Kin grows revenue by 53% year-over-year, records positive full-year operating income

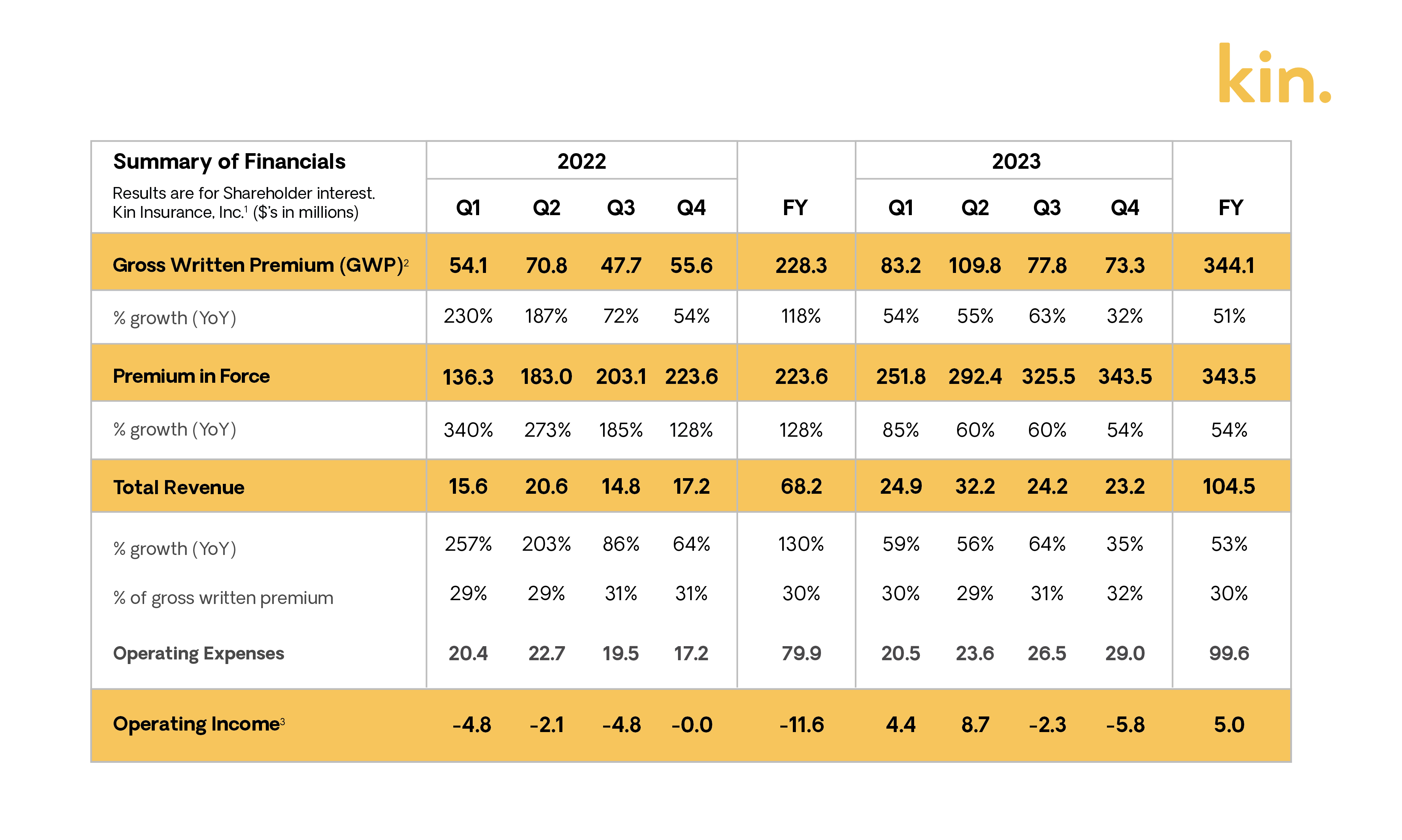

CHICAGO, IL – February 15, 2024 – Kin, the pioneering digital, direct-to-consumer home insurance company, today announced operating results through the fourth quarter ended December 31, 2023. Kin finished 2023 with $344.1 million in gross written premium and $104.5 million in total revenue. Kin’s operating income landed at $5.0 million, an increase of 143% over the prior-year period. Kin’s premium in force also jumped to $343.5 million in the fourth quarter of 2023, an increase of 54% over the prior-year period.

Kin finished 2023 with $344.1 million in gross written premium and $104.5 million in total revenue. Kin’s operating income landed at $5.0 million, an increase of 143% over the prior-year period. Kin’s premium in force also jumped to $343.5 million in the fourth quarter of 2023, an increase of 54% over the prior-year period.

In 2023, Kin nearly quadrupled its geographic footprint by launching five states – Alabama, Arizona, Mississippi, South Carolina, and Virginia. Kin's growth momentum has continued into the early months of this year, marked by its second most successful month ever for new bound premium in January.

“We’re very proud of our 2023 results. Kin generated an operating profit while maintaining a fast growth rate, and our reciprocal exchanges beat their forecasted loss ratios. We did that while investing heavily in technology to extend our competitive moat,” said Sean Harper, CEO of Kin. “We’ve always had positive unit economics, and with more of our revenue coming from renewals and our expenses growing slower than revenue, we’re now generating positive operating income.”

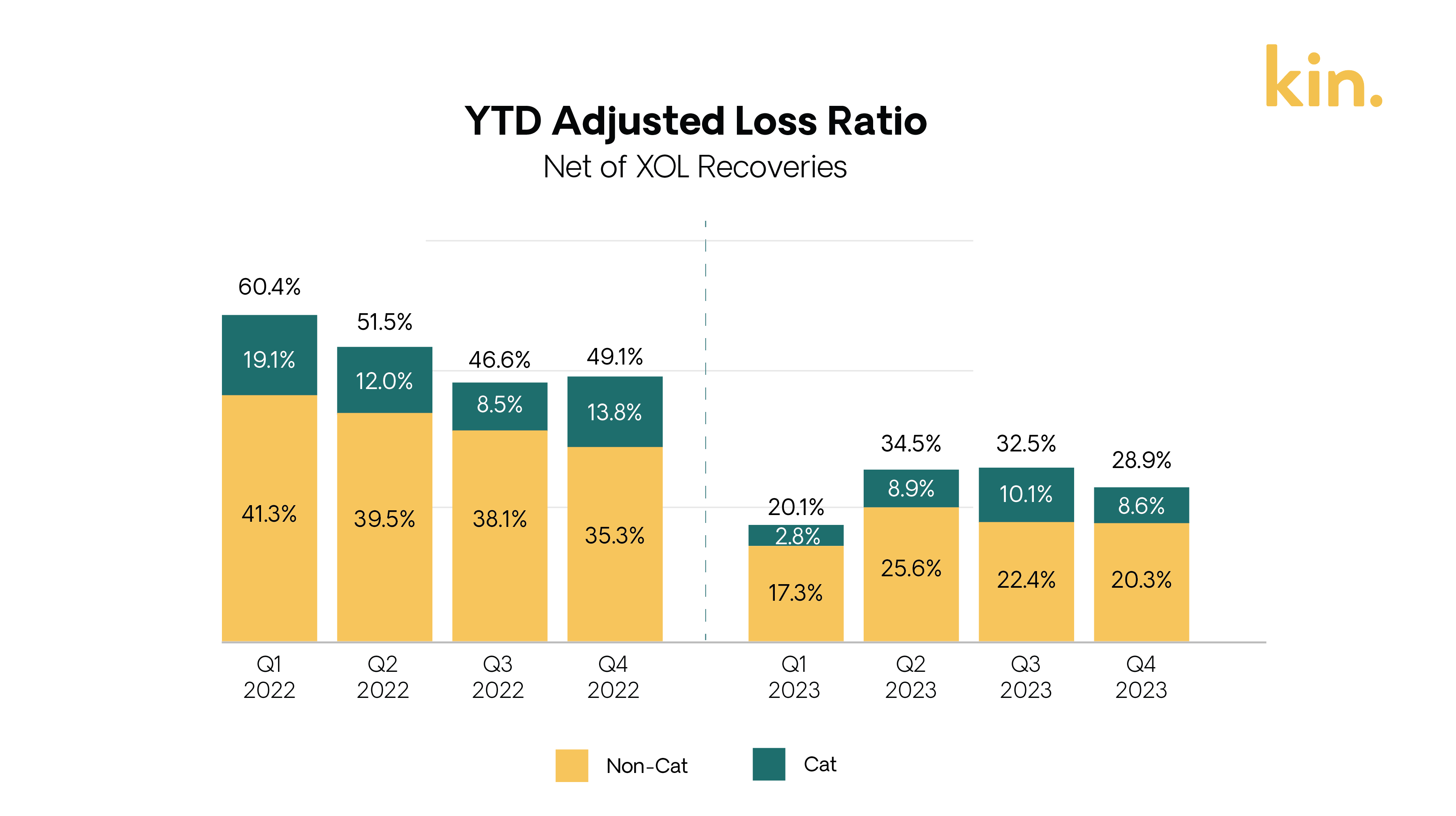

The reciprocal exchanges managed by Kin continued to drive down their adjusted loss ratios4. The adjusted loss ratio for the Kin Interinsurance Network, net of XOL recoveries, was 20.0% in the fourth quarter of 2023 – the lowest for a single quarter in Kin’s history. Non-cat adjusted loss ratio5 was 15.0% in the fourth quarter of 2023, which beat the previous low of 17.3% in the first quarter of 2023. The adjusted loss ratio landed at 28.9% for the year, which bettered Kin’s target by 15.5%.

The reciprocal exchanges managed by Kin continued to drive down their adjusted loss ratios4. The adjusted loss ratio for the Kin Interinsurance Network, net of XOL recoveries, was 20.0% in the fourth quarter of 2023 – the lowest for a single quarter in Kin’s history. Non-cat adjusted loss ratio5 was 15.0% in the fourth quarter of 2023, which beat the previous low of 17.3% in the first quarter of 2023. The adjusted loss ratio landed at 28.9% for the year, which bettered Kin’s target by 15.5%.

“Kin’s reciprocals have always performed well compared to their geographic competitors when it comes to loss ratio. However, combined ratios really deteriorated across the P&C industry in 2021 and 2022,” said Angel Conlin, chief insurance officer at Kin. “Now that the industry has returned to healthier levels, you can really see Kin’s outperformance, which is due to our data and technology advantage throughout the insurance value chain.”

About Kin

Kin is the only pure-play, direct-to-consumer digital insurer focused on the growing homeowners insurance market. Kin makes homeowners insurance more convenient and affordable by eliminating the need for external agents. Kin’s technology platform delivers a seamless user experience, customized options for coverage, and fast, high-quality claims service. Behind the scenes, Kin utilizes thousands of data points about each property to provide accurate pricing and produce better underwriting results. Kin is a fully licensed carrier that offers coverage through its reciprocal exchanges, which are owned by its customers. To learn more, visit www.kin.com.

1 The financial information represents the GAAP consolidated results of Kin Insurance, Inc. exlcuding its variable interest entities (VIE's), which are its reciprocal insurance carriers and captive.

2Gross Written Premium includes premium written by the reciprocals managed by Kin Insurance, Inc. and certain third-party carriers.

3Operating Income represents net income/loss attributable to Kin Insurance, Inc. excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation and other non-operating expenses.

4Adjusted loss ratio is a non-GAAP measure defined as loss and loss adjustment expenses, net of catastrophe excess of loss reinsurance recoverables divided by earned premium and the "earned" portion of subscriber surplus contributions during the period.

5Non-cat adjusted loss ratio excludes named storms and Property Claim Services (PCS) events as defined by Insurance Services Office, Inc. (ISO).

Related Posts:Additional Resources

Displaying post 1 / 3