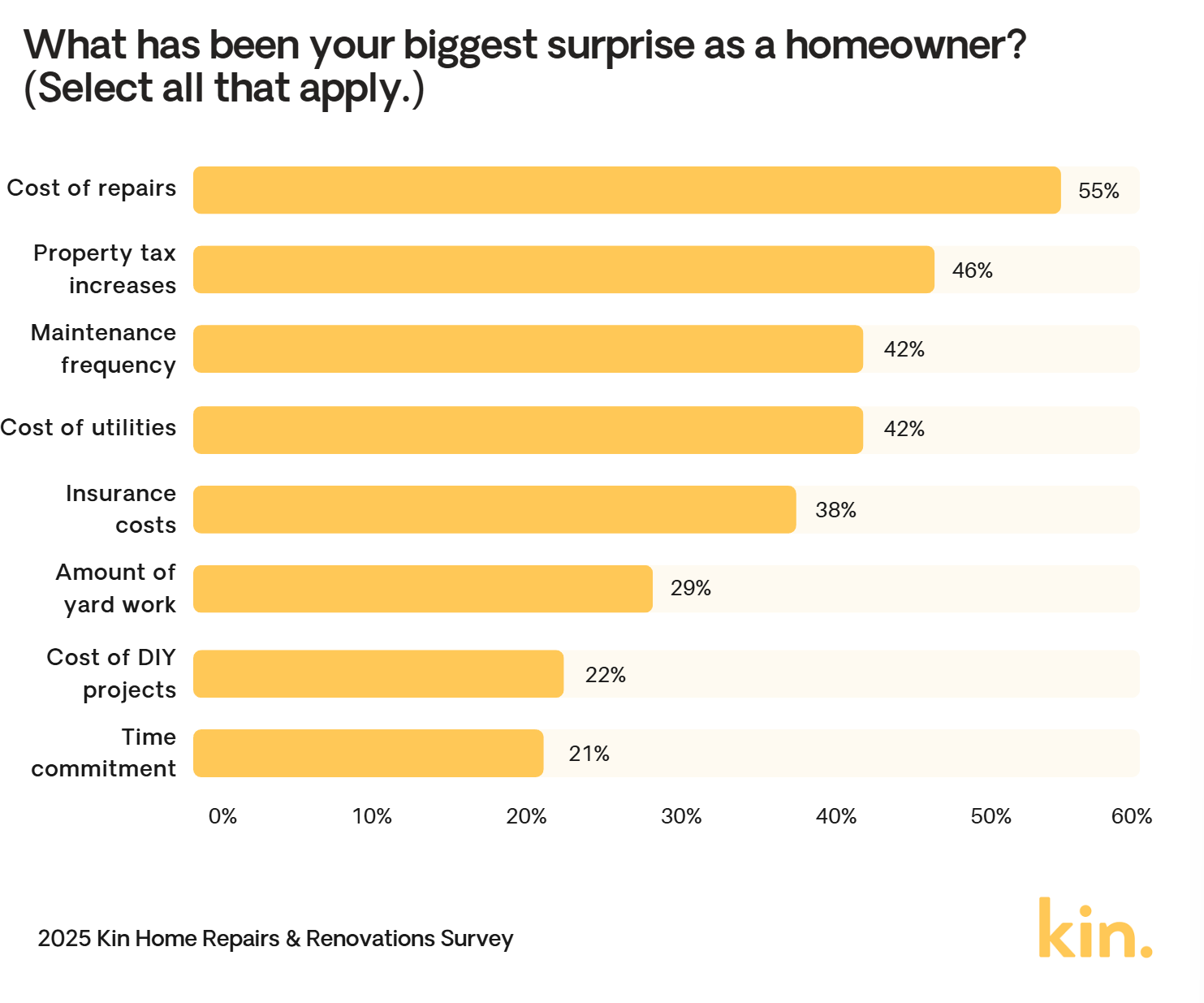

Repair cost sticker shock: In fact, 55% say the cost of repairs has been their biggest surprise as a homeowner, while 41% say major unexpected repair costs are their greatest fear.

-

The other biggest surprises include property tax increases (46%), frequency of maintenance needs (42%), and the cost of utilities (42%).

-

Nearly 1 in 4 listed natural disaster damage (24%) as their greatest fear, while others included an inability to afford mortgage payments (14%) and break-ins/security concerns (8%).

-

Insurance is motivating renovation projects: Why are homeowners taking on so many DIY projects? 82% say they were at least partially motivated by a desire to save money on home insurance.

-

The most commonly completed projects are installing smoke detectors (17%), installing security systems (17%), installing or cleaning gutter guards (12%), and plumbing/electrical improvements (12%).

-

“Next time, I’ll just pay someone”: After making their own repairs or renovations, 28% of American homeowners say they’d either definitely hire professionals or consider it for future projects.

-

An additional 35% said they’d try again themselves but plan better first.

For 75% of American homeowners, DIY projects look easier and cheaper on TV

While home renovation and repair TV series have inspired millions of people to pick up a hammer, three-quarters of American homeowners (75%) say that watching these shows made DIY projects look “much” or “somewhat” easier and cheaper than they turned out to be in reality.

This disconnect is clear when homeowners reflect on their most recent project: Nearly half (47%) said it was more expensive than they budgeted for, with 8% saying it cost at least double their original expectation. Timelines are another area where reality diverges from television, as 42% of American homeowners say their project took longer than anticipated, and 12% said it took at least twice as long.

These experiences may explain why many homeowners are hesitant to make their own repairs or renovations in the future. After a challenging DIY experience, 28% of homeowners say they would either definitely hire professionals or seriously consider it for future projects, while an additional 35% say they would try again themselves but would be sure to plan better first.

Unexpected repairs are the greatest fear — and greatest surprise — for many homeowners

In addition to planned renovations, the day-to-day cost of maintenance and unexpected repairs are a significant source of stress for American homeowners. When asked about their biggest surprise as a homeowner, the cost of repairs was the number-one answer cited by 55% of American homeowners, followed by property tax increases (46%), the frequency of maintenance needs (42%), and the cost of utilities (42%).

These surprises align closely with homeowners’ fears: A major unexpected repair is the greatest fear for 41% of American homeowners, far outweighing other concerns like damage from a natural disaster (24%), the inability to afford mortgage payments (24%), and break-ins or security concerns (8%).

“This survey shows how anxious homeowners are about the cost of surprise repairs like roof damage or burst pipes,” says Angel Conlin, Chief Insurance Officer at Kin. “It’s a great reminder about the critical role home insurance plays in helping pay for repairs to damage caused by sudden and accidental damage from covered perils. While home insurance doesn't cover regular home maintenance, it provides coverage that can include everything from common events such as sudden pipe bursts, kitchen fires, lightning, and theft to major catastrophes like wildfires, tornados, and hurricanes. Having that financial safety net is one of the best ways to protect the investments you’ve made in your home and to mitigate that number-one fear.”

A majority of homeowners have completed home projects to save money on home insurance

Of course, DIY projects aren’t just about making homes more attractive: 82% of American homeowners say they were at least partially motivated by a desire to save money on home insurance when planning and completing their projects.

The most common projects are installing smoke detectors (17%), installing security systems (17%), installing or cleaning gutters guards (12%), and plumbing or electrical improvements (12%). These improvements don’t just make homes safer, they can also potentially help lower your insurance premium by reducing your home’s risk in the eyes of insurance companies.

The most cost-effective home improvement projects that could lower your home insurance premium

Homeowners should speak with their insurance provider before starting a major project to see what discounts or benefits may apply, but here are some of the most common and cost-effective.

Security and safety systems: Installing a monitored security system, smart smoke detectors, and fire suppression systems may qualify you for a policy discount with some insurance providers.

Home hardening projects: Installing storm shutters, reinforcing your roof, and installing impact-resistant shingles could lead to significant savings.

Parts and system upgrades: Replacing an old roof or updating plumbing and electrical systems may not provide a direct discount, but they can help prevent steep premium increases or surcharges associated with outdated components and systems.

Water damage mitigation: Installing an automatic water shut-off device or a water leak detection system can help prevent water damage, which is one of the leading causes of claims that can increase your premium.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 American adults between the ages of 18 and 65 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on November 4, 2025. Percentages were rounded to the nearest whole number.