A windstorm mitigation inspection provides insight into how resistant your home is to wind and wind-related perils. A certified inspector will check all the factors that affect your home’s wind resistance, including the roof, doors, and windows.

Getting a windstorm mitigation inspection can help you save money on your home insurance premiums if it shows that your home is well protected against damage caused by wind. Some states even require insurers to provide discounts or credits to homeowners who pass a windstorm mitigation inspection.

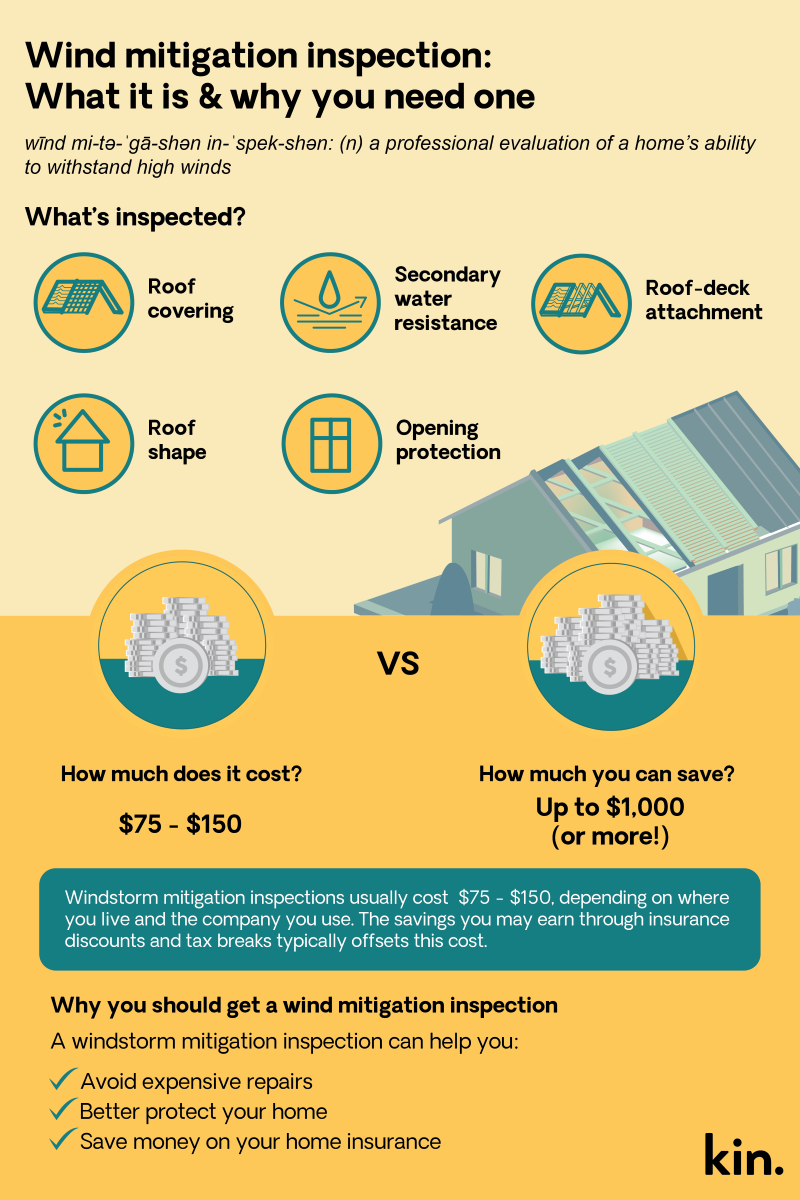

How much money can you save with a windstorm mitigation inspection?

Windstorm mitigation inspections can significantly reduce the cost of your home insurance. For instance, a windstorm mitigation inspection in coastal communities can reduce premiums by hundreds of dollars to $1,000 or more.

The amount you save will depend on the results of the inspection, the state you live in, and your insurer. However, if you live in a state with a higher risk for storms, such as Florida, state law may mandate that insurers offer home insurance discounts for homes that rate well for wind resistance. In some cases, those states may also offer financial incentives, like tax deductions or tax credits.

How much does a windstorm mitigation inspection cost?

Windstorm mitigation inspections generally cost between $75 and $150, though how much you’ll pay for an inspection will depend on where you live and the inspector you choose. Before you settle on a windstorm mitigation inspector, get a few estimates to compare costs.

What’s included in a windstorm mitigation inspection?

Windstorm mitigation inspections include a list of criteria meant to evaluate the risk your home faces during a wind-related event, such as a hurricane. However, the criteria vary by state.

For example, an inspection report in Florida includes the following seven indicators:

1. Building code

Home inspectors will evaluate your home to determine if it complies with current state and local building codes. Newer homes are more likely to meet current standards, while older homes often need to be brought up to code.

In some cases, homeowners are required to provide documentation, such as building permits, that shows when the property was built or last updated. As such, if you’re remodeling your home to meet current codes, always keep relevant documentation so you can provide copies to your insurer.

2. Roof covering

The materials used to construct your roof can affect your home’s windstorm mitigation rating. For instance, metal roofs, shingles with high-wind resistance ratings, concrete or clay tiles, or composite roofing materials are often considered acceptable roofing materials for windstorm mitigation.

Age also plays a role, with older roofs presenting a higher risk of damage. If your roof was recently replaced, you may need to provide the construction permit. The inspector will also determine whether your roof covering meets state and local building codes.

3. Roof-deck attachment

The home inspector will assess how well your roof deck is secured to the trusses or rafters located in your attic. The inspection report includes details about the measurement of the nails, the spacing between nails, and the materials used to attach the roof.

4. Roof-wall attachment

The home inspector will evaluate how well your roof is attached to the walls of your home. The inspection report includes details about the attachments used, which may include toe nails, clips, single wraps (e.g., sanibel straps and structured anchor bolts), and double wraps. Double wraps are considered the strongest connection type, while toe nails are the weakest.

5. Roof geometry

Your roof’s shape directly affects how wind-resistant it is. Hip-shaped roofs are considered one of the best wind-resistant designs because they slope down on all sides, lowering the chances of clashes with hurricane winds. Your windstorm mitigation report will note the shape of your roof and may include other details such as the slope of your roof and its dimensions.

6. Secondary water resistance

Secondary water resistance (SWR), also called sealed roof deck, is a protective barrier that sits under the first layer of your roof for extra protection against water damage. The inspection report will note if your home has SWR and the type of barrier it uses.

7. Opening protection

The windstorm mitigation inspection will also examine whether your windows and doors are sealed and shatter-proof to guard against wind and water damage. It considers both glazed openings (such as those with windows and glass) and non-glazed openings (such as doors and garage doors) and how well they can withstand wind and impacts from flying debris.

How long is a windstorm mitigation inspection good for?

Windstorm mitigation inspections are typically good for five years from the date of your inspection. If you replace your roof, install storm windows, or make any other modifications to the structure of your home or wind-mitigation features, you’ll likely need a new inspection.

A new inspection ensures that you still qualify for any existing credit. Further, if your upgrades can increase your windstorm mitigation rating, you may be eligible for a more significant discount.

How to get a windstorm mitigation inspection

Getting a windstorm mitigation inspection is a straightforward process:

-

Find a certified home inspector. You can locate home inspectors in your area using the International Association of Certified Home Inspectors search tool. Before you select an inspector, get several quotes to ensure you’re getting the best price.

-

Schedule the inspection. The home inspector will visit your home at a scheduled time to complete the wind inspection.

-

Get your wind inspection report. Once you receive your wind inspection report, you can send it to your home insurance company. Depending on the outcome of the report, where you live, and your insurer, you may be eligible for a policy discount.

Tip: Once you have a windstorm mitigation inspection, keep a copy on hand. If the inspection took place within the last five years, you can provide a copy to a prospective insurer if you’re shopping around and getting home insurance quotes from new insurers.

Edited by

Jennifer Lobb

Edited by

Jennifer Lobb