Kin increases gross written premium by 63% year-over-year, surpasses $270M in 2023

Kin’s profitable growth accelerates amid seasonal slowdown

CHICAGO, IL – November 13, 2023 – Kin, the direct-to-consumer home insurance company built for every new normal, today announced operating results through the third quarter ended September 30, 2023.

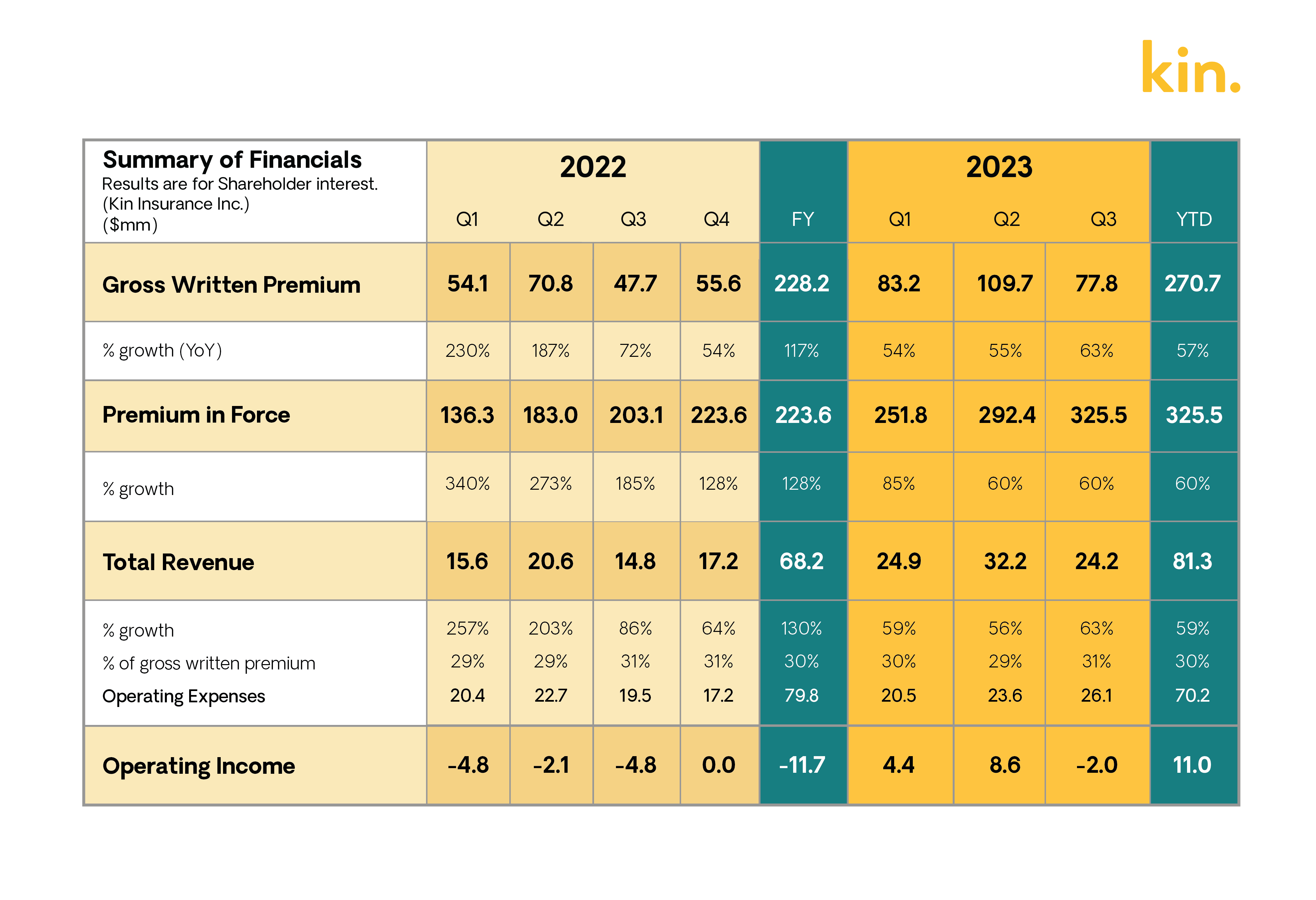

Kin finished the third quarter of 2023 with $77.8 million in gross written premium and $24.2 million in total revenue. Kin’s operating income remains positive at $11.0 million year-to-date, an increase of 194% over the prior-year comparative period. Kin’s premium in force also jumped to $325.5 million in the third quarter of 2023, an increase of 60% over the prior-year comparative period.

Building upon the momentum from the first half of 2023, Kin continues to geographically diversify its business by growing and scaling Louisiana and its newly launched states – Alabama, Arizona, Mississippi, South Carolina, and Virginia.

“The third quarter was very positive – our reciprocal exchanges continued their momentum on loss ratio, we posted our fastest year-over-year growth so far this year, and our operating expenses grew much slower than our revenue,” said Kin CEO Sean Harper. “We’re on track to achieve the rule of 70 for the year and continue our strategy of growing fast while expanding margins.”

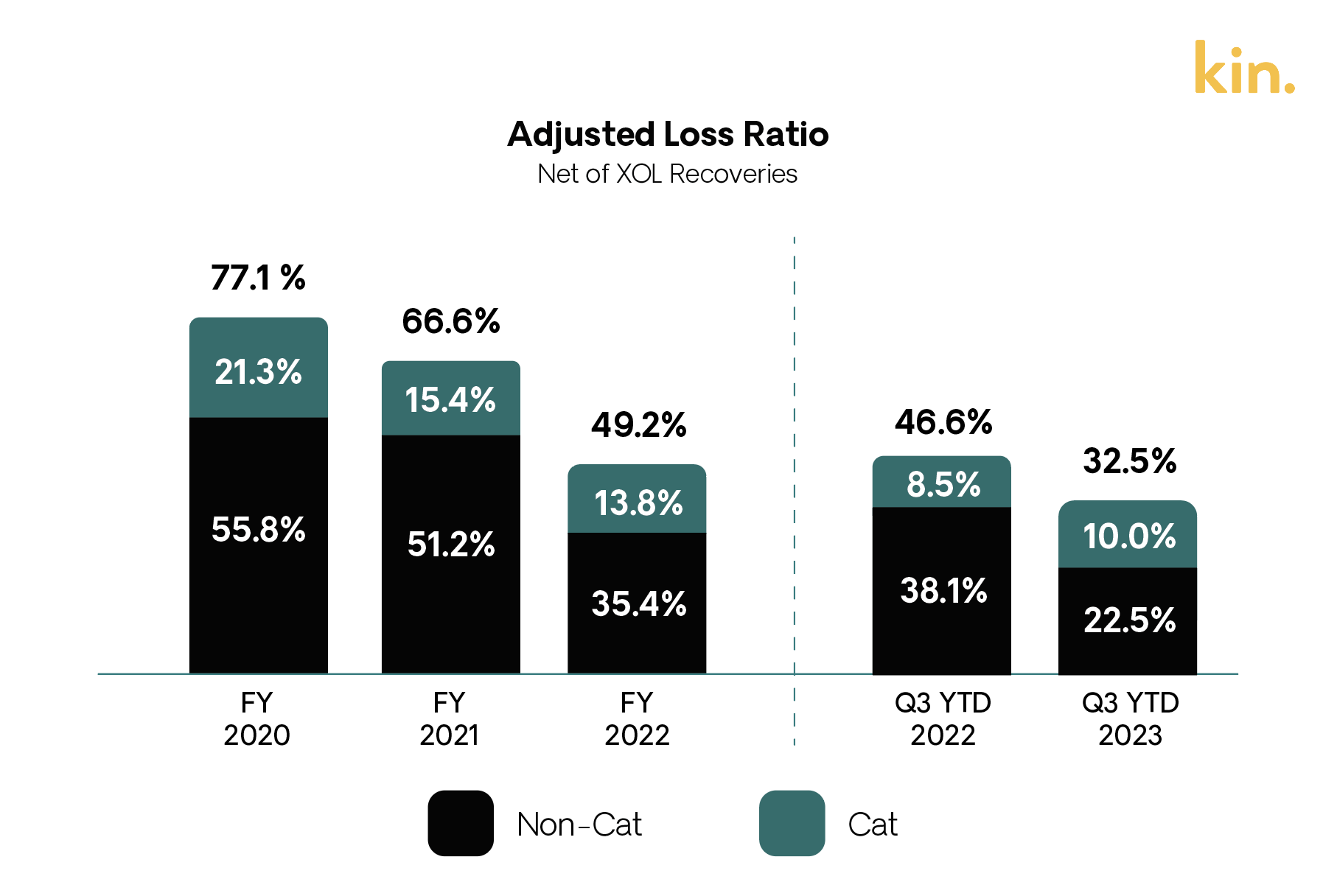

While combined ratios have deteriorated across the P&C industry, Kin continues to drive down its adjusted loss ratio1. The adjusted loss ratio for the Kin Interinsurance Network, net of XOL recoveries, was 32.5% through the third quarter of 2023. Non-cat adjusted loss ratio2 was 17.4% in the third quarter of 2023, just slightly above the all-time low of 17.3% in the first quarter of 2023.

“We’ve weathered the storms, both literal and figurative, by taking a very proactive, technology-driven approach to support customers and triage claims,” said Angel Conlin, chief insurance officer at Kin. “Our strong loss ratio demonstrates that we’re well-managed and focused on sustainability, even with increasing volume. It's all about the security and confidence we provide to those who rely on us."

Cat events during the third quarter of 2023 were headlined by Hurricane Idalia, where Kin consistently tracked above the industry’s average claims closure rate, according to the Florida Office of Insurance Regulation.

About Kin

Kin is the only pure-play, direct-to-consumer digital insurer focused on the growing homeowners insurance market. Kin makes homeowners insurance more convenient and affordable by eliminating the need for external agents. Kin’s technology platform delivers a seamless user experience, customized options for coverage, and fast, high-quality claims service. Behind the scenes, Kin utilizes thousands of data points about each property to provide accurate pricing and produce better underwriting results. Kin is a fully licensed carrier that offers coverage through its reciprocal exchanges which are owned by its customers. To learn more, visit www.kin.com.

1Adjusted loss ratio is a non-GAAP measure defined as loss and loss adjustment expenses, net of catastrophe excess of loss reinsurance recoverables divided by earned premium and the "earned" portion of subscriber surplus contributions during the period.

2Non-cat adjusted loss ratio excludes named storms and Property Claim Services (PCS) events as defined by Insurance Services Office, Inc. (ISO).

Related Posts:See More Headlines

Displaying post 1 / 3