Extreme weather events including droughts, floods, tornadoes, hurricanes, and wildfires became more frequent during the last five years, according to a recent study by NASA. From unpredictable storms to record-breaking heat waves, the climate is changing, and so are the risks to our homes.

Kin commissioned a new study of U.S. homeowners to uncover the financial and emotional toll of extreme weather damage, and the results are revealing: More than one in four American homeowners say their homes have been damaged by a severe weather event since 2020, and for those who experienced a major incident, the emotional recovery often takes longer than the physical repairs.

Key takeaways:

-

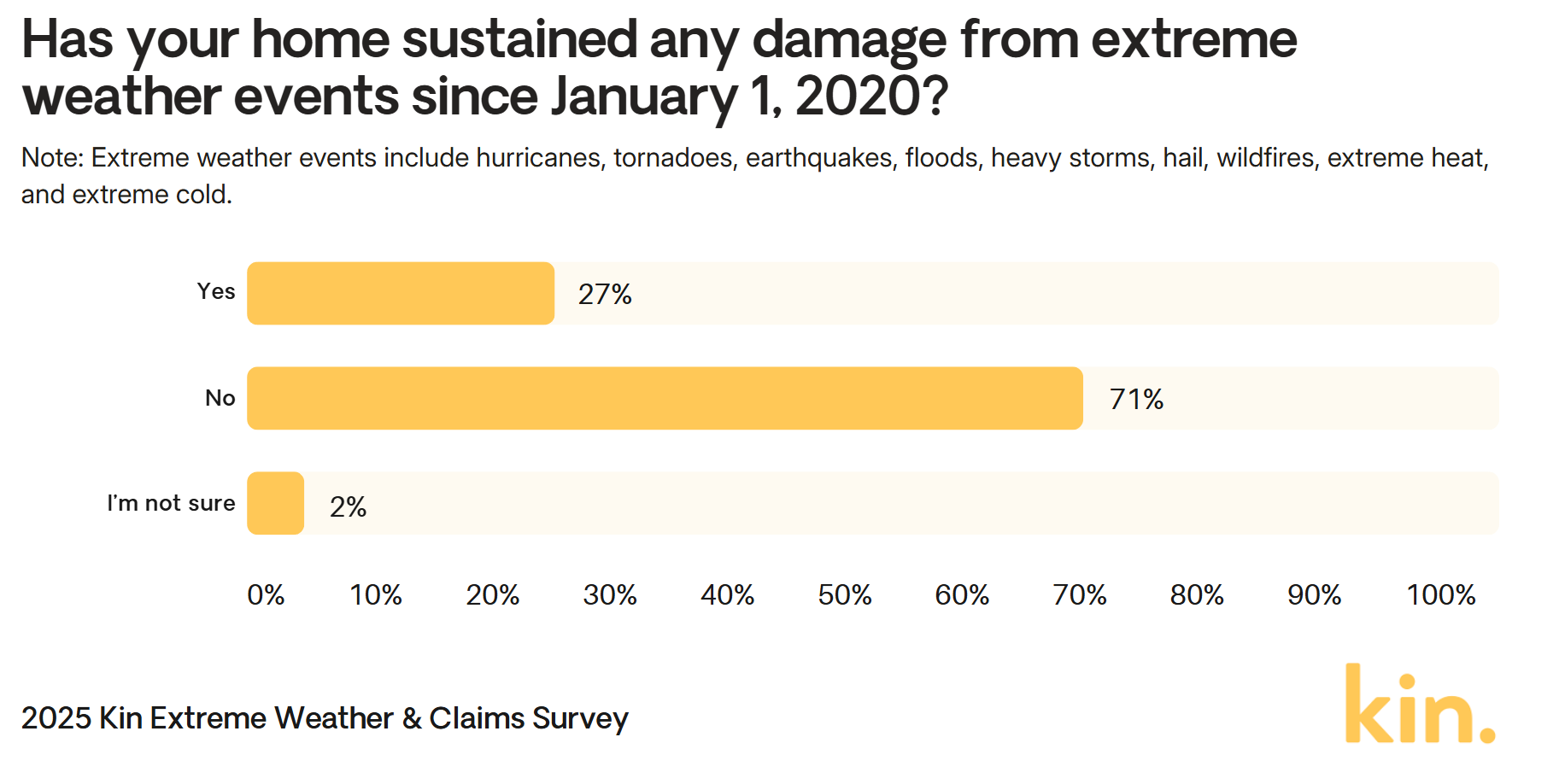

Since January 1, 2020, 27% of American homeowners say their homes sustained damage from an extreme weather event.

-

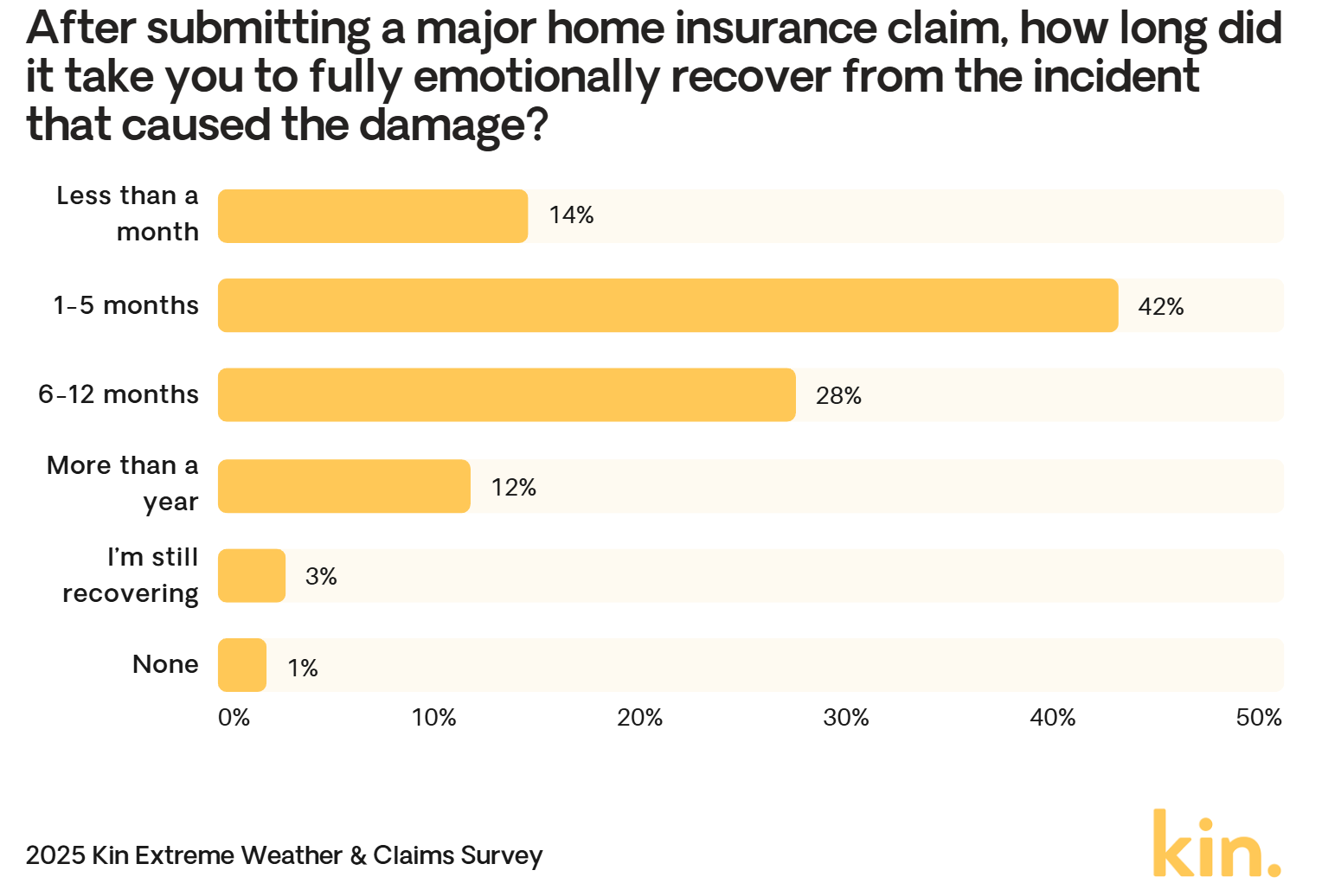

40% of Americans whose homes suffered major damage took six months or more to “emotionally recover” from the incident. 12% took more than a year.

-

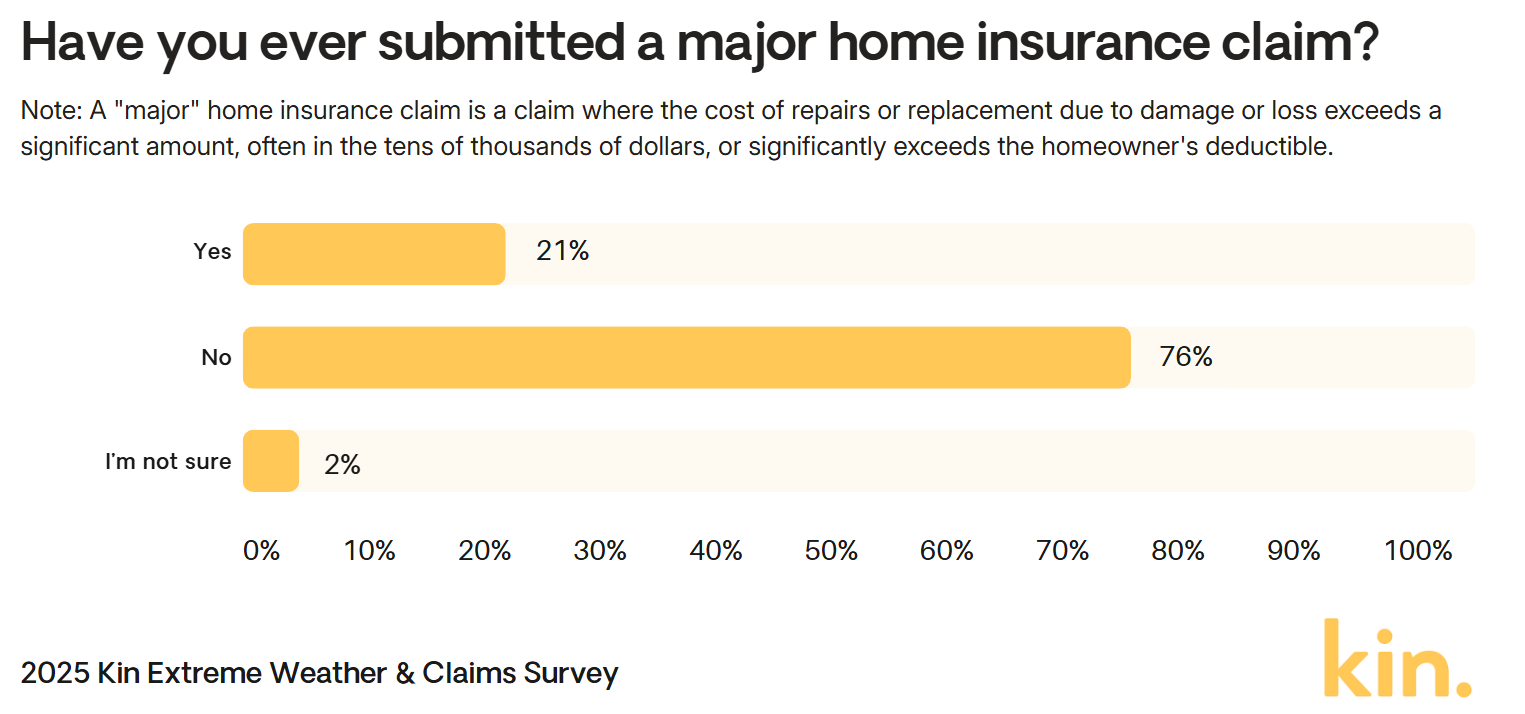

1 in 5 (21%) American homeowners have submitted a major insurance claim since buying a home.

-

50% of these homeowners considered switching insurance providers after submitting a major claim.

-

24% of those homeowners paid more than $10,000 out of pocket for repairs or replacements after receiving insurance payouts.

27% of American homes sustained damage from an extreme weather event since 2020

More than one in four (27%) American homeowners say their homes have sustained damage from an extreme weather event since January 1, 2020. The most common causes of damage were storms (23%), hail (17%), and hurricanes (15%).

More than half (58%) of these homeowners say the cost of their insurance premiums increased after sustaining damage and submitting claims to their home insurance companies.

Filing a major property insurance claim can increase your cost of coverage because it may indicate your home faces higher risks than originally assessed. However, while more than a dozen states have laws that may protect a homeowner from being immediately dropped or surcharged for a single catastrophic claim, such events contribute to an insurer's overall risk assessment, which can lead to higher premiums over time. In other cases, filing a claim may not directly raise the cost of your premium, but it may make you ineligible for some discounts that had previously brought your cost down.

Filing a major property insurance claim can increase your cost of coverage because it may indicate your home faces higher risks than originally assessed. However, while more than a dozen states have laws that may protect a homeowner from being immediately dropped or surcharged for a single catastrophic claim, such events contribute to an insurer's overall risk assessment, which can lead to higher premiums over time. In other cases, filing a claim may not directly raise the cost of your premium, but it may make you ineligible for some discounts that had previously brought your cost down.

39% of Americans whose homes suffered major damage took six months or more to “emotionally recover”

After your home is damaged, safety fears, lost belongings, and the stress of paying for repairs can be a psychological burden in addition to a financial one. In fact, 39% of U.S. homeowners who experienced major home damage from extreme weather reported that it took six months or more to emotionally recover from the incident.

12% of affected homeowners said it took them more than a year to emotionally recover. Only 1% didn’t need to recover at all.

1 in 5 American homeowners have submitted a major insurance claim

According to the survey, roughly one in five (21%) American homeowners have submitted a major insurance claim at some point in their journey as a homeowner.

A "major" home insurance claim is one where the cost of repairs or replacements due to damage or loss exceeds a significant amount, often in the tens of thousands of dollars, or significantly exceeds the homeowner's deductible.

Submitting a claim can be an eye-opening experience for many homeowners, as they see how well their home insurance company supports them through the process — and how the coverage decisions they made on their policy impact their claim. After submitting a major claim, 50% of these homeowners considered switching insurance providers, while 12% actually switched.

“Getting the support you need when submitting a claim is one of the most important factors when choosing a home insurance provider,” says Kin’s Chief Insurance and Compliance Officer Angel Conlin. “That’s why we built Kin to put policyholders first — and provide them with timely and compassionate support before, during, and after the claims process.”

Meanwhile, 44% considered moving to a different home as a result of the frequency or severity of their claims, and 66% made additional home renovations after filing a claim. Finally, after receiving insurance payouts as a result of their claim, 24% still paid more than $10,000 out of pocket for repairs or replacements.

“When choosing a deductible for your home insurance policy, it’s crucial to balance the cost of your premium with how much you can afford to pay out-of-pocket in the event of a claim,” Conlin says.

How to harden your home against damage and avoid major claims

While you can't control the weather, you can take steps to make your home more resilient and potentially avoid future claims.

-

Invest in impact-resistant windows and doors. If you can’t afford these, hurricane shutters are also a good investment.

-

Hire a professional to install hurricane clips.

-

Install a wind- and impact-rated garage door.

-

Ensure your soffits were property installed.

-

Retrofit your gable ends.

-

Install a water-leak monitoring device to reduce damage by notifying you of a leak.

-

Install gutter guards to keep your gutter free of debris.

-

Buy surge protectors to prevent your electrical system from getting fried during a powerful storm.

-

Regularly prune your trees to minimize the chance of dead branches falling through your roof, especially during a storm.

Methodology

Kin commissioned Pollfish to poll a nationally representative sample of 1,000 U.S. adults between the ages of 18 and 60 who currently own a single-family home in the United States. (For the purposes of this survey, apartments, condos, mobile, and manufactured homes did not qualify as single-family homes.) The survey was performed online on July 18, 2025. Percentages were rounded to the nearest whole number.